Welcome back to Market Mosaic.

To help you benchmark your strategy against top global performers, we are excited to introduce our latest engagement tool: the Business Intelligence Score.

In this week's edition, we unpack the widening gap between Big Tech's $4.2T market cap surge and the 1.1M job cuts reshaping consumer confidence. Particularly, how 63% of small businesses are navigating tariff pressures while consumers demand both lower prices and faster delivery.

Now, let's dive into our insights for this week.

— Insights Team, Rwazi

Do you actually know your market? Check your Business Intelligence Score

Understanding your decision-making skills is the first step to closing the gap between consumer behaviour and your business strategy.

Ready to find out where you stand?

Technology

Economy

Consumer Universe

Supply Chain

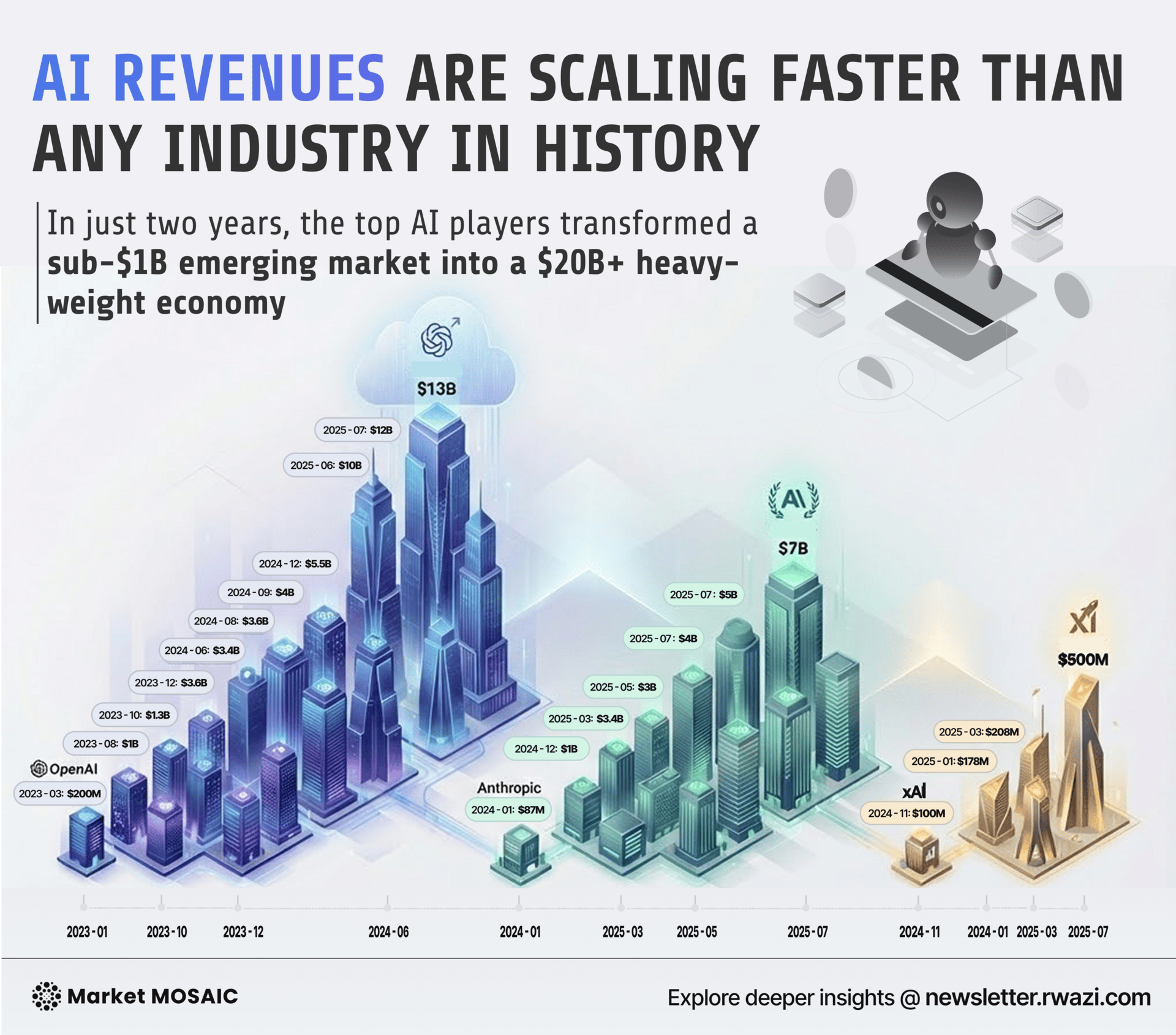

The great divergence in Big Tech's AI race

The 7 largest tech companies reached a combined market cap of $22 trillion by December 5th, up 26.5% ($4.2T) year-to-date. However, this masks dramatic winners and losers.

Alphabet surged 67%, adding $1.56T in value, while Nvidia gained 35% ($1.14T) and Broadcom climbed 70%. These 3 companies accounted for 75% of the group's total gains. Our consumer data shows 79% of consumers now regularly interact with AI-powered features in search and productivity tools, up from 41% at year-start.

The contrast is stark with Apple, down 9% for the year. Our surveys reveal that 62% of potential smartphone upgraders cite AI capabilities as a primary consideration, yet only 34% believe Apple offers competitive AI features compared to Android alternatives.

Meta's 25% gain reflects successful AI personalisation. User engagement increased 18% year-over-year, with 67% of regular users spending more time on Meta platforms specifically due to improved AI-curated content.

Microsoft's modest 15% gain reveals consumer scepticism about AI monetisation. Only 41% of consumers who tried Microsoft's AI tools continue using them after 3 months, versus 68% retention for competing products.

Key Insights

Companies delivering tangible, immediate AI value are winning both market share and investor confidence, while those positioning AI as a future promise are being left behind by increasingly demanding consumers.

The layoff wave and its impact on consumer confidence

Employers announced nearly 1.1M job cuts through October 2025, up 65% versus 2024, the highest since 2020. Government layoffs exploded 715% to 307,000 positions. Technology cuts rose 17% to 141,000, while warehousing surged 378% to 90,000 positions.

Our data analysis shows 63% of tech workers now express job security anxiety, up from 38% a year ago. The impact extends beyond those directly affected: 49% of employed consumers are increasing savings and reducing spending due to job loss concerns.

Consumer debt stands at $20.8T, but behaviour patterns show defensive positioning. Credit card utilisation decreased 7 percentage points year-over-year. 67% of consumers now view building emergency funds as their top priority, up from 52% at year-start.

Households directly affected by layoffs are cutting discretionary spending by an average of 32%. This spending pullback ripples through communities as economic anxiety spreads.

Key Insights

The layoff surge is creating a consumer confidence crisis extending far beyond those directly affected. Job security concerns are driving defensive spending behaviors that prioritize savings over consumption, with profound implications for economic growth across all sectors.

Asset growth masks financial anxiety

U.S. household assets reached $190.1T in Q1 2025. Financial assets (primarily stocks and ETFs) comprise 43% of total assets, while homes represent 27%. However, 61% of consumers describe themselves as financially stressed despite record asset levels.

The concentration in equities creates volatility stress. 68% of consumers with significant holdings check their portfolios weekly, and 41% check daily. This constant monitoring influences spending; consumers quickly curtail purchases when values decline.

On the liability side, mortgages represent 67% of the $20.8T in household debt. Student loans (9% of liabilities) significantly constrain spending, with 54% of borrowers reporting that these payments prevent major purchases they would otherwise consider.

Credit card debt represents only 6% of liabilities, but has an outsized psychological impact. 78% of consumers with credit card balances describe feeling stressed, and this stress directly correlates with reduced discretionary spending.

Key Insights

Record household assets fail to translate into consumer confidence because wealth is concentrated in volatile financial assets while debt burdens and economic uncertainties create persistent anxiety.

Small businesses navigate the tariff tightrope

63% of small and medium-sized businesses report tariff impacts on operations. Among those affected, 44% are absorbing costs rather than risking stockouts or losing customers through price increases.

Our data analysis shows 73% of consumers actively price-compare before purchasing, and 59% will immediately switch suppliers if prices seem unfair. Small businesses recognise minimal margin for error in this environment.

Preference for offshore suppliers dropped from 31% in 2024 to 28% in 2025. 64% of consumers prefer domestically-sourced products when prices are comparable, though only 23% will pay significant premiums for domestic sourcing.

Inventory strategies have become riskier. 55% of SMBs now carry excess stock exceeding 20% of forecasted demand, up from 48% last year. Dead stock (inventory held over 1 year) increased from 12% to 17% of businesses experiencing this problem.

Key Insights

Small businesses are caught between tariff-induced costs, consumer price sensitivity, and inventory strategy risks. Their challenges reflect broader tensions where trade policy changes collide with consumer expectations shaped by decades of globalization and price stability.

Consumer Insights Report (2025)

We bypass the noise to bring you actionable consumer insights from the world's fastest-moving markets for precision over predictions. HOLIDAY EXECUTIVE ACCESS: 60% OFF🎄 Add promo code HOLIDAY25 at...

This is Question #4 from our Business Intelligence assessment. 40% of leaders get this wrong. 📉

👇 Vote below, then see the correct answer by taking the full quiz here

A competitor launches an AI feature. What’s your interpretation?

In the other news, we are curating “The Circle,” a private, premium community for business executives, leaders and professionals like you, with exclusive benefits and high-class experiences.

Kindly let us know your level of interest in the poll below.

How interested are you in joining the exclusive Market Mosaic Circle?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}