Welcome back to Market Mosaic. As you know, data is only as good as the decisions it drives. To help you benchmark your strategy against top global performers, we are excited to introduce our latest engagement tool: the Business Intelligence Score.

In case you missed our live session of the Conversations with Market Mosaic on how consumer-sourced data is the new engine for growth, you can catch up on the replay here.

Now, let's dive into our insights for this week.

— Insights Team, Rwazi

How strong is your business intelligence?

Understanding your decision-making skills is the first step to closing the gap between consumer behaviour and your business strategy.

Ready to find out where you stand?

Technology

Economy

Consumer Universe

Supply Chain

The old guard still maintains its grip on digital consumer attention

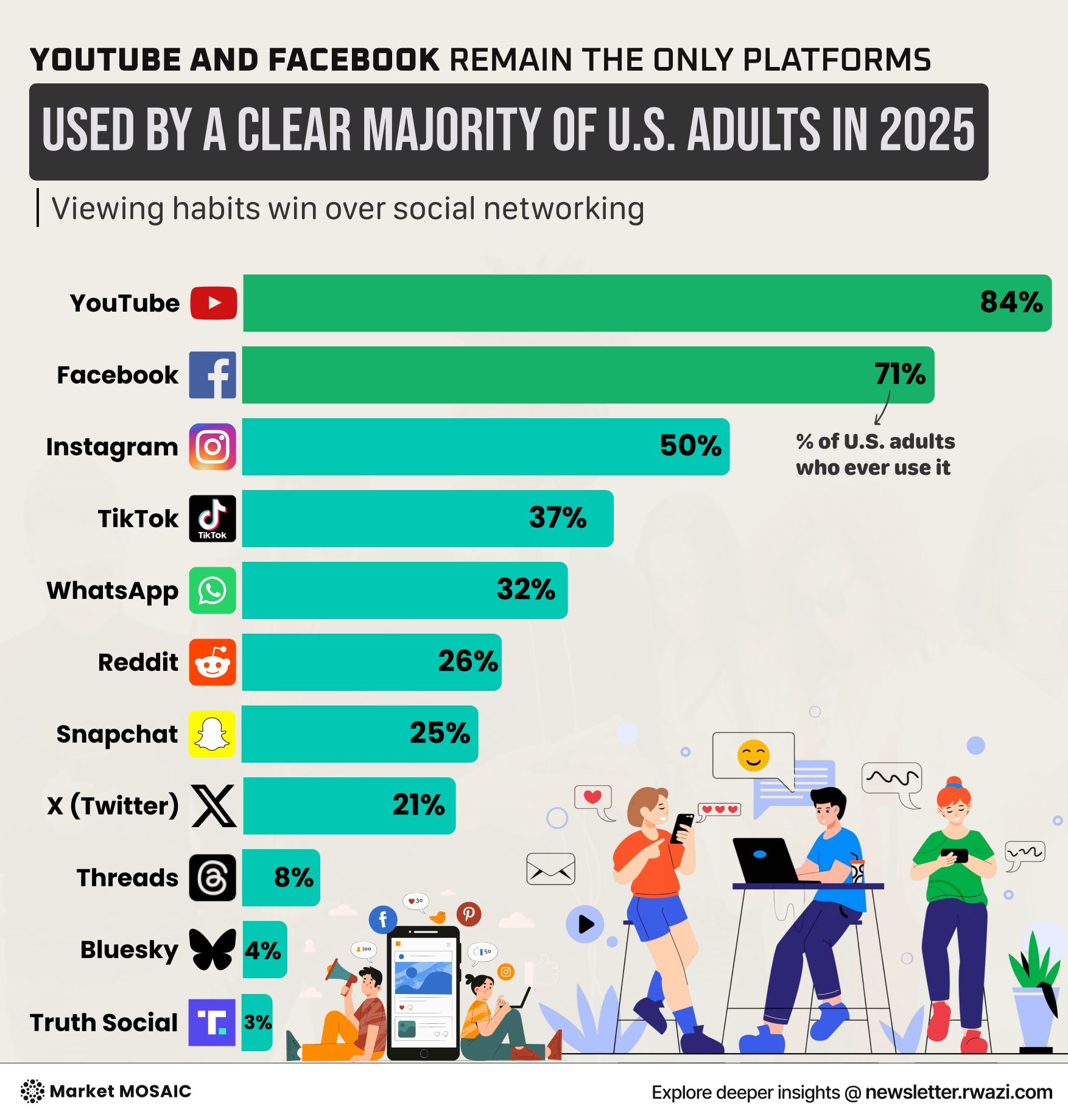

The latest social media usage data shows that established platforms continue to command overwhelming consumer attention. YouTube reaches 84% of US adults, while Facebook captures 71%. Instagram has climbed to 5% adoption, and TikTok sits at 37%.

Newer platforms face steep challenges. X reaches 21% of adults, Threads registers just 8%, Bluesky sits at 4%, and Truth Social at 3%. These figures go to show the difficulty of building meaningful scale when consumer attention remains anchored to platforms with established network effects.

Daily engagement patterns reinforce why YouTube and Facebook continue attracting advertiser dollars and creator investment. While new platforms generate excitement, actual shifts in consumer behaviour remain gradual and uneven.

Key Insights

Consumer loyalty to established platforms reflects deep behavioral patterns that newer entrants struggle to overcome. For brands, this means diversification strategies must be balanced against the reality that YouTube and Facebook still offer unmatched reach and engagement consistency.

Trade agreements now shape global market access

The United Kingdom leads with 39 active trade agreements, reflecting its post-Brexit strategy to compensate for lost EU market access. Chile follows with 31 agreements, while Singapore maintains 28. These smaller economies use trade deals as key tools for growth, given their heavy reliance on imports.

The United States ranks 17th with just 14 agreements, showing a more cautious approach to trade liberalisation. At the other end, Taiwan operates with only 4 agreements, Bangladesh has 5, and Sri Lanka and Papua New Guinea each count 6.

For consumers, extensive trade networks translate to wider product variety and more competitive pricing. Nations with limited trade openness face higher prices and restricted selection, particularly for goods not efficiently produced domestically.

Key Insights

The divergence in trade agreement adoption show differences in national economic strategies. Markets with extensive networks offer easier entry for multinational companies, while those with limited agreements require more complex strategies but potentially face less foreign competition.

Scale and diversification command premium valuations

Procter & Gamble leads the consumer packaged goods sector with a market capitalisation of $374.5 billion, far ahead of competitors. This valuation reflects investor preference for diversified portfolios spanning beauty, home care, health, and personal care.

Coca-Cola follows at $292.5 billion, while L'Oréal and Philip Morris each command around $251.5 billion. American firms claim half of the top 20 positions, including PepsiCo at $200.4 billion and Colgate-Palmolive at $68.8 billion.

Mid-cap players like Henkel ($33.9 billion), Estée Lauder ($32.1 billion), and Church & Dwight ($23.3 billion) show that focused category leadership in specific niches can generate substantial value without competing across all categories.

Key Insights

The massive valuation premium commanded by P&G underscores that scale matters, but diversification matters more. Companies that leverage shared capabilities across multiple categories while maintaining strong brand equity create resilience that investors reward handsomely.

Domestic manufacturing appeals beyond price considerations

Our data analysis of 148 manufacturers from all 50 states in the United States gained insights from consumers with domestically produced alternatives across multiple categories. "Made in USA" is the most compelling marketing label, compared to just "tariff-free."

This disparity suggests consumer interest in domestic products transcends immediate price calculations, reflecting values-based decisions around job preservation, supply chain resilience, and quality perceptions.

However, visibility remains challenging as the US advertising space is dominated by importers and large retailers.

Key Insights

Companies must invest in marketing strategies that effectively communicate production credentials to consumers seeking these alternatives in an import-dominated marketplace.

Last Thursday, we went live on LinkedIn with our industry leaders, Kapil Mathrani and Peter Garazha, to explore a critical shift in the market: moving from secondary data to real-time, consumer-sourced intelligence.

If you missed the session, the replay is now available to watch here.

We dove deep into how creative strategies change when powered by ground-level consumer behaviour.

We are curating “The Circle,” a private, premium community for business executives, leaders and professionals like you, with our exclusive benefits and high-class experiences.

To help us finalise the benefits and (literally) build the Circle for you, kindly let us know your level of interest in the poll below.

How interested are you in joining the exclusive Market Mosaic Circle?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: