Welcome back to Market Mosaic.

As you know, data is only as good as the decisions it drives. To help you benchmark your strategy against top global performers, we are excited to introduce our latest engagement tool: the Business Intelligence Score.

In this week's edition, we explore how AI companies are achieving unprecedented revenue acceleration and analyse why retailers must master data-driven agility to navigate the era of the hyper-selective shopper.

Now, let's dive into our insights for this week.

— Insights Team, Rwazi

Do you actually know your market? Check your Business Intelligence Score

Understanding your decision-making skills is the first step to closing the gap between consumer behaviour and your business strategy.

Ready to find out where you stand?

Technology

Economy

Consumer Universe

Supply Chain

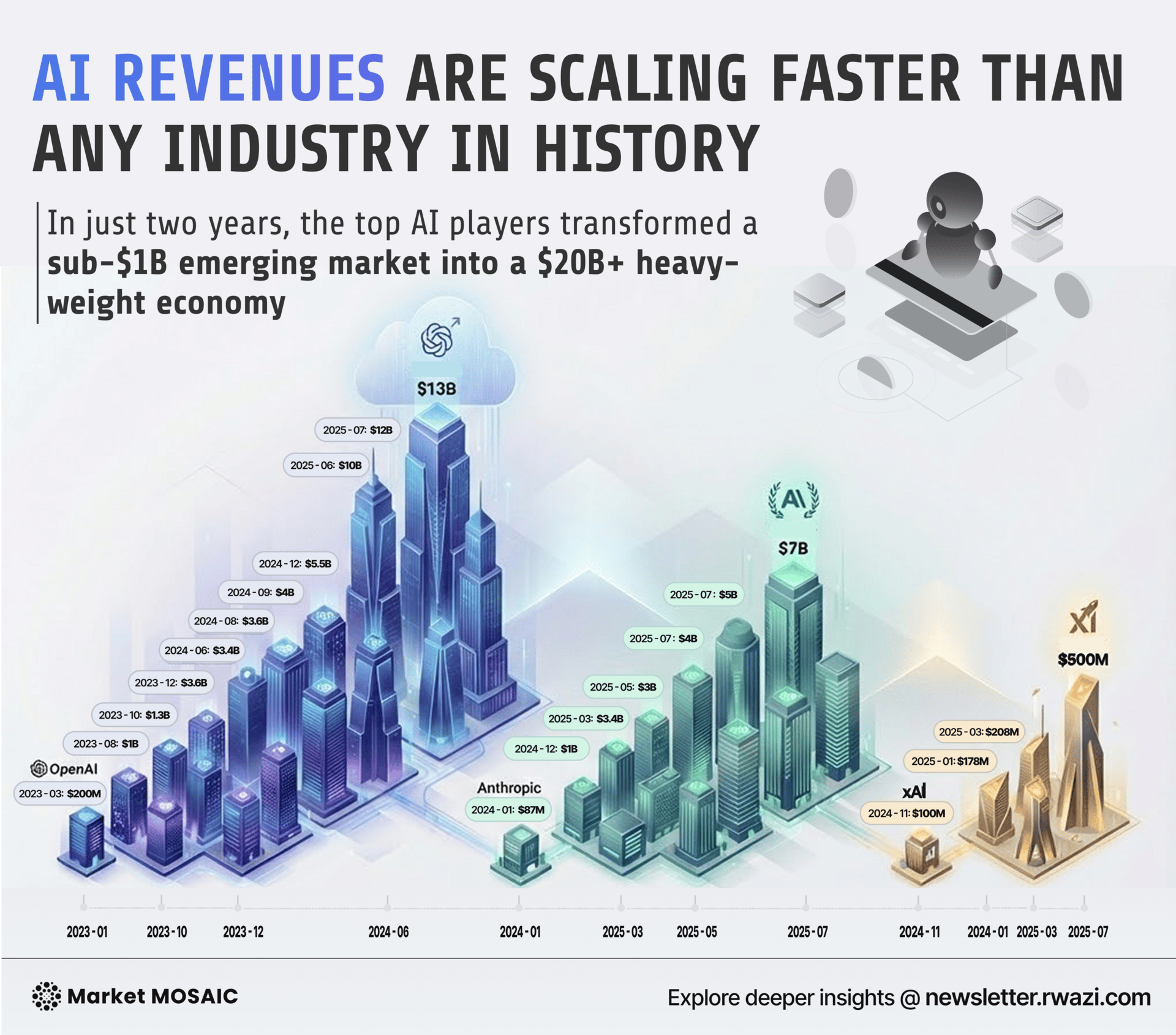

The AI revenue race accelerates at unprecedented speed

The AI sector is experiencing explosive revenue growth that defies traditional patterns. OpenAI has surged to $13 billion in annualised revenue by August 2025, up from $200 million in early 2023, a 65-fold increase in just over 2 years.

Anthropic has demonstrated equally impressive momentum, climbing from $87 million in annualised revenue at the beginning of 2024 to $7 billion by October 2025. This 80-fold increase signals the AI market can support multiple large-scale players as enterprises and consumers embrace AI-powered solutions across virtually every operation.

Even newcomer xAI has shown remarkable traction, growing from $100 million in late 2024 to $500 million by mid-2025. The 5-fold growth trajectory suggests the AI market remains expansive enough to accommodate new entrants with differentiated offerings.

The rapid adoption across all 3 platforms indicates organisations are treating AI as mission-critical infrastructure worth significant investment.

Key Insights

The explosive revenue growth across leading AI companies signals a fundamental shift from experimental adoption to essential infrastructure that commands premium pricing and sustained investment.

Travel Tuesday emerges as the new frontier in holiday shopping

The holiday shopping is transforming as consumers extend deal-hunting beyond traditional retail into travel. Travel Tuesday, occurring on the Tuesday following Thanksgiving, has emerged as a powerful new shopping phenomenon reflecting changing consumer priorities.

Search interest in Travel Tuesday has increased more than 5x over a 2-year period. While Cyber Monday still commands 10x the search volume, its declining interest contrasts sharply with Travel Tuesday's upward trajectory, suggesting a shift from material goods toward experiential purchases.

Geographic concentration remains primarily in North America, with some presence in Australia, the UK, the Netherlands, and Spain.

Key Insights

Travel Tuesday is now a rebalancing of consumer spending priorities toward experiences, creating opportunities for travel players to capture discretionary spending previously going to traditional retail.

Holiday spending shows restraint in the U.S.

28% of Americans will spend less on holiday decorations this year, slightly exceeding the 26% who will reduce gift spending. 56% cite money-saving efforts, 44% express economic uncertainty, and 42% say they have enough decorations already.

Average holiday spending is projected to drop 10% to $1,595. Gen Z is cutting spending by 34%, millennials by 13%. Gift spending specifically will average $628, down 2% from last year's $641.

These patterns reveal consumers making calculated trade-offs, prioritising financial security over peripheral purchases, with younger generations leading the shift.

Key Insights

The pullback in holiday decoration spending shows consumers prioritizing financial security over aesthetic enhancements, with younger generations driving a potential long-term shift in consumption patterns.

Retailers adapt to hyper-selective consumers

Retail success now depends on decoding foot traffic data signals and adapting to hyper-selective consumer behaviours. Shoppers are approaching retail with intentionality, researching online before store visits and expecting seamless omnichannel experiences.

Analysing which categories draw traffic, timing, and channels informs staffing, inventory, and promotional decisions. The 2025 holiday season is a critical bellwether for 2026 performance.

Retailers must maintain agility to pivot quickly while managing supply chains requiring months of advance planning. Consumers expect fluid journeys across all touchpoints without distinguishing between channels.

Key Insights

Success requires mastering data-driven agility, where foot traffic and omnichannel behaviour patterns inform real-time strategic adjustments for extraordinarily selective shoppers.

This is Question #4 from our Business Intelligence assessment. 40% of leaders get this wrong. 📉

👇 Vote below, then see the correct answer by taking the full quiz here

A competitor launches an AI feature. What’s your interpretation?

In the other news, we are curating “The Circle,” a private, premium community for business executives, leaders and professionals like you, with exclusive benefits and high-class experiences.

Kindly let us know your level of interest in the poll below.

How interested are you in joining the exclusive Market Mosaic Circle?

Last Thursday, we went live on LinkedIn with our industry leaders, Kapil Mathrani and Peter Garazha, to explore a critical shift in the market: moving from secondary data to real-time, consumer-sourced intelligence.

If you missed the session, the replay is now available to watch here.

We dove deep into how creative strategies change when powered by ground-level consumer behaviour.

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: