You are welcome to yet another edition of Market Mosaic.

First, we are happy to share our latest addition to Market Mosaic: a quiz that reveals your unique business decision-making style based on market trends.

Sounds interesting, right? Feel free to check it out below to discover where you fit, so you can always play to your strengths.

Now, let’s explore this week's edition and dive into the actionable insights from our analyses together.

— Insights Team, Rwazi

What’s your market persona as a business leader?

Take our quick quiz to discover if you’re an Explorer, Builder, Analyst or Strategist and find out how your mindset shapes your market strategy.

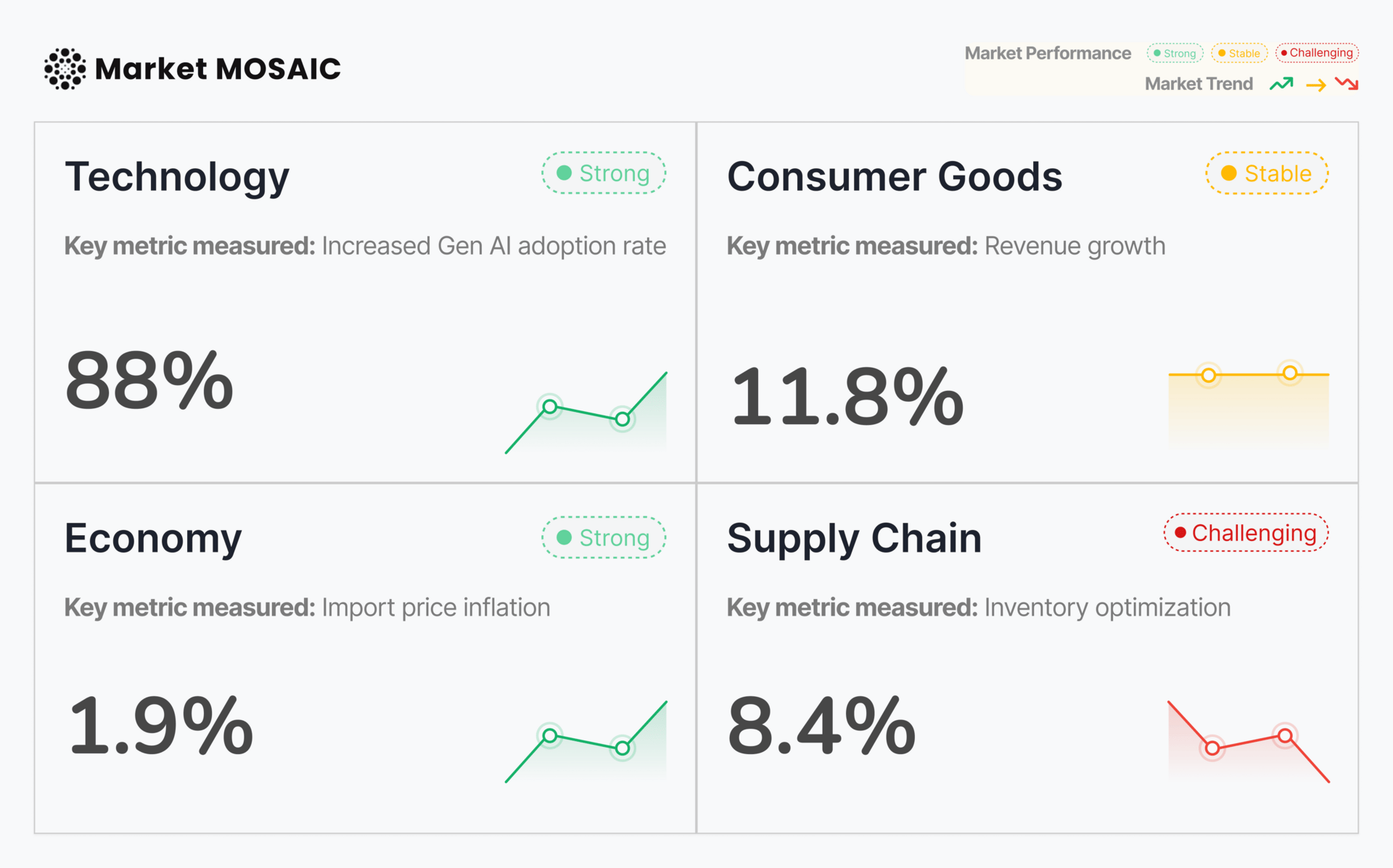

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

OpenAI hits $500 billion valuation

In just six years, OpenAI has achieved a $500 billion valuation through an employee share sale in October 2025. This continues its exponential growth trajectory, despite its AI model costing less to train than its competitors.

Yet the numbers show concerning economics: the company generated approximately 3.7 billion dollars in 2024 revenue while losing over 5 billion dollars.

Microsoft's $13 billion investment in cash and cloud credits positions it as OpenAI's primary distribution channel. Strategic partnerships and infrastructure control appear as valuable as the algorithms themselves.

OpenAI's capped-profit structure creates tension between nonprofit oversight and investor expectations for returns at a half-trillion dollar valuation.

The sector now commands median valuation multiples of 25 to 30 times revenue, far exceeding traditional software peers.

Key Insights

Distribution channels and computational infrastructure may prove more valuable than algorithmic innovation alone.

This means that AI capabilities will increasingly arrive through familiar platforms rather than standalone products, embedding intelligence into existing consumer workflows.

Consumer spending drives 3.8% GDP growth

The U.S. economy grew at 3.8% in Q2 2025, revised upward from the initial 3% estimate. Personal consumption expenditure exceeded expectations despite tariff impacts beginning to show in some product categories.

However, beneath the headline growth, private investment declined 13.8% as businesses drew down accumulated inventories.

Real final sales to domestic purchasers, which strip away trade and inventory volatility, increased 2.9%. The PCE price index came in at 2.1%, with core PCE at 2.6%.

Consumer spending appears concentrated in services rather than durable goods, meaning that households are prioritising experiences and personal services over physical products.

Key Insights

American consumers are maintaining spending levels that support economic growth even as businesses hesitate on investment.

This resilience depends on labor market stability and whether price pressures remain contained.

AI avatars challenge livestream shopping hosts

Livestream shopping has exploded in many parts of the world, changing everyday products into viral entertainment.

Human hosts have built thriving careers streaming 8 to 12 hours daily while coordinating inventory and responding to hundreds of viewer messages, but now face competition from AI-powered avatars that never tire and can stream continuously without the physical and emotional toll humans experience.

Indonesia now serves as a critical test case for how automation might challenge digital retail jobs across developing markets.

Consumer acceptance varies by context: efficiency-focused transactions may favor AI automation while entertainment-oriented shopping experiences continue valuing human personality.

Key Insights

The rise of AI livestream hosts is seen as broader tensions between automation and human connection in digital commerce.

Consumer acceptance depends heavily on whether efficiency or entertainment drives the purchase.

Singapore leads container efficiency rankings

Singapore dominates global container shipping with 6.62 TEUs per capita, far exceeding larger economies.

The UAE ranks second at 2.15 per capita, supported by Dubai's Jebel Ali Port with 19.4 million TEUs capacity and the Jafza free zone hosting 11,000 companies, facilitating 190 billion dollars in annual commerce.

Despite China and the U.S. generating the highest absolute container volumes, the UAE accomplishes 10 times more per capita than either country.

China processes 299 million TEUs but achieves only 0.19 per capita, the same as the United States, with 62 TEUs. India lags at 0.01 per capita despite a substantial consumer market size.

These disparities translate directly into product availability and pricing for consumers.

Efficient port infrastructure reduces time and expense between manufacturing and retail shelves, with specialised trading hubs serving as critical nodes in regional supply chains.

Key Insights

Infrastructure quality and strategic positioning often matter more than market size in determining supply chain efficiency.

Specialized trading hubs create competitive advantages that larger consumer markets cannot easily replicate. This enables efficient goods movement while potentially creating bottlenecks when disruptions affect these critical nodes.

Which trend will have the greatest impact on your business or purchasing decisions?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are redressing their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a 35+ page analysis, predictions, and real-time market data fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen or read sooner: