Welcome to the 100th edition of Market Mosaic.

We hit a triple-digit edition. For 100 consecutive weeks, we have tracked the pulse of the global economy, from the retail crashes of 2024 to the infrastructure boom of 2025. Thank you for trusting us with your inbox in 2026.

To mark this milestone, we are looking at the biggest number of all: Global Growth. The headlines for 2026 are painting a grim picture of a "global slowdown." The averages are dropping.

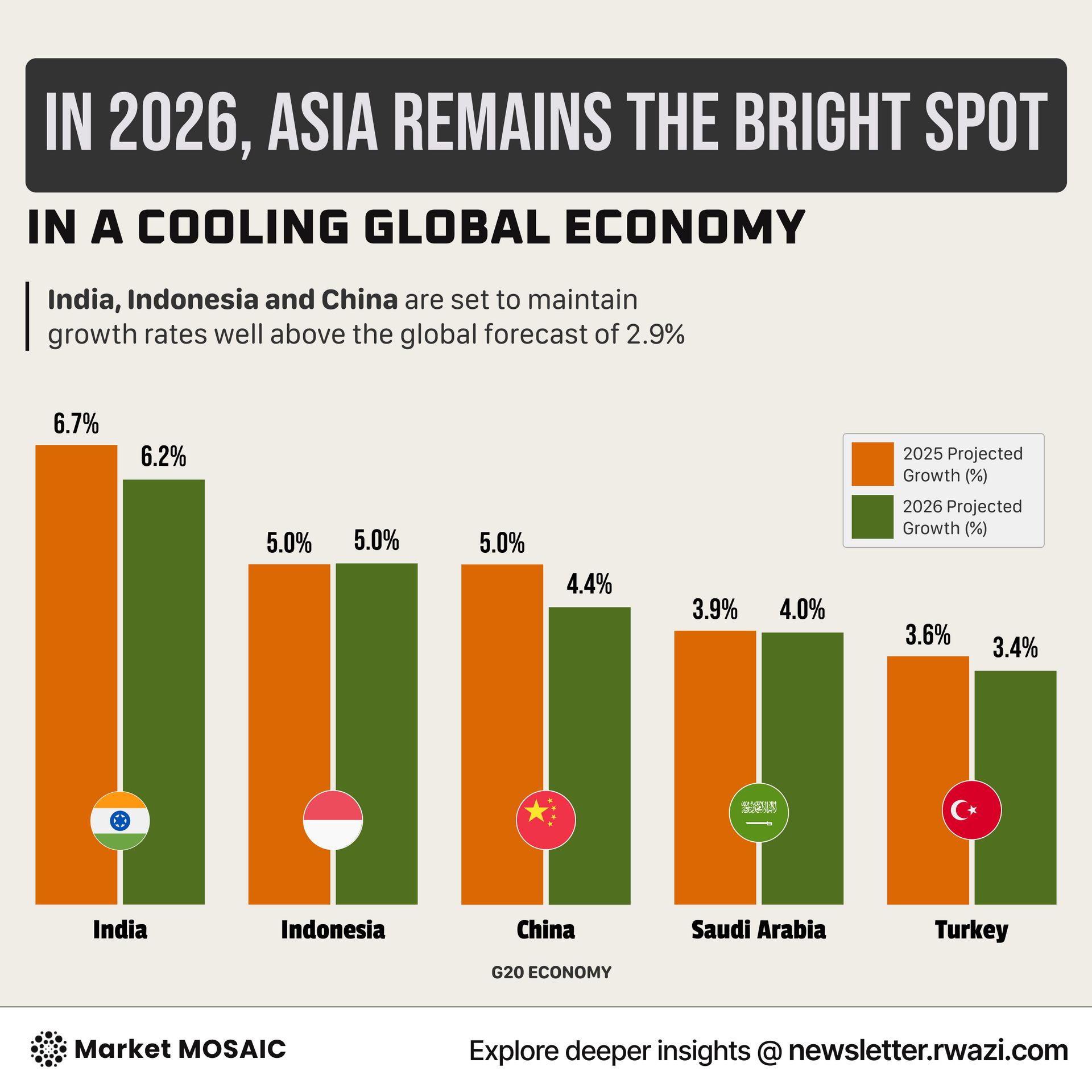

While the world cools down to 2.9%, a specific cluster of G20 nations is heating up. Here is our bold prediction for where the real growth lives in 2026.

— Insights Team, Rwazi

OUR BOLD PREDICTIONS FOR 2026

Global growth drops to 2.9% while these markets hit 6%+

The global economy has proved resilient, but the engine is undeniably sputtering. According to our new forecasts, global GDP growth is projected to slow from 3.2% in 2025 down to 2.9% in 2026.

The drivers of this slowdown are clear, ranging from elevated policy uncertainty to rising barriers to trade. However, looking at the aggregate data hides the massive divergence happening among the G20 economies, which together account for around 80% of global GDP.

Here are the four bright spots defying the global gravity in 2026.

India is the unstoppable engine. India tops the G20 list and is projected to exceed 6% growth yet again. We track it moving from 6.7% in 2025 to a projected 6.2% in 2026. This resilience is not just a function of population growth. It is being driven by robust domestic demand, a massive digital transformation, and a manufacturing sector that is finally capitalising on the "China+1" supply chain shift.

Indonesia is the King of Stability. While the rest of the world slows down, Indonesia holds the line. It is projected to maintain a steady 5.0% growth rate in both 2025 and 2026. The archipelago is actively leveraging its young workforce and its dominance in commodity exports, specifically nickel and critical minerals essential for the global EV transition.

China is slowing but remains a giant. China faces structural slowdowns, dropping from 5.0% in 2025 to 4.4% in 2026. Context is key here, as 4.4% growth on a $19 Trillion economy is still massive in absolute terms. China remains a key player, pivoting aggressively from low-end manufacturing to high-tech industrial output to sustain this momentum.

Saudi Arabia is the diversification play. Saudi Arabia is bucking the trend entirely. While most nations are slowing, the Kingdom is accelerating, moving from 3.9% in 2025 to 4.0% in 2026. Buoyed by oil revenues, the country is successfully deploying capital into ambitious economic diversification efforts, creating new growth sectors outside of energy.

Key Insight

If your 2026 strategy targets "Global Growth," you will miss the mark. The global economy is cooling, but the growth economy is concentrated.

The strategic pivot for 2026 is clear. Capital allocation shouldn't be based on stability, which is the hallmark of advanced markets. It should be based on velocity, which is currently found in Emerging Asia and the diversifying Middle East.

We give you the business competitive edge you need to thrive in 2026.

THE BLIND SPOT

Why "Shadow AI" is your new security leak

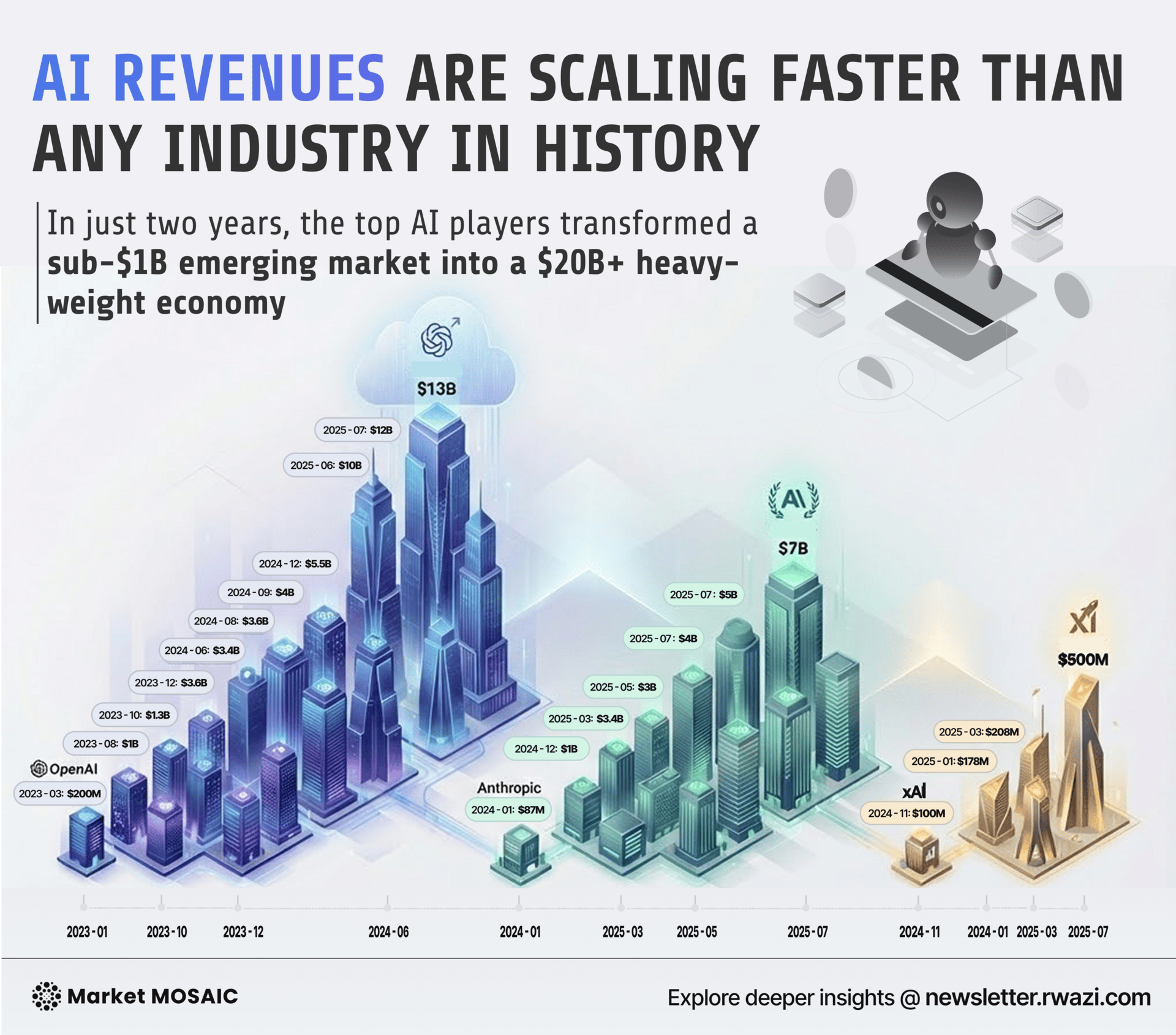

2026 is the year AI becomes unavoidable for business intelligence and market decision-making, just as it is for security. Artificial intelligence is rapidly transforming cybersecurity as 2026 begins, intensifying both cyber threats and defensive capabilities. At the same time, unauthorised "shadow AI" use inside organisations is creating dangerous blind spots and new data-exposure risks.

Core situation

AI is now central to both cyber offence and defence, enabling large-scale pattern analysis, automated decision-making, and faster incident response across thousands of attacks. However, emerging AI use is also expanding the attack surface and introducing novel vulnerabilities in security operations.

Shadow AI problem

Shadow AI refers to employees using unapproved AI tools (e.g., public chatbots or coding assistants) without IT or security oversight. This behaviour can leak sensitive data, violate compliance, and create unmonitored systems that attackers can exploit.

Escalating AI-driven threats

Adversaries are using AI to industrialise zero-day discovery, exploit development, and evasion, dramatically accelerating the production and weaponisation of new vulnerabilities. Security analysts expect major AI-driven incidents to spur increased security investment and push organisations toward AI-powered, zero-trust defences.

Key Insight

AI is shifting from a supportive security tool to an autonomous co-worker, increasingly responsible for detection, investigation, and automated remediation workflows in cyber defense.

Organizations that fail to govern shadow AI and harness agentic AI safely risk both more frequent breaches and loss of control over critical security decisions.

These analyses are just one layer of the data we track and insights we bring to you.

Unlock the full intelligence suite with Market Mosaic Premium:

✅ Weekly Sector Deep-Dives: Get the granular data behind the trends.

✅ Live Sector Performance Tracker: Watch the shifts in real-time.

✅ Quarterly Consumer Insights Reports: Free for Premium members.

How has Market Mosaic impacted your business decision-making?

You’ve read the data. But how well did you synthesise it?

We built a proprietary assessment to find out. The Business Intelligence Score (BIS) benchmarks your strategic thinking against the 200,000+ executives reading this newsletter.

It takes 3 minutes, and it gives you a "Strategic Insights" for 2026.

Ready to find out where you stand?