Welcome back to Market Mosaic. This week, we explore how 3,046 megawatts of Northern Virginia cloud infrastructure powers consumer expectations while 3,200 critical UK facilities face climate threats, among others.

In case you missed the latest edition in our “Conversations with Market Mosaic” series, you can catch up here.

Let's dive into the insights.

— Insights Team, Rwazi

What’s your market persona as a business leader?

Our quiz discovers if you are an Explorer, Builder, Analyst or Strategist and how your mindset shapes your market strategy.

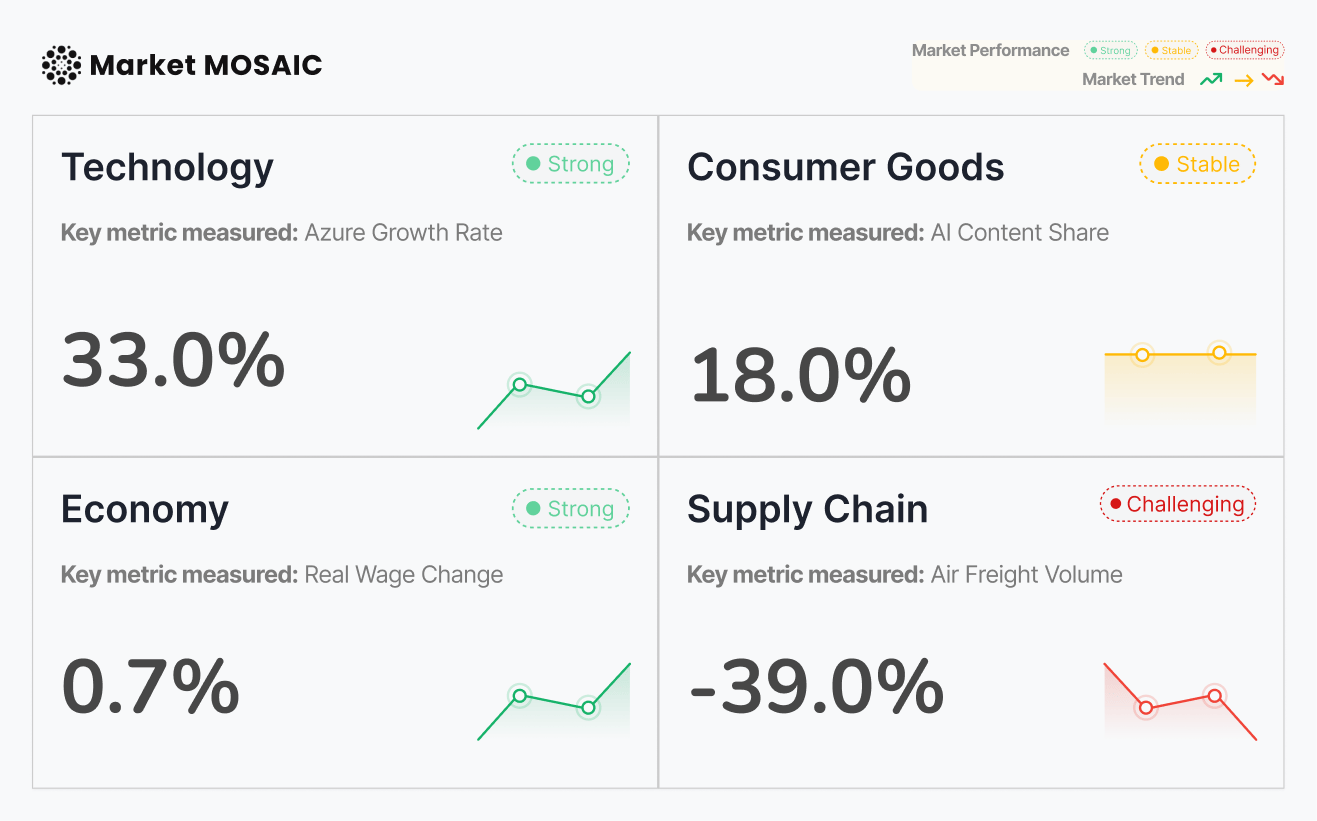

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

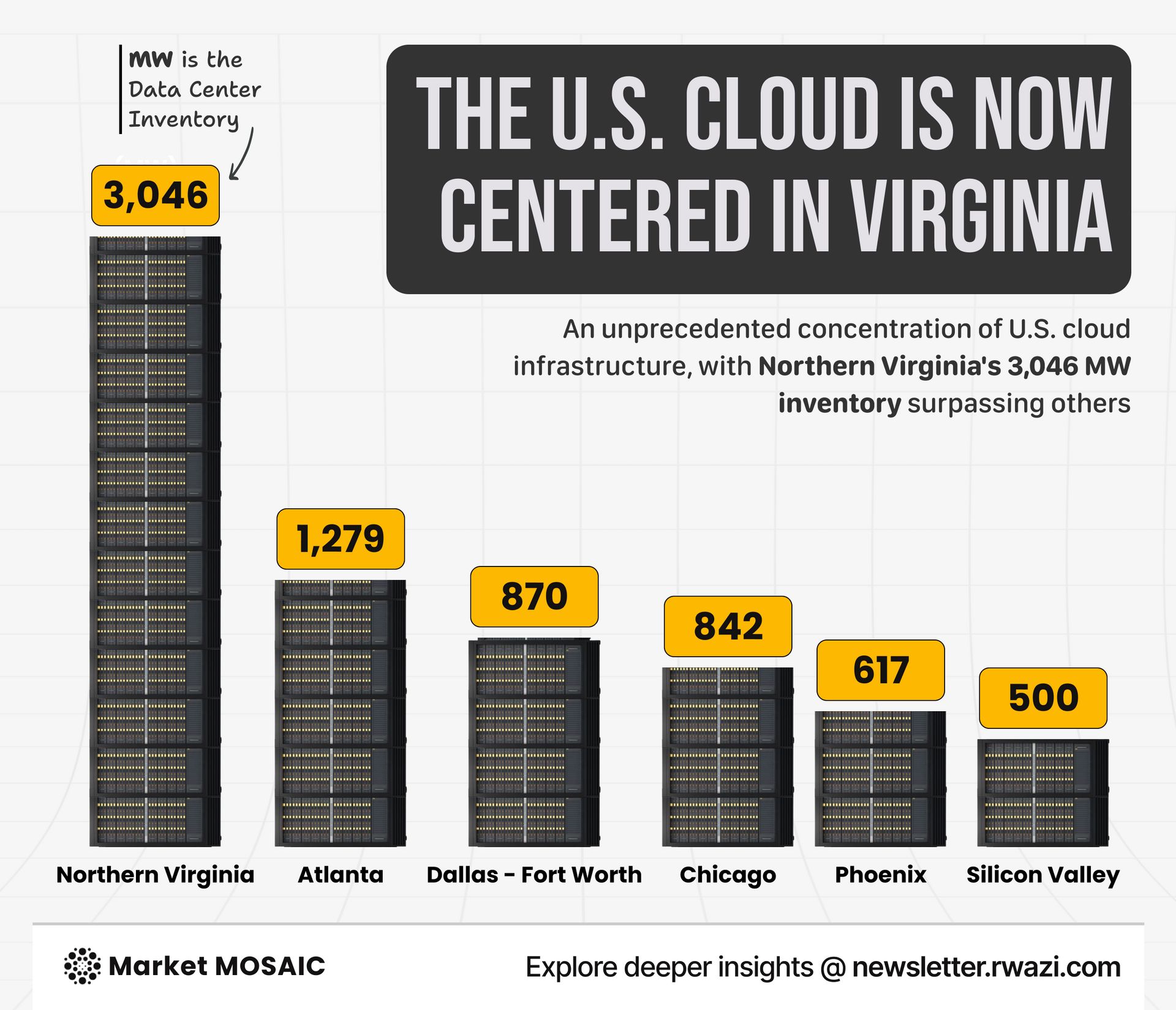

Northern Virginia dominates cloud infrastructure in the US

Northern Virginia leads U.S. cloud infrastructure with 3,046 MW of data centre capacity, more than double Atlanta's 1,279 MW. Dallas-Fort Worth follows at 870 MW, Chicago at 842 MW, Phoenix at 617 MW, and Silicon Valley at 500 MW.

This concentration powers the seamless digital experiences consumers now expect as standard. Every streaming video, financial transaction, AI recommendation, and social media interaction flows through these data centres. The strategic distribution ensures minimal latency and maximum reliability.

Geographic expansion reflects growing AI workload demands and edge computing requirements.

This clustering model is being replicated globally, particularly in emerging markets, enabling faster cloud access and better service quality for consumers in Asia, Latin America, and Africa.

Key Insights

Cloud infrastructure concentration directly shapes consumer expectations, establishing instantaneous, always-available access as a baseline requirement for competitive businesses.

Developing markets now trade at compelling valuation discounts

Developing market stocks trade at P/E ratios over 30% lower than developed markets and more than 40% below U.S. equities. Singapore leads at 15.3, followed by Europe and the UK at 15.9, while U.S. stocks command 27.5.

Lower valuations attract foreign investment that flows into infrastructure and business expansion. Our data analysis shows markets with significant investment inflows see consumer confidence rise 12-18% within twelve months, driving increased discretionary spending.

With the emerging economy middle class projected to grow by 1.2 billion people over the next decade, current valuations may underestimate expanding consumer purchasing power.

However, lower ratios also reflect concerns about stability, regulatory uncertainty, and currency volatility.

Key Insights

These market valuations signal both opportunity and challenges, with investment flows driving consumer market development and service improvements reshaping global consumption patterns.

The subscription economy now shows value hierarchies

Music streaming maintains consistent pricing at $10.99 monthly across Spotify, YouTube Music, and Apple Music, representing exceptional value per consumption hour. Video streaming shows greater fragmentation, ranging from Apple TV Plus at $9.99 to Sling TV at $40.00.

Our data analysis shows subscribers actively watch content on just 2.3 platforms while maintaining 3.7 subscriptions, indicating significant budget waste. Ad-supported tiers now attract 37% of new subscribers, showing substantial price sensitivity.

The New York Times has attracted 9.7 million digital subscribers, nearly three times The Wall Street Journal's base, despite lower pricing. Average households now maintain 7.4 active subscriptions totalling over $150 monthly.

Key Insights

Subscription proliferation creates financial burden many consumers struggle to optimize, suggesting opportunities for aggregation platforms and management tools that maximize value while controlling costs.

Climate risks threaten UK’s supply chain Infrastructure

Analysis of over 67,000 UK supply chain locations shows 3,200+ essential facilities in high-risk storm zones, representing 5% of critical infrastructure. Manufacturing bears the heaviest burden with 2,561 factories (6%) exposed, followed by 604 warehouses (4%) and 47 data centres (3%).

Regional concentration creates systemic risks. Manchester hosts high-risk manufacturing with £1.6 billion in revenue exposed.

Cardiff-area warehouses at risk show 10% of regional storage capacity. Glasgow shows dense data centre concentration, threatening digital infrastructure.

For consumers, these vulnerabilities mean product shortages, delivery delays, and price spikes during severe weather.

Growing storm frequency shifts disruptions from occasional to recurring challenges, eroding consumer confidence.

Key Insights

Supply chain concentration in high-risk climate zones requires urgent response through infrastructure hardening or geographic diversification to maintain service reliability.

In case you missed it, for this edition of "Conversations with Market Mosaic", we spoke to Andrew Dremin, a Senior Retail & E-commerce Leader with deep expertise in the forces shaping the digital retail.

🟣 Market Mosaic: Pricing in retail and e-commerce keeps changing fast. What's one big shift you've noticed in how brands are approaching pricing today?

🟢 Andrew Dremin: The days of "set-it-and-forget-it" pricing are over. Modern retail, perfected by Amazon, now runs on intelligent, AI-powered dynamic pricing. Amazon's algorithms famously change millions of prices daily, but the AI has evolved far beyond just tracking rivals.

New systems, including Generative AI, now predict demand and analyse your specific browsing behaviour to find the perfect price at the perfect moment. This lets Amazon strategically slash prices on popular items to look like the low-price leader, while quietly protecting profits on everything else.

The impact is huge: recent data shows this level of AI personalisation can boost revenue by up to 40%.

Also want to feature in our next expert interview edition on Conversations with Market Mosaic?

Let us know here

What’s one thing we could improve to make this newsletter more valuable for you?

Would you be open to a quick 15-minute call to give more feedback? 📞💬

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: