Welcome to yet another edition of Market Mosaic, where this week, we explore the reality behind the $200 billion AI infrastructure boom where only 11% of consumers actually want AI-powered smartphones and analyse how foreign retail giants have quietly become Latin America's largest private employers.

In our Chart of the Week, we also visualise the global AI compute divide that positions just ten nations to control 79 exaflops of processing power.

Read further, follow us and let’s dive into the insights together.

— Insights Team, Rwazi

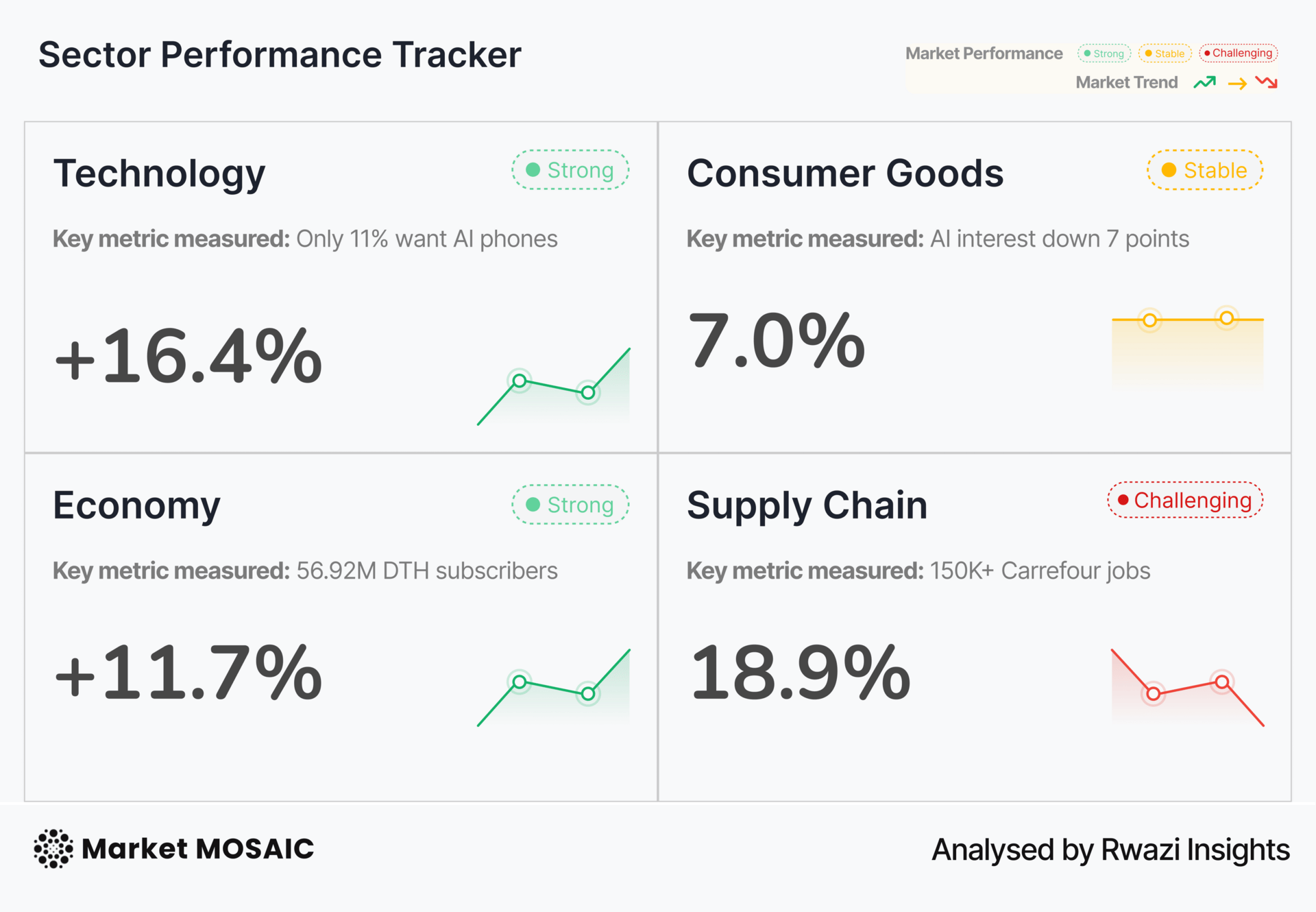

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Can you spot the next big shift?

AI is already challenging how products are built, but only a few leaders see what’s coming next. We compiled 35+ pages of market data and predictions. Now, you can know what’s ahead.

AI compute power is concentrated in a few hands

Data analysis by Rwazi Insights shows this stark reality in global AI infrastructure: computing power is becoming the new oil, and it's heavily concentrated among a select few nations.

The United States dominates with nearly 40 million H100 equivalents, representing almost half of global compute capacity, while surprising players like the UAE and Saudi Arabia have emerged as major forces in the AI arms race.

The data tells a compelling story of transformation. Gulf nations are systematically converting oil wealth into digital dominance, with the UAE controlling over 23 million H100 equivalents despite having fewer than 200,000 physical chips.

Meanwhile, China's massive chip stockpile of 628,900 units translates to only 400,000 compute equivalents, showcasing its reliance on older, less efficient processors, a direct consequence of ongoing trade restrictions.

Perhaps most striking is the energy requirement: running these systems at maximum capacity would consume 55 gigawatts of electricity, equivalent to California's peak summer demand. This massive energy footprint raises critical questions about sustainability as AI infrastructure scales globally.

Key Insights

AI compute capacity is becoming a new measure of national power, creating a digital divide that could determine economic leadership for decades to come.

India's DTH market consolidation

India's Direct-to-Home television market, with over 56.92 million subscribers, presents a fascinating case study in market maturity and consolidation. Tata Play's 31.99% market share, closely followed by Airtel Digital TV at 29.38%, shows how established players leverage infrastructure and brand trust to maintain dominance.

What's particularly interesting is the near-parity between the top four players, with DishTV and Sun Direct holding 19.53% and 19.10% respectively. This balanced competition goes to show a mature market where differentiation comes through service quality and content offerings rather than price wars.

The presence of DD Free Dish as a government-backed option adds another layer to consumer choice, particularly important in price-sensitive segments of the Indian market. Safe to say that traditional media consumption patterns are evolving alongside streaming services and digital platforms.

Key Insights

Mature markets like India's DTH sector demonstrate how consumer loyalty and service quality become key differentiators when price competition reaches saturation points.

The $200 billion AI smartphone disconnect

Despite massive industry investment and marketing campaigns promoting AI-powered smartphones, consumers remain unimpressed. Our data analysis shows that only 11% of consumers would purchase a new device specifically for AI features, a seven-point drop from last year, signalling growing scepticism rather than enthusiasm.

The disconnect between corporate AI ambitions and consumer priorities couldn't be clearer. While Samsung promotes Galaxy AI, Google integrates Gemini, and Apple rolls out Apple Intelligence, consumers continue to prioritise practical concerns: 62% cite price as their primary factor, 54% want longer battery life, and 39% need more storage. AI integration ranks dead last at just 11%.

Privacy concerns compound the adoption challenge, with over 40% expressing worries about how AI handles their data, an increase from last year. Half of consumers refuse to pay extra for AI features, even as companies explore premium AI service tiers.

Key Insights

The consumer technology sector's AI strategy faces a fundamental reality check—practical utility and privacy concerns outweigh flashy AI features in driving purchase decisions.

Foreign supply chains are shaping Latin America's retail sector

The fact that France's Carrefour, not a domestic company, is Brazil's largest private employer challenges assumptions about the complex dynamics of modern retail expansion in Latin America.

Carrefour Brasil employs over 150,000 people across its operations, including the wholly-owned Atacadão wholesale network. This French multinational's dominance in Brazilian employment shows how successful international retail expansion can create significant local economic impact beyond traditional measures of market penetration.

The pattern extends northward, where Mexico's largest private employer is FEMSA, the world's largest Coca-Cola bottler. With over 350,000 employees and $40 billion in sales, FEMSA operates at remarkable speed, opening more than four new OXXO convenience stores daily across Mexico, Colombia, and Peru.

Financial performance data also shows interesting regional variations. Walmex (Walmart Mexico and Central America) reports exceptional efficiency with 10.9% ROA and 23.1% ROE, while generating $51.98 billion in net sales. In contrast, some regional players struggle significantly as GPA shows alarming -12.2% ROA and -81.9% ROE.

Key Insights

International retail expansion in Latin America shows how successful business models can scale across similar markets, creating significant employment and economic impact while raising strategic questions about domestic industry development and economic independence.

What would make you upgrade your smartphone in 2025?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are revising their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a comprehensive 35+ page analysis that includes predictions and real-time market data, fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: