Welcome back to Market Mosaic. Before we dive in, we are excited to introduce something new: a quiz that captures how market forces are shaping market priorities for you.

Take a moment to weigh in below and see how your outlook compares with business leaders worldwide.

Now, let's explore this week's insights and uncover what's moving global markets.

— Insights Team, Rwazi

What’s your market persona as a business leader?

Our quiz discovers if you’re an Explorer, Builder, Analyst or Strategist and how your mindset shapes your market strategy.

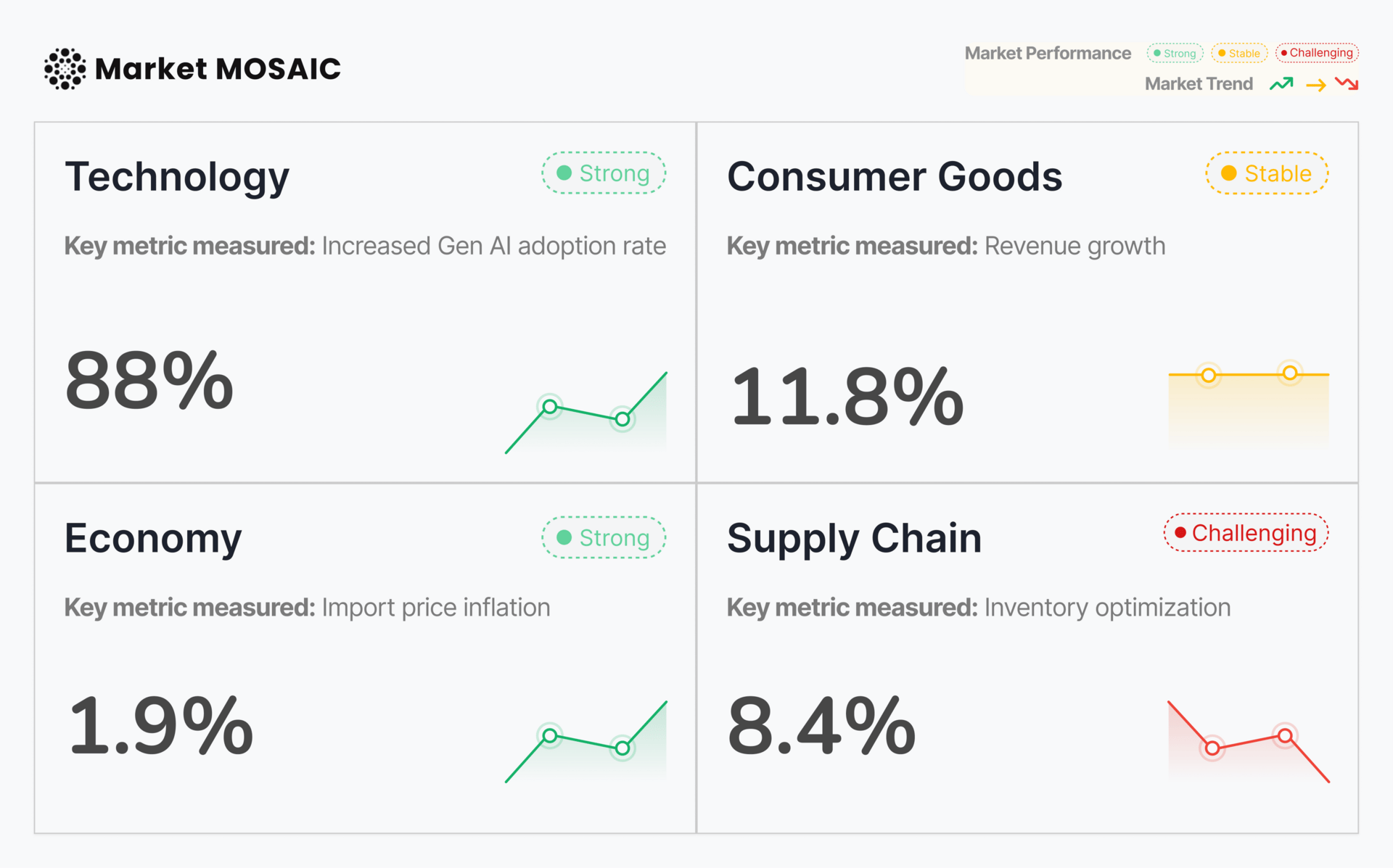

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

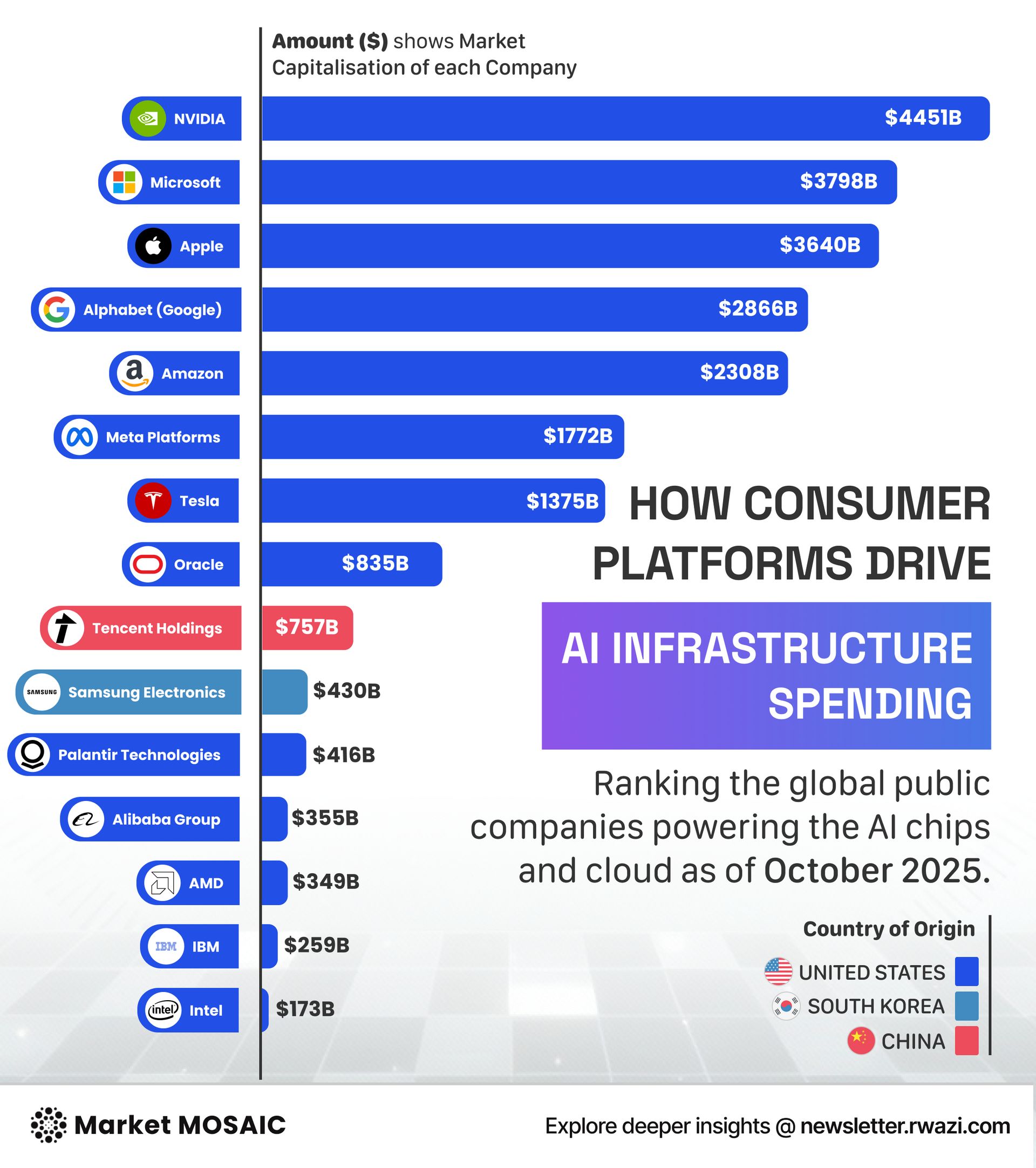

AI infrastructure power consolidates among tech giants

NVIDIA's $4.45 trillion valuation cements its position as the AI revolution's computational backbone. Microsoft ($3.8T), Apple ($3.6T), Alphabet ($2.9T), Amazon ($2.3T), and Meta ($1.8T) dominate the infrastructure layer through which billions interact with AI daily.

Asia's champions are mounting a serious challenge. Tencent ($757B), Samsung ($430B), Alibaba ($355B), and Cambricon ($73B) represent China's strategic push for AI sovereignty. AMD ($349B), Intel ($173B), and Qualcomm ($165B) compete for chip market share.

This happens while specialised players like Palantir ($416B) and CoreWeave ($72B) prove the infrastructure market remains contestable.

Key Insights

AI infrastructure has become a two-tiered global competition between American hyperscale dominance and Asian strategic challengers.

And with consumer-facing applications increasingly dependent on this concentrated base, raising questions about technological sovereignty and pricing power.

Global debt now hits $150 trillion

Global non-household debt reached $150 trillion in Q1 2025. The US shoulders $58.8 trillion (39%), followed by China ($26.1T) and Japan ($11.1T). European nations, including France ($6.5T), the UK ($6.3T), and Germany ($4.7T) carry substantial burdens.

This debt mountain impacts consumers through higher taxes, reduced public services, and constrained business investment.

Central banks face an impossible choice between raising rates to control inflation (risking fiscal crises) or maintaining low rates (risking persistent inflation). Younger consumers now express growing anxiety about inheriting unsustainable economic obligations.

Key Insights

The $150 trillion debt burden constrains future growth and consumer welfare. Expect prolonged fiscal austerity, elevated borrowing costs, and reduced public investment fundamentally reshaping the economic environment.

Indonesia's film industry leverages AI for Hollywood-scale production

Indonesian filmmakers are using generative AI to achieve Hollywood-level production values at a fraction of the cost.

AI-powered tools generate complex CGI sequences and storyboards in days rather than weeks, while synthetic voices enable multilingual localisation. This technological leap allows Indonesian films to compete internationally.

However, traditional VFX artists, storyboard specialists, and voice actors face displacement.

The Indonesian government and industry must address workforce transitions through training programs and social safety nets while ensuring AI enhances rather than replaces human creativity.

Key Insights

AI democratizes filmmaking for emerging markets, enabling diverse storytelling voices globally.

But workforce displacement requires proactive policy responses to support creative professionals transitioning to AI-augmented roles.

Tesla's price cuts face BYD's structural advantage

Tesla reduced Model Y and Model 3 prices by $5,000 to address market share erosion to BYD, which has outsold Tesla globally since late last year.

Even at new prices, BYD vehicles remain over $10,000 cheaper due to vertically integrated battery production, lower costs, and government support.

BYD now operates in 80+ countries and aims to double international sales to 800,000 units.

Tesla's stripped-down models exclude premium features like autosteer and heated seats, potentially diminishing brand appeal.

Tesla scrapped plans for a $25,000 mass-market EV, instead offering budget variants of existing models. Chinese manufacturers employ sophisticated segmentation strategies with diverse product portfolios, creating pressure across multiple segments.

Key Insights

Tesla confronts structural disadvantages against Chinese competitors controlling the EV supply chain.

Consumers benefit from competition driving down prices, but Chinese EV dominance carries implications for Western automotive employment and technological sovereignty.

Compared to previous versions, how would you rate the current look & feel of Market Mosaic newsletter?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are redressing their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a 35+ page analysis, predictions, and real-time market data fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: