It’s the third intelligence briefing of Market Mosaic. We are happy you have chosen to read our cutting-edge market insights and global economic trends.

In case you are new here, our weekly insights newsletter curates consumer insights for you as a business leader and professional to inform your strategic decisions with a market competitive advantage. 📈 Let’s make the ride all worth it! 🤝

— Insights Team, Rwazi

Our Edition this week:

DATA SPOTLIGHT

Automation & Resilience Innovations

Investments in supply chain technology solutions are accelerating as firms around the world aim to address fragility exposed by recent shocks amid pressures for greater efficiency, visibility, and resilience.

Our analysis shows that warehouse automation deployments grew 15% last year while order tracking tools and risk mitigation technology saw similar upticks. Finding efficiencies by prioritising technology while navigating complex global logistics challenges remains key.

THE PULSE

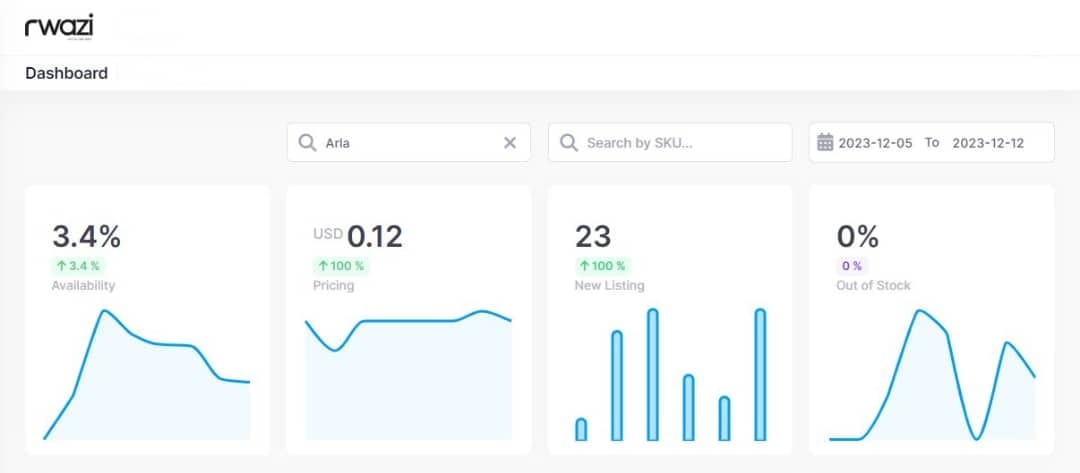

Featured Chart: YoY growth rates for key supply chain tech categories

Data analysis: Rwazi

SECTOR SCAN

Transforming the fragmented logistics sector

The logistics and supply chain ecosystem, particularly in emerging economies, is transforming amid technology growth and infrastructure challenges like fragmented markets, poor infrastructure, and complex regulations that drive up costs. Smaller fragmented players have traditionally dominated emerging market transportation. But startups are now innovating around financing, inventory management, warehousing and distribution to plug supply chain gaps while improving agility. However, the key lies in increasing infrastructure funding and adopting new technologies across the ecosystem.

Larger retailers and manufacturers are also modernizing to distribute goods more effectively. In African countries, informal retail represents 90% of FMCG value. The absence of supply chain data handicaps sales strategies and expansion. New logistics players and digitization are key to overcoming information blindspots.

Meanwhile, third-party logistics transforms, with smaller operators being replaced by modern tech-enabled providers. Though change is gradual, improved infrastructure and trade processes will unlock efficiency at scale

OUR COMPETITIVE WATCH

Carriers outpace shippers in tech deployment

Our analysis found that logistics carriers are outpacing shipper brands in deploying automation and modern supply chain technologies. Larger retailers struggle to compete with small informal shops comprising 90% of fast-moving consumer goods retail in emerging markets. Carriers show more urgency addressing delivery delays, visibility gaps, and bottlenecks. Major players are actively piloting blockchain, IoT sensors, and fleet electrification. And vertically integrated leaders increasingly set the pace.

However, shippers tend to lag on tech adoption beyond piecemeal solutions. Turning the tide will require cross-industry collaboration to smooth infrastructure and regulations towards unleashing innovation.

Our insight is that every supply chain participant has a role in driving transformation through collaboration and adopting innovations to address local infrastructure needs. The opportunity truly exists to reshape global commerce through strategic technologies and partnerships.

WHAT’S HAPENING AT RWAZI?

ICYMI: New feature on HubSpot for Startups

Our success story was featured in an in-depth profile and video by HubSpot for Startups as one of Techstars alumni whose mentorship has buillt startup superstars like ours. You can read the feature here.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights to decide with data. 📊

You can also go read an extensive blog version of this edition on our website here.

Do you have any sector’s consumer market insights you think we should explore in future briefs? Feel free to choose and share with us.