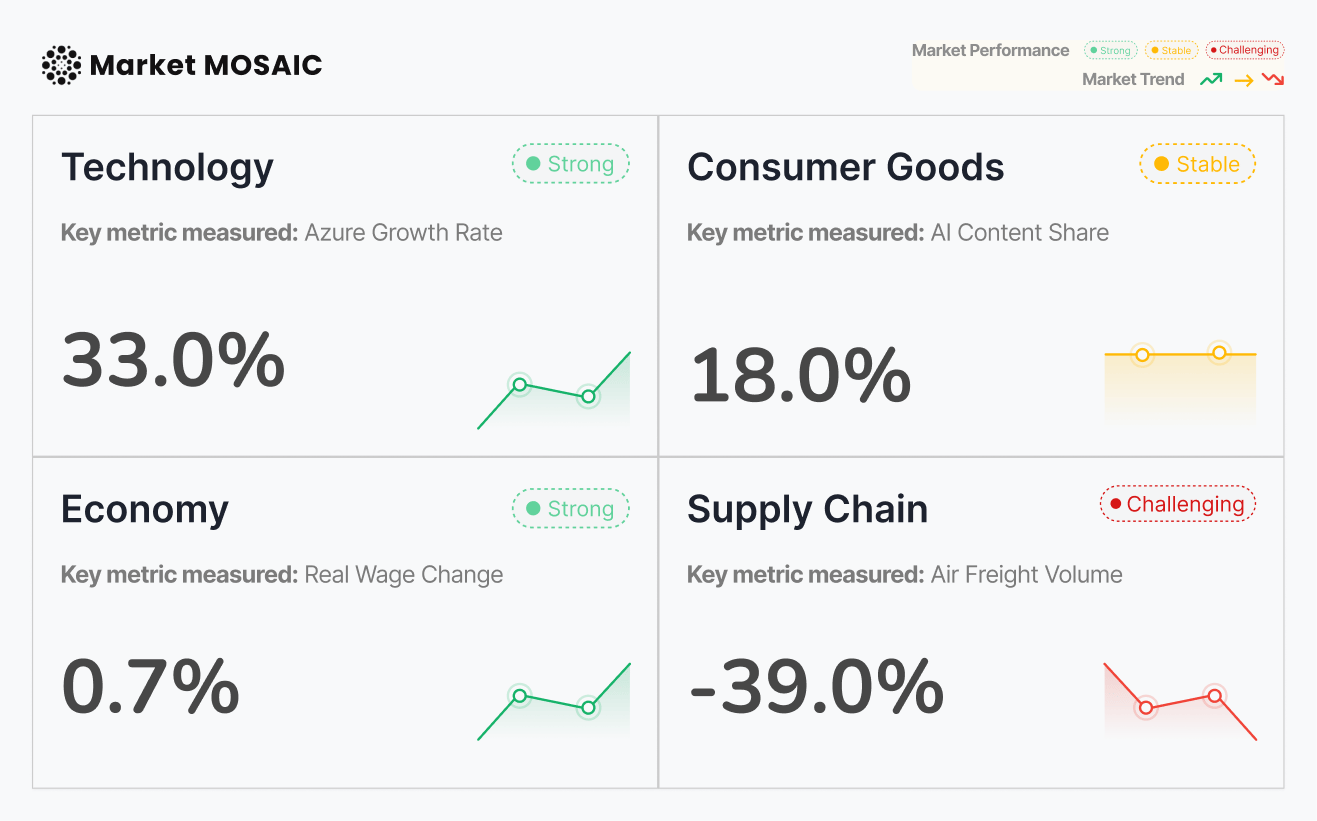

Welcome to Market Mosaic, where, in this week's edition, we explore the shifts challenging global markets, from AWS's $120 billion dominance facing Microsoft's 33% growth surge to 67 countries suspending US mail service.

We also analyse how AI-generated music is capturing 18% of streaming platforms and why American consumers feel poorer despite economic recovery, with real wages declining 0.7% since 2021.

Read further, follow us and let’s dive into the insights together.

— Insights Team, Rwazi

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

Can you spot the next big shift?

AI is already challenging how products are built, but only a few leaders see what’s coming next. We compiled 35+ pages of market data and predictions. Now, you can know what’s ahead.

Cloud wars intensify as AWS dominance is challenged by AI-driven growth

Amazon Web Services continues its reign as the cloud computing king, now approaching $120 billion in annual revenue and surpassing iconic brands like Nike, Coca-Cola, and Disney. However, the competition is growing than ever, with Microsoft Azure emerging as a formidable challenger.

According to data analysis by Rwazi Insights, AWS maintains approximately 30% market share, translating to $29.7 billion in revenue, while Microsoft Azure has surged to 20% with $19.8 billion. What's now striking is Azure's growth trajectory with 33% year-over-year compared to the market average, which is driven primarily by its strategic AI integration and OpenAI partnership.

Consumer behaviour analysis also shows businesses are increasingly prioritising AI-powered cloud solutions over traditional infrastructure services. Companies are willing to pay premium prices for platforms that offer seamless AI integration, with 67% of enterprise decision-makers citing AI capabilities as their primary cloud selection criteria.

Key Insights

The cloud computing market is transitioning from a infrastructure-focused industry to an AI-capability-driven ecosystem, where success depends not on storage capacity but on artificial intelligence integration and enterprise workflow optimization.

Even in the inflation aftermath, U.S. consumers still feel the pinch

Despite headline economic indicators suggesting recovery, American consumers continue grappling with the lingering effects of the 2021-2022 inflation crisis. Data analysis by Rwazi Insights shows a disconnect between macroeconomic performance and household financial reality.

The data paints a concerning picture: while average hourly earnings have increased 21.8% since January 2021, the Consumer Price Index has risen 22.7%, resulting in a net 0.7% decline in real wages. This means American workers have less purchasing power today than they did four and a half years ago.

Consumer spending patterns reflect this reality. Our tracking shows 58% of households have reduced discretionary spending, with particular cuts in dining out (-23%), entertainment (-31%), and non-essential retail purchases (-19%).

Key Insights

The inflation crisis has created a lasting consumer psychology of financial constraint that persists despite improving economic metrics, now altering spending behaviors and brand loyalty patterns across demographics.

AI disrupts music in Latin America as artists fight for streaming survival

Latin America's vibrant music ecosystem faces an existential threat as AI-generated content floods streaming platforms, now altering the economics of music consumption and artist compensation.

The numbers are alarming: AI-generated music now represents 18% of all uploads to Deezer, up from 10% in January. Industry projections suggest AI-powered music will capture approximately 20% of streaming platform revenue by 2028, directly impacting human artists' already minimal earnings.

Consumer listening data also shows troubling trends. While AI music quality remains subpar, its sheer volume is overwhelming human-created content. Independent artists report significant drops in discovery rates, with streaming algorithm changes favouring high-volume content over artistic merit.

Artists are adapting through various strategies: focusing on live performances, returning to physical media like vinyl and cassettes, and creating collaborative playlists for visibility. However, these adaptations are still survival tactics rather than sustainable growth strategies.

Key Insights

The AI music invasion is now a bigthreat to creative industries' economic models, forcing artists to compete not just with peers but with algorithmically-generated content that costs virtually nothing to produce while diluting the cultural authenticity that consumers ultimately seek.

67 countries restrict U.S. mail service in a global shipping crisis

A global shipping crisis is unfolding as 67 countries have suspended or restricted mail services to the United States following the elimination of the "de minimis" rule.

The scope is challenging: from Costa Rica's recent addition to the list, major economies including Mexico, Canada, Brazil, Germany, France, the UK, Japan, and South Korea have implemented various levels of shipping restrictions.

E-commerce platforms like Shein, which built business models around direct-to-consumer small parcel shipping, face challenges. Independent sellers on platforms like Etsy report a decline in international sales, while immigrant communities face challenges in sending money and goods to family members abroad.

Air freight data supports the severity: China-U.S. small parcel air freight dropped 39% in just ten days following the rule change. Major Asian suppliers are pivoting to bulk shipments despite 30% tariff rates, altering global trade flows and supply chain strategies.

Key Insights

The elimination of de minimis exemptions has triggered a global reconfiguration of small-parcel commerce, forcing businesses to abandon direct-to-consumer international models while creating significant barriers for personal and family communications across borders.

Given the current market disruptions we have covered this week, which trend do you believe will have the most lasting impact on global business operations in the next 12 months?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are revising their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a comprehensive 35+ page analysis that includes predictions and real-time market data, fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: