Welcome to the new Market Mosaic.

In case you missed it, we are excited to unveil our completely redesigned website: newsletter.rwazi.com

We have rebuilt your entire user experience from the ground up to serve as a central intelligence hub for executives and business leaders like you, designed to give you the edge you need.

In this week’s edition, we analyse the most expensive course correction in tech history and what it signals for the future of AI hardware. We also break down the stark cost-of-living arbitrage between the world's two superpowers.

Now, let’s dive into the insights.

— Insights Team, Rwazi

Technology

Economy

Consumer Universe

Supply Chain

Meta’s Reality Labs lost $19.2B in 2025 alone

Less than five years after Meta laid out its vision for a VR-centric future, the "Metaverse" as we knew it is officially dead. Earlier this month, Meta reportedly began laying off 1,000 people in its Reality Labs division, pivoting aggressively toward AI-powered smartglasses instead of the bulky VR headsets that were central to its initial strategy.

In 2025 alone, the Reality Labs division lost $19.2 billion, bringing the total operating losses for its big bet to nearly $90 billion over the past seven years. Despite this, the company seems ready to move on, with no mention of the metaverse in its recent earnings call, even as it braces for another year of heavy losses from the division.

However, the pivot is already showing promise. While VR headsets remain niche, Meta's AI-powered smartglasses, developed with Ray-Ban and Oakley, are seeing rapid adoption. For Meta, this hardware is a Trojan horse: AI glasses will eventually see what you see and hear what you hear, giving the company an unprecedented data advantage for ad targeting.

Key Insights

Meta is willing to burn $90 billion to own the next computing platform. The shift from "immersion" (VR) to "intelligence" (AI Glasses) acknowledges that consumers don't want to escape reality, they want to augment it.

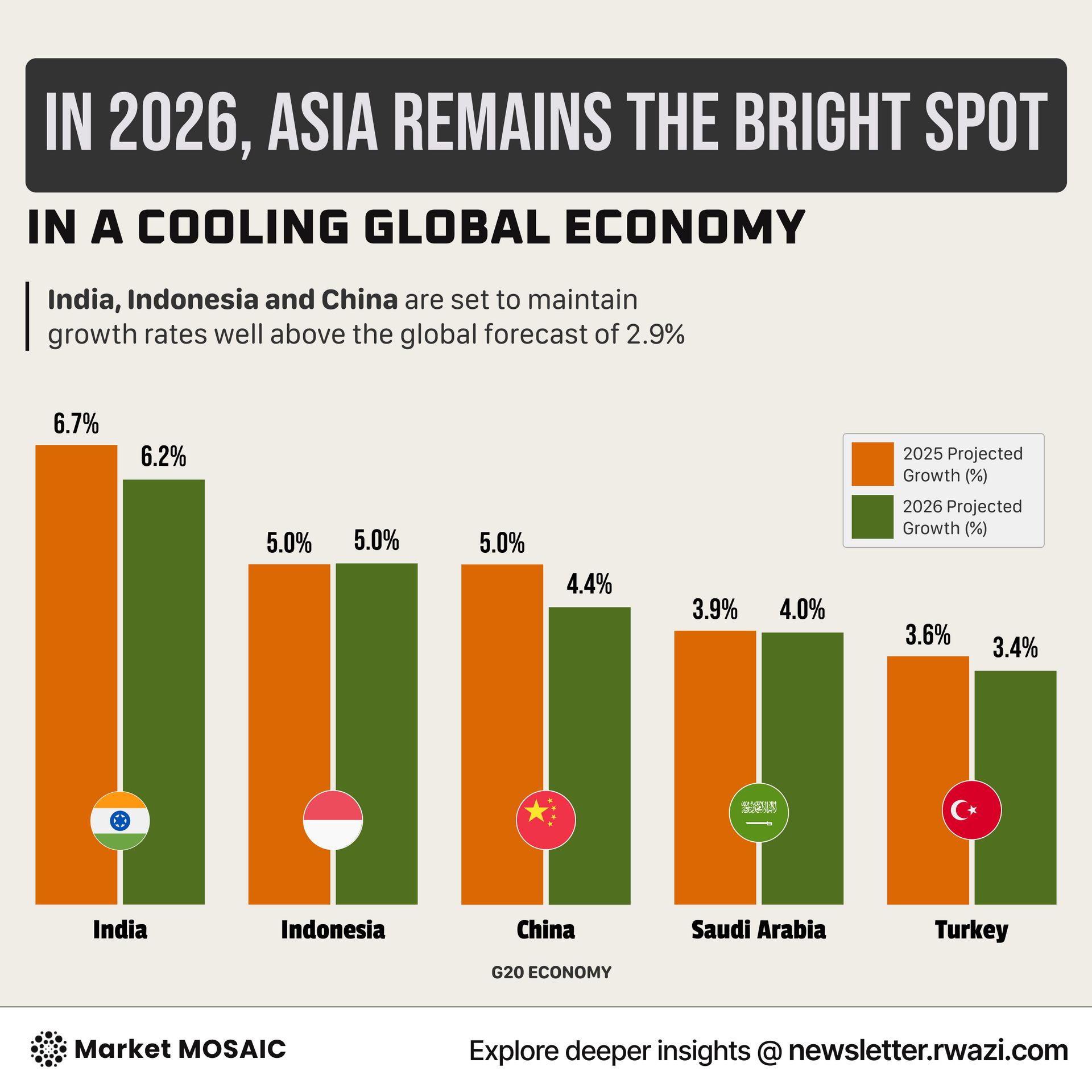

Global inflation to hit 3.7% in 2026 as U.S. stabilises at 2.4%

After years of volatility, the global economy is finding its footing. Global inflation is projected to ease from 4.2% in 2025 to 3.7% in 2026.

However, the global map remains deeply fractured. While major economies like China (0.7%), Switzerland (0.6%), and Italy (2%) are effectively seeing price stagnation, hyperinflation continues to ravage specific regions. Venezuela is forecasted to hit 682.1% inflation in 2026.

This reality means multinational businesses must operate with two distinct playbooks: one for the stable, low-growth West, and another for the volatile, high-risk emerging markets.

Key Insights

Stability has returned to the G7, but the "inflation tail" is long. The gap between the lowest inflation rate and the highest shows that monetary policy is no longer a synchronized global tide, but a series of isolated local storms.

We are pleased to launch Rwazi's Product Council, an exclusive opportunity for a select group of industry leaders (limited to 10 founding members) to help shape the future of market intelligence and retail analytics.

As a council member, you will receive:

Strategic Influence: Direct access to our product team to share insights and guide our roadmap as we build the next generation of decision intelligence tools.

Competitive Edge: VIP early access to new features and the latest market intelligence capabilities before they are publicly available, giving you a first-mover advantage.

Official Recognition: A formal seat on Rwazi's Product Council as an acknowledged industry advisor.

This isn't a heavy time commitment as we are looking for strategic conversations and candid feedback as we build. The access and influence, however, are very real.

Interested? Reply here or fill out the poll below.

Are you interested in claiming one of the 10 founding seats on the Rwazi Product Council?

The purchasing power gap of China vs. USA in 2026

When we analyse cost-of-living data, a startling disconnect emerges between nominal wages and actual lifestyle affordability. While the average monthly net salary in the U.S. ($4,276) is roughly 4x higher than in China ($1,007), the cost of core services in the U.S. erodes that advantage almost instantly.

The price multiplier for basic existence in the U.S. is extreme. Renting a 1-bedroom apartment in a city centre costs $1,747 in the U.S. versus just $559 in China. Basic utilities are 4x more expensive in the U.S. ($210 vs. $51), and internet access is nearly 7x more expensive ($72 vs. $11).

There are exceptions where the U.S. retains an advantage, specifically in commodities and agriculture. Gasoline is cheaper in the U.S. ($3.32/gallon vs. $4.35), as is milk ($4.00 vs. $6.77). But for the modern urban service economy, transport, housing, connectivity, and dining, the U.S. consumer is paying a massive "lifestyle tax" that Chinese consumers are not.

Key Insights

Nominal GDP ignores purchasing power. A U.S. salary looks dominant on paper, but after deducting the "fixed costs" of housing, healthcare, and transport, the discretionary income gap between the American and Chinese middle class is far narrower than headline statistics suggest.

Why loyalty is dead for the "Pivoting Retailer”

Retail continues to evolve because consumers continue to evolve. The old paradigm of "brand loyalty" is being replaced by "value loyalty." Shoppers today are selective, value-conscious, and ruthlessly efficient as they channel their spending toward the brands that simply "get it" in the moment. If the customer is always right, then retail must always be pivoting.

Success in 2026 now depends entirely on velocity. Retailers can no longer rely on legacy reputation; they must understand how shopping behaviours are changing in real-time.

We are seeing a shift where categories gain momentum not over years, but over weeks. Expectations around convenience and experience have hit a new baseline: if you aren't frictionless, you are invisible.

Key Insights

The "sticky" customer is a myth. In an era of infinite choice and perfect price transparency, loyalty is rented, not owned.

The winners of 2026 will be the retailers who treat their supply chain not as a logistics function, but as a customer experience engine that can turn on a dime.

🔓 Unlock the rest of this week’s insights

You have seen the trends on a preview. 💡 Now access the full deep-dive analysis and every future edition. 📉

Upgrade your subscription now ⚡Market Mosaic Premium subscription gets you ⤵:

- 🔍 Exclusive weekly deep-dives on your business sector

- 📈 Live "Sector Performance Tracker" access

- 📘 Full access to our monthly "Executive Playbooks"

- 📚 Our quarterly Insights Reports for free

- 📡 Curated "Market Signals" (Top 5 Weekly Reads)

- 🗄️ Unlimited access to all our Insights archive

- 📊 Visual Library Access (All data visualisations you need to stay updated)

- 💳 Exclusive Partner Deals & Tech Discounts