Welcome back to Market Mosaic. This week, we unpack the paradox of the $1.64 trillion AI market correction amid accelerating consumer adoption, and analyse the widening gap between corporate promises and economic reality in global markets.

Plus, how retailers are gambling on a discount-free holiday season.

In case you missed the latest edition in our “Conversations with Market Mosaic” series, you can catch up here.

Let's dive into the insights.

— Insights Team, Rwazi

What’s your market persona as a business leader?

Our quiz discovers if you are an Explorer, Builder, Analyst or Strategist and how your mindset shapes your market strategy.

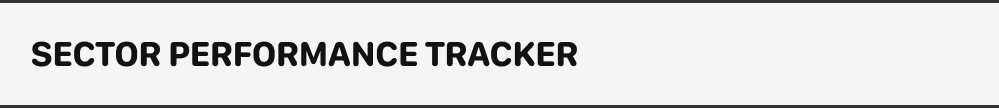

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

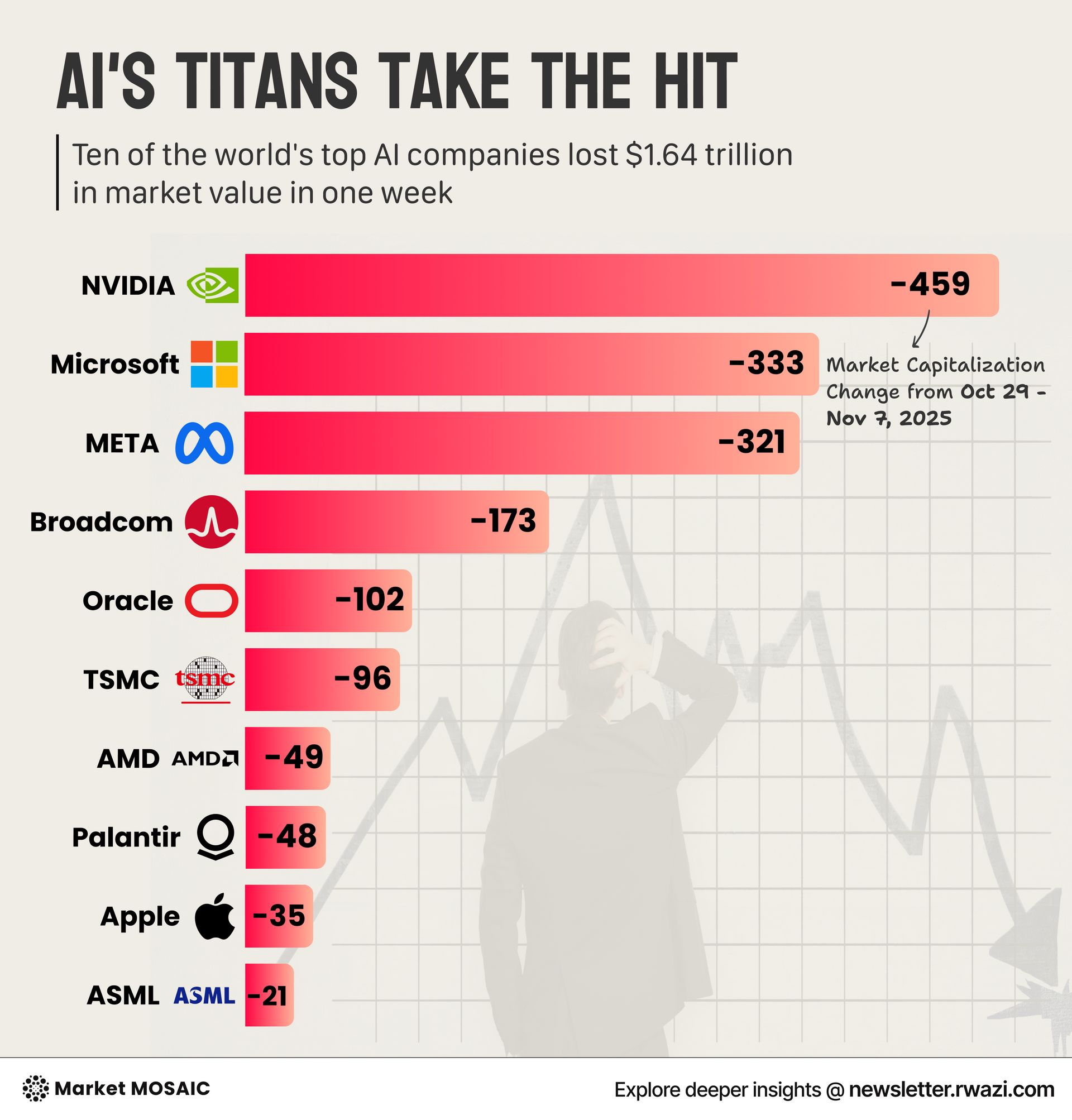

The great AI market cap collaspe

Ten major AI companies collectively lost $1.64 trillion in market capitalisation between October 29 and November 7, 2025. This is the biggest market correction in the AI sector's brief but explosive history, with Nvidia alone shedding $459 billion in value, followed by Microsoft at $333 billion and Meta at $321 billion.

What makes this correction particularly noteworthy is its breadth. From semiconductor manufacturers like ASML losing $21 billion to software giants like Oracle shedding $102 billion, no segment of the AI ecosystem was spared.

Even Apple, typically insulated from pure-play AI volatility due to its diversified hardware business, saw its market value decline by $35 billion during this period.

The correction appears to have been triggered by a combination of factors, including concerns about the sustainability of massive capital expenditures, questions about monetisation timelines, and emerging competitive pressures from unexpected sources.

Key Insights

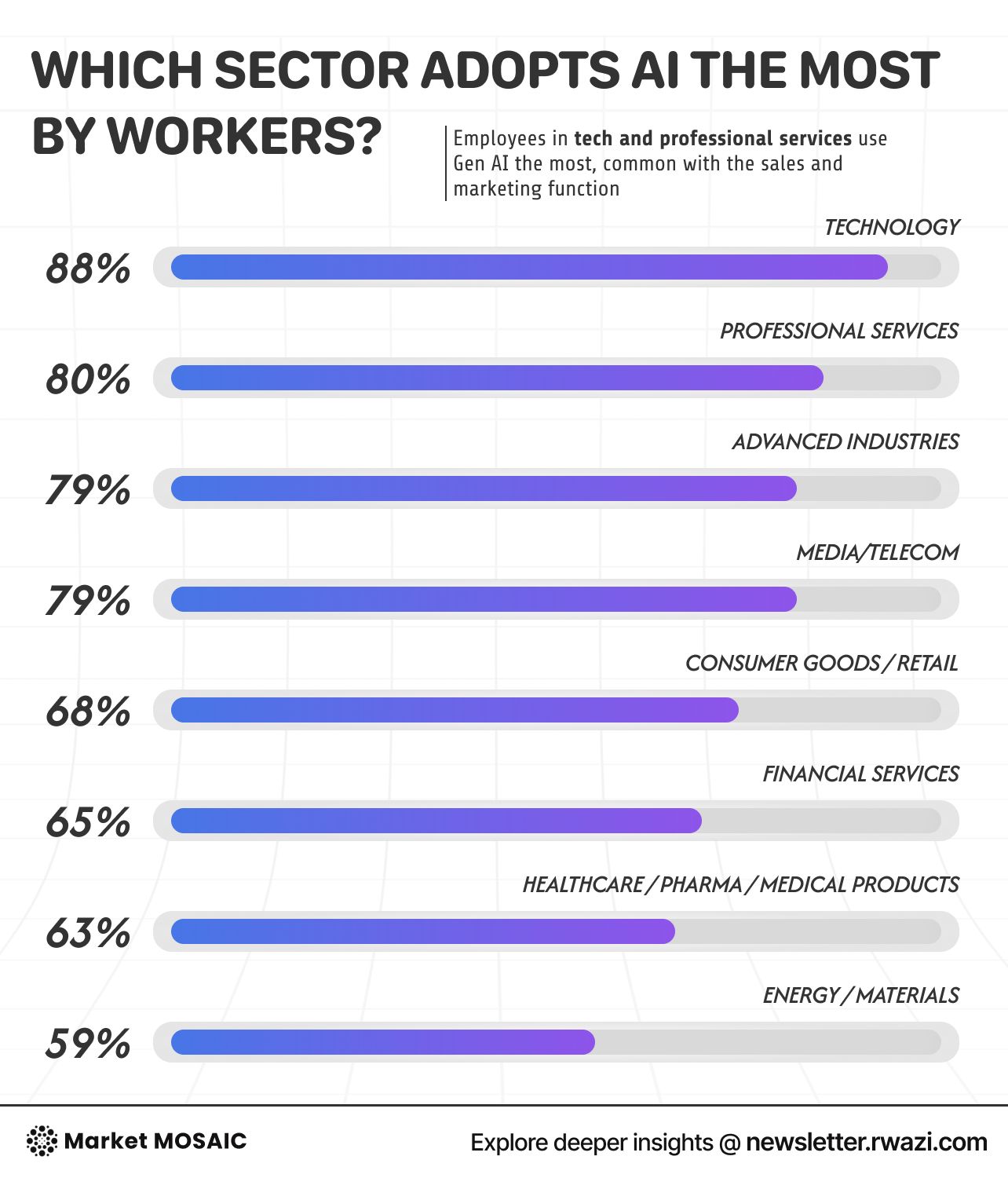

The market correction in AI stocks reflects investor anxiety about returns on massive infrastructure investments, but consumer adoption patterns remain strong and accelerating.

The data center jobs’ mirage

Microsoft and Google promised thousands of jobs from their data centres in Chile.

But permit filings show a shocking reality: only hundreds of permanent positions after construction, mostly in security and cleaning rather than high-skill technology roles.

This gap is challenging investment negotiations across other developing markets.

Seventy-nine per cent of consumers in these regions now prioritise projects that create quality local jobs over those that simply increase GDP through capital expenditure.

Key Insights

The disconnect between corporate job creation promises and automated data center reality is eroding trust in technology investments across emerging markets.

Communities increasingly demand transparent employment commitments and meaningful local economic participation, reshaping how governments evaluate large-scale technology projects.

Apple's tariff-driven quarter as consumer anxiety fuels growth

Apple exceeded expectations with revenue surging 14% to $96.4 billion, its strongest growth since December 2021. iPhone sales grew 13.5% to $44.6 billion, but the driver shows fascinating consumer psychology: 46% of purchasers cited fears of tariff-related price increases as a factor in upgrading earlier than planned.

This tariff anticipation effect pulled forward future demand as consumers actively forecasted policy changes. Services revenue reached $27.4 billion with 13.3% growth, supported by 2.3 billion active devices and over one billion paid subscriptions. Mac sales jumped 14.8% following new MacBook Air releases.

However, Wearables declined 8.6% and iPad fell 8.1%, reflecting market saturation and longer replacement cycles as product durability improved.

Key Insights

Consumer anxiety about future economic conditions is reshaping purchasing behavior, with buyers making preemptive decisions to avoid anticipated price increases.

How retailers will offer value this upcoming holiday in a discount drought

Retailers are implementing a shift as the 2025 holiday season approaches. Average discount depths have declined 18% compared to last year, even as 74% of holiday shoppers cite discounts as a primary purchase factor.

They are deploying alternative strategies to maintain sales without sacrificing margins. Buy now, pay later availability increased 53%, with 41% of holiday shoppers planning to use BNPL services versus 28% last year.

Personalised promotions generate 32% higher conversion rates than generic discounts while requiring only 6% of the discount depth.

Key Insights

Retailers are reducing traditional discounts while introducing alternative value mechanisms like buy now, pay later and personalized offers, testing consumer willingness to pay closer to full price.

The 2025 holiday season will determine whether consumers accept new forms of value or simply defer purchases.

We are curating an exclusive Market Mosaic Circle, a private, premium community for business executives, leaders and professionals like you, with our exclusive benefits and high-class experiences.

To help us finalise the benefits and (literally) build the Circle for you, kindly let us know your level of interest in the poll below.

How interested are you in joining the exclusive Market Mosaic Circle?

In case you missed it, for this edition of "Conversations with Market Mosaic", we spoke to Andrew Dremin, a Senior Retail & E-commerce Leader with deep expertise in the forces shaping the digital retail.

🟣 Market Mosaic: Pricing in retail and e-commerce keeps changing fast. What's one big shift you've noticed in how brands are approaching pricing today?

🟢 Andrew Dremin: The days of "set-it-and-forget-it" pricing are over. Modern retail, perfected by Amazon, now runs on intelligent, AI-powered dynamic pricing. Amazon's algorithms famously change millions of prices daily, but the AI has evolved far beyond just tracking rivals.

New systems, including Generative AI, now predict demand and analyse your specific browsing behaviour to find the perfect price at the perfect moment. This lets Amazon strategically slash prices on popular items to look like the low-price leader, while quietly protecting profits on everything else.

The impact is huge: recent data shows this level of AI personalisation can boost revenue by up to 40%.

Also want to feature in our next expert interview edition on Conversations with Market Mosaic?

Let us know here

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: