Welcome back to Market Mosaic. As always, we are excited to bring back something exciting for you this week: a quiz that captures how market forces are influencing your business priorities.

Take a moment to weigh in and see how your outlook compares with business leaders across the world.

Then let's uncover what's moving global markets together.

— Insights Team, Rwazi

What’s your market persona as a business leader?

Our quiz discovers if you are an Explorer, Builder, Analyst or Strategist and how your mindset shapes your market strategy.

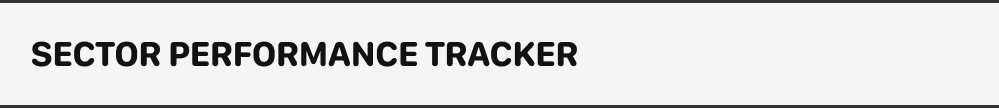

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

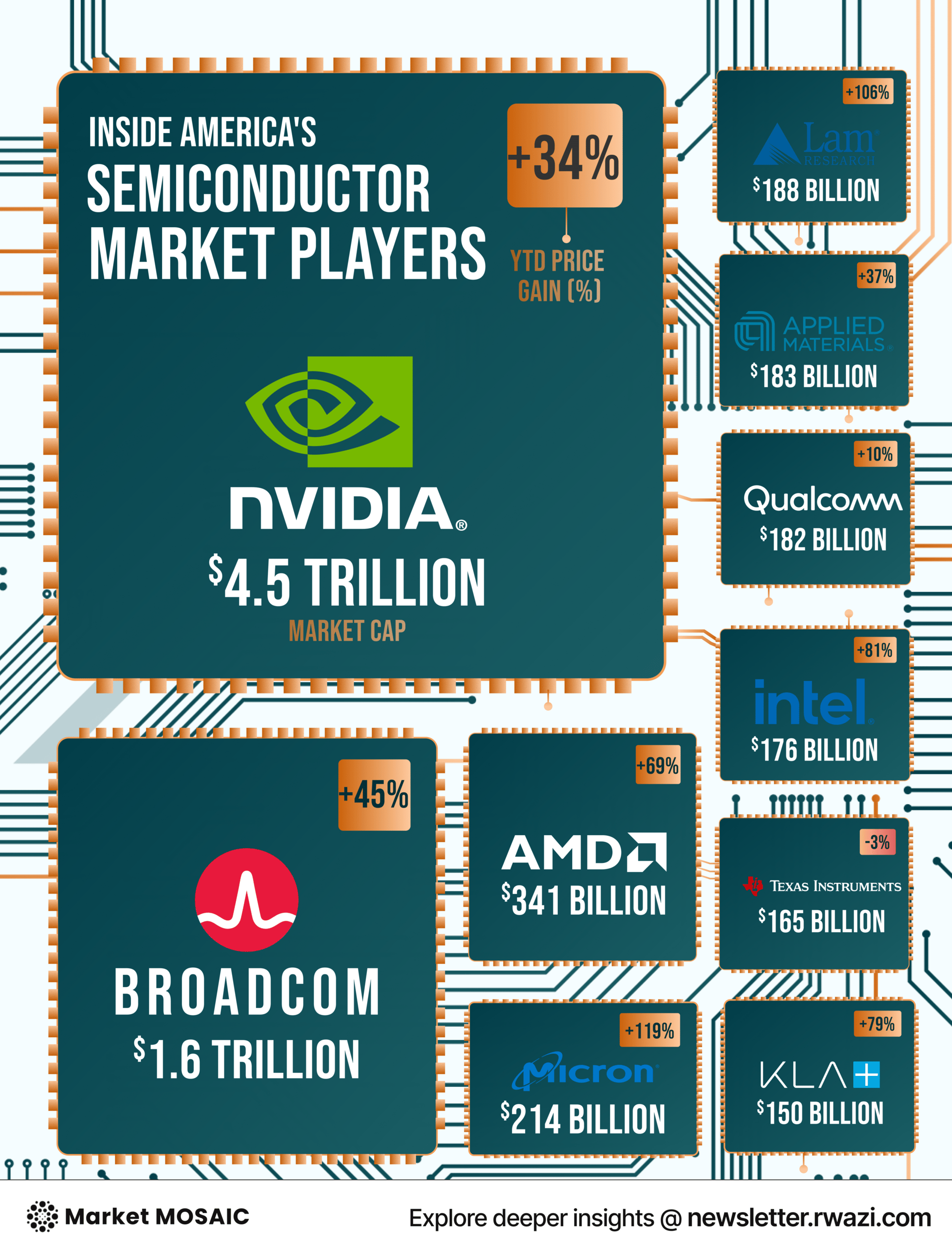

Nvidia's dominance faces growing competition

While Nvidia commands 80% of the AI chip market with a $4.5 trillion market cap, the real story lies in who's gaining ground fastest.

Micron Technology has surged 119% year-to-date, followed by Lam Research at 106% and Intel at 81%. AMD's 69% gain and multi-billion-dollar supply deal with OpenAI signal a growing appetite for alternatives to Nvidia's ecosystem.

This diversification promises more competitive pricing, greater innovation, and reduced supply chain risk for AI-powered products.

The competition is driving rapid advancement in energy efficiency and processing power, making AI capabilities more accessible and affordable for consumers worldwide.

Key Insights

The semiconductor market is moving from Nvidia-dominated monopoly into a competitive arena where specialized players are carving niches to accelerate advanced computing more accessible to businesses and consumers alike.

Global growth moderates amid policy turbulence

Global growth is projected to slow from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026. Advanced economies will grow around 1.6% while emerging markets maintain momentum above 4%.

The U.S. decelerates from 2.8% in 2024 to 2.0% in 2025, with inflation remaining above target.

Regional variations are striking. India maintains 6.6% growth, while Sub-Saharan Africa's 4.1% trajectory suggests expanding consumer markets.

These growth pockets represent critical opportunities for companies diversifying beyond saturated developed markets.

Key Insights

The global economy is fragmenting into distinct growth corridors, with emerging markets offering the most compelling consumer opportunities while advanced economies face prolonged modest expansion and persistent inflation pressures.

Filipino workers power Japan's robotic workforce

Japanese convenience stores are deploying robots remotely controlled by workers in the Philippines, creating a new paradigm for cross-border physical labour.

This addresses Japan's severe labour shortages while offering employment to Filipino workers at rates higher than local alternatives, though less than Japanese wages.

For consumers, service quality remains unchanged while the economic model has been fundamentally reimagined.

This previews how retail and service industries worldwide will operate in the coming decade, though it raises questions about wage equity and long-term job security as AI systems become more capable.

Key Insights

Cross-border tele-operation is now reimagining global labor markets, offering short-term employment opportunities in developing economies while accelerating the transition toward full automation.

AI flood forecasting now powers predictive aid

Google's Flood Hub now delivers flood warnings five days in advance, enabling consumers and businesses to get assistance before disasters strike.

Trials have shown that farmers who receive early signals significantly improve their livelihoods by moving livestock and harvesting crops early before floods arrive.

For supply chains, this predictive capability allows companies to preposition inventory, reroute shipments, and adjust production schedules to reduce disruptions and maintain continuity.

When agricultural supply chains are protected, food prices remain stable and availability is maintained.

Key Insights

AI-powered predictive systems are enabling communities and businesses to mitigate losses before disasters strike, with far-reaching implications for supply chain resilience and consumer welfare.

On a scale of 1–4, how easy was it to navigate this newsletter?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are redressing their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a 35+ page analysis, predictions, and real-time market data fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: