You asked for deeper insights. And we delivered.

As Market Mosaic evolved, we are introducing our new global media platform: newsletter.rwazi.com

This transformation was driven by you. We heard your requests for in-depth analyses, compelling data visualisations, easier navigation, and a central archive of all our premium offerings.

And this is the result that grows with your needs.

In this week’s edition, we unpack the reality of Google’s search dominance, the booming $44 billion creator ad market, and the critical supply chain shock hitting consumer electronics.

Now, let’s dive into the insights.

— Insights Team, Rwazi

Technology

Economy

Consumer Universe

Supply Chain

Google retains 90% search dominance despite the AI hype

The global search engine market share in 2025 shows a stark truth: despite the deafening noise around artificial intelligence and alternative discovery tools, Google dominates global search.

Accounting for nearly 90% of all queries worldwide, Google remains the default operating system for the digital consumer's curiosity. Its massive scale, habit-forming familiarity, and deep integration across devices have created a moat that even the most advanced AI has yet to cross.

Microsoft’s Bing stands in second place but remains a distant runner-up with just over 4% of the global market. The remaining players are fighting for scraps; Yandex holds a modest 2.18% share driven by regional loyalty, while privacy-focused DuckDuckGo captures less than 1% of the market.

Key Insights 💡

While AI is changing how we find answers, the data proves that user behaviour is incredibly sticky. For now, the internet’s front door is still largely controlled by a single landlord.

Creator Ad Spend projected to hit $44B by 2026

The Creator Economy has officially graduated from an experimental budget line item to a primary media channel. Advertising spend in this sector is projected to reach $37.10 billion in 2025, continuing an upward trajectory from just $13.90 billion in 2021.

The market saw its largest jump in 2024 with a growth rate of 34%, and while the pace is normalising, the outlook for 2026 points to a further rise to $43.90 billion.

However, as spending scales, advertisers are demanding clearer measurement, stronger standards, and better discovery tools. The double-digit growth we are seeing, projected at 26% this year and 18% in 2026, is based on the ecosystem solving issues around credibility and audience fit.

Key Insights 💡

The slowdown in growth rate (rom 34% down to a projected 18% in 2026) is not a sign of weakness, but of maturation. The Creator Economy is stabilizing into a standard, predictable asset class for global advertisers.

P&G's $374B valuation proves bigger is better

In the consumer goods world, size matters. Procter & Gamble stands alone at the top with a market cap of $374.5 billion, outpacing nearest rivals Coca-Cola ($292.5B) and L’Oréal ($251.5B).

This gap highlights a "valuation premium" on scale. P&G’s sprawling portfolio, spanning beauty, home care, and health, gives it a defensive resilience that focused competitors cannot match.

While mid-sized players like Estée Lauder ($32.1B) offer growth potential, investors are clearly favouring the giants who can lock in recurring cash flow regardless of the economy.

Key Insights💡

In the CPG universe, the ultimate moat is diversification. P&G’s dominance proves that being "everything to everyone" is a winning strategy when volatility is the new normal.

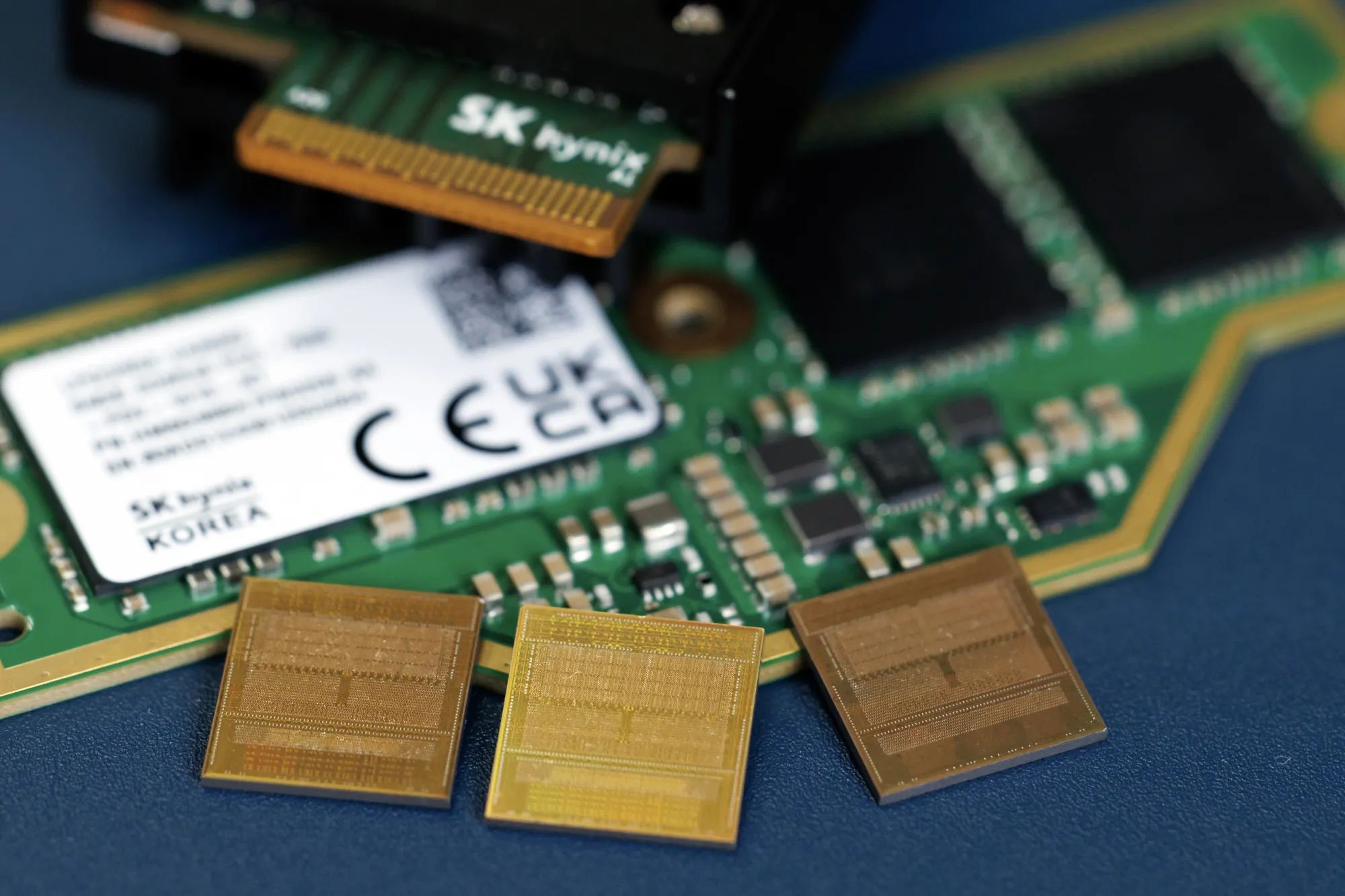

AI demand triggers 90% price spike in memory chips

The insatiable demand for AI is creating a supply shock for everyone else. Chipmakers like Samsung and SK Hynix are prioritising high-end chips for AI data centres over the standard chips used in laptops and phones.

The result is a massive bottleneck for consumer devices. Prices for standard DRAM memory chips are expected to jump 90–95% in the first quarter alone. This forces electronics makers into a difficult corner: absorb the costs or charge you more.

We forecast that global smartphone shipments will fall by 2.1% in 2026 as low-cost models become unsustainable and are pulled from the market.

Key Insights 💡

AI is eating the hardware market. The specialised chips required to run AI models are physically crowding out the chips needed for your phone.

Expect a year of "Hardware Inflation" where devices get pricier, not because of new features, but because of the AI boom.

This is Question #4 from our Business Intelligence assessment. 40% of leaders get this wrong. 📉

👇 Vote below, then see the correct answer by taking the full quiz here

A competitor launches an AI feature. What’s your interpretation?

Today’s edition marks another first step into your experience of the new Market Mosaic. We have redesigned every element of your experience.

And this is just the beginning. As we evolve from a newsletter into a global media platform, our promise to you remains constant: to provide the data-backed edge you need to navigate a complex global economy.

Thank you for being part of this growth journey with us.

🔓 Unlock the rest of this week’s insights

You have seen the trends on a preview. 💡 Now access the full deep-dive analysis and every future edition. 📉

Upgrade your subscription now ⚡Market Mosaic Premium subscription gets you ⤵:

- 🔍 Exclusive weekly deep-dives on your business sector

- 📈 Live "Sector Performance Tracker" access

- 📘 Full access to our monthly "Executive Playbooks"

- 📚 Our quarterly Insights Reports for free

- 📡 Curated "Market Signals" (Top 5 Weekly Reads)

- 🗄️ Unlimited access to all our Insights archive

- 📊 Visual Library Access (All data visualisations you need to stay updated)

- 💳 Exclusive Partner Deals & Tech Discounts