It’s another global intelligence briefing of Market Mosaic by Rwazi. We are happy you have chosen to read our cutting-edge market insights and global economic trends.

In this week’s edition, we dive into the complex dynamics of global oil prices and the drivers behind them. From the impact of e-mobility growth to the ongoing tug-of-war between OPEC and US shale producers, we uncover the key factors shaping the global oil market landscape.

Let's explore the insights together!

— Insights Team, Rwazi

Our Edition this week:

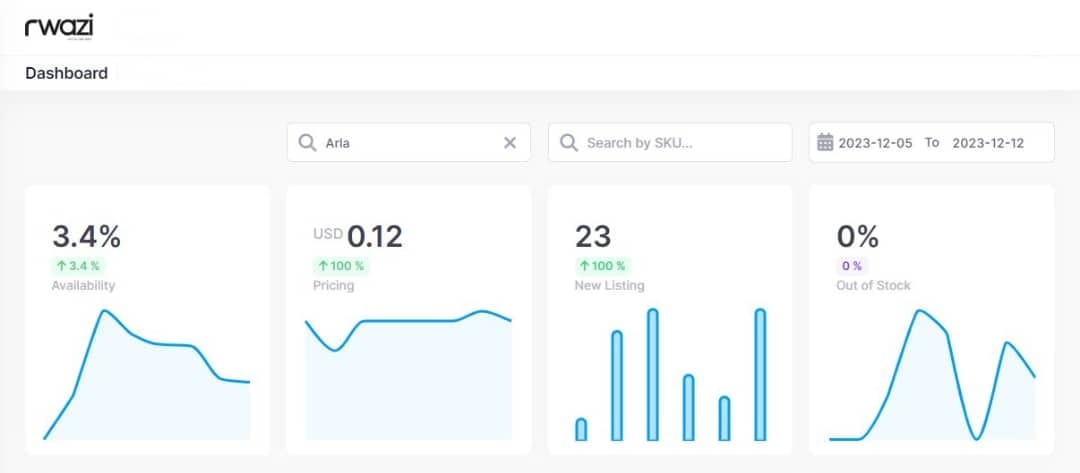

DATA SPOTLIGHT

E-mobility growth reshapes oil demand

Our consumer analysis in China, the world's largest car market, found that electric vehicle adoption with sales accelerating faster than expected. This signals a major demand shift, with three in five likely to buy an EV in 2025. The top purchase drivers include lower maintenance and environmental impact.

This also points to steeper declines in gasoline demand over the next decade than previously forecasted. Oil and gas players must adapt strategies to the speed and scale of this mobility transformation underway.

Key Insight: The EV inflection point has major implications for global oil supply-demand balances.

THE PULSE

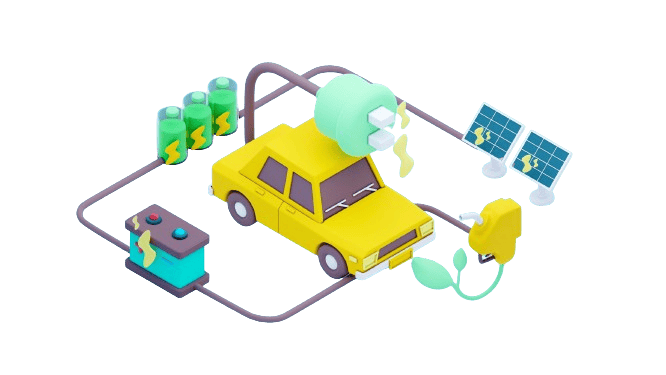

Featured Chart: China, United States attracted the highest clean energy investment volumes

Source: International Energy Agency • Data analysis: Rwazi

SECTOR SCAN

Transport accounts for 50% of oil usage

Over 50% of global oil consumption comes from road transportation like passenger vehicles and trucks. Aviation accounts for another 8%. With the growth of alternate mobility options like EVs and falling costs, oil demand for transport could drop by 30% by 2030, according to Rwazi consumer analysis.

Companies involved in extracting, refining and distributing oil are most exposed if demand plateaus. Firms like xx should accelerate investments in diversification and multi-energy strategies to hedge risks.

Key Insight: The mobility transformation creates risks for sectors of the oil value chain.

OUR COMPETITIVE WATCH

OPEC vs US Shale

Despite OPEC+ supply cuts, resilient US shale has gained market share with lower break-even costs and advanced technology. This dynamic points to ongoing battles ahead. A potential medium-term spike may occur if shale can't keep pace with the post-pandemic demand. Ultimately, EVs, renewables and efficiency gains will determine long-term pricing.

Key Insight: The shale vs OPEC interplay brings short-term pricing volatility before broader trends dominate.

WHAT’S HAPPENING AT RWAZI?

Feature on Alumni Ventures

We were featured on One Startup to Know, a series that examines some of Alumni Ventures’ most impactful and innovative portfolio companies. You can read the feature here.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights to decide with data. 📊

Do you have any sector’s consumer market insights you think we should explore in future briefs? Feel free to choose and share with us.