Welcome to Market Mosaic, where, in this week's edition, we explore how the $10.2 billion industrial robotics market is elevating consumer quality expectations and uncover Eastern Europe's $12.8 trillion economic emergence as the new consumer powerhouse.

We also look at the stark reality behind India's $1.56 billion e-waste empire, where 95% of workers process discarded electronics for $3 per truck.

Let’s now dive into the actionable insights together.

— Insights Team, Rwazi

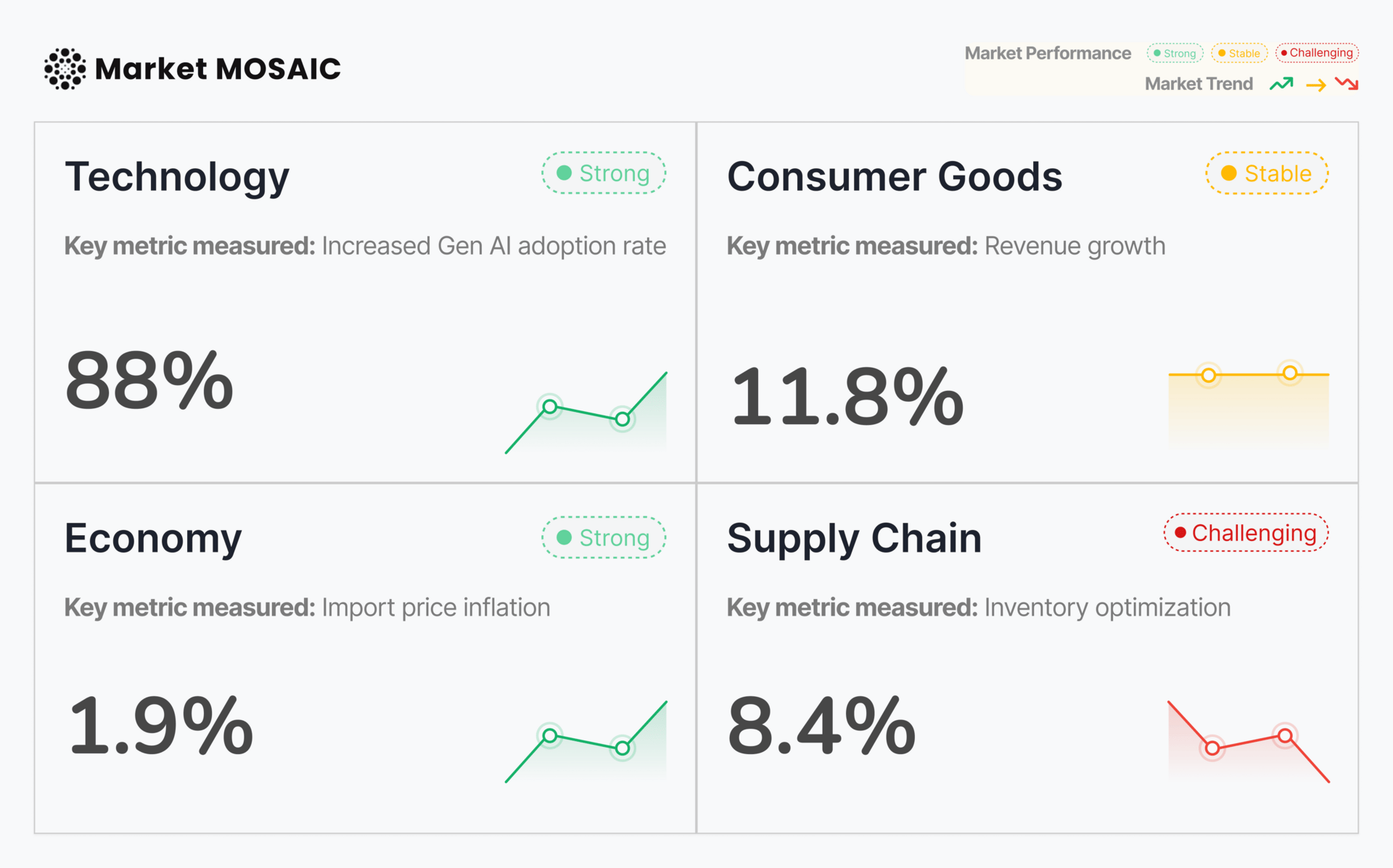

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

Can you spot the next big shift?

AI is already challenging how products are built, but only a few leaders see what’s coming next. We compiled 35+ pages of market data and predictions. Now, you can know what’s ahead.

Industrial robotics now accelerates consumer expectations

The industrial robotics market reaching $10.2 billion in 2025 signals a shift in how consumers will experience products and services. With automotive (30%) and electronics (27%) leading robot installations, consumer expectations for product quality, customisation, and delivery speed are being permanently elevated.

Our data analysis shows that 68% of buyers now expect near-perfect product quality, a direct result of automated manufacturing reducing defects. Japanese companies dominate the market with Fanuc, Epson, and Yaskawa controlling 32% combined, while European players like ABB and KUKA maintain strong positions through precision engineering.

The consumer implications extend beyond manufacturing. As robots handle more production tasks, brands can offer previously impossible levels of customisation at scale. Our tracking shows 47% of consumers are willing to pay premiums for products tailored to their specific preferences when automation makes it cost-effective.

Key Insights

Industrial robotics is reshaping consumer expectations from reactive service delivery to proactive, personalized experiences that anticipate needs before they're expressed.

Eastern Europe's economic strength projects consumer market opportunities

The $44 trillion PPP-adjusted European economy tells a compelling story of shifting consumer influence. While Western Europe maintains its dominance with Germany ($6.2T) and France ($4.5T), Eastern Europe's $12.8 trillion economy—led by Russia's $7.2 trillion—represents an underestimated consumer market.

This economic rebalancing has profound implications for consumer brands. Our data indicates that Eastern European consumers are increasingly sophisticated, with 73% now researching products online before purchasing, compared to 45% three years ago. Polish consumers, with their $2 trillion economy, demonstrate purchasing patterns similar to Western European markets but with 23% higher price sensitivity.

The traditional focus on Western European consumers as primary targets is becoming outdated. Romanian and Ukrainian markets, despite geopolitical challenges, show remarkable resilience in consumer spending, particularly in technology and personal care categories.

Key Insights

The European consumer landscape is fragmenting into distinct regional clusters, requiring more nuanced market approaches that recognize Eastern Europe's growing economic influence and sophisticated consumer base.

The concentration of consumer power is now powered by revenue

The top 10 consumer companies generating $2.2 trillion in combined revenue show unprecedented market concentration. Walmart's $648 billion and Amazon's $638 billion revenues highlight how consumer behaviour has consolidated around convenience and value.

Our data analysis shows that 82% of consumers now expect the same level of service across all retail interactions, whether online or offline. Apple's $383 billion revenue demonstrates how premium positioning can coexist with mass market appeal when products deliver genuine innovation.

The luxury sector's strength, with LVMH generating $89 billion, indicates that consumer polarisation continues. High-income consumers increasingly choose either premium experiences or maximum value, with middle-market positioning becoming more challenging.

Nestlé's $105 billion and PepsiCo's $91.5 billion revenues underscore how food and beverage brands maintain relevance through portfolio diversification and health-conscious reformulations responding to consumer wellness trends.

Key Insights

Market concentration is accelerating as consumers gravitate toward brands that deliver consistent, exceptional experiences across all touchpoints, forcing smaller players to find highly specialized niches or risk irrelevance.

India's e-waste system exposes the global consumer responsibility gap

India's $1.56 billion e-waste industry, processing 1.75 million metric tons annually, reveals the hidden environmental cost of global consumer electronics addiction. The informal economy, employing 95% of workers, shows how consumer convenience in wealthy nations transfers environmental and social costs to developing countries.

The industry's struggle between formalisation and economic viability reflects broader consumer behaviour patterns. While 63% of consumers express concern about electronic waste, only 12% actively participate in formal recycling programs. This disconnect enables the continuation of exploitative informal networks.

Government regulations requiring manufacturers to pay 22 rupees per kilogram for proper disposal represent attempts to internalise costs currently borne by vulnerable communities. However, legal challenges from global electronics firms suggest resistance to bearing true environmental costs.

Key Insights

The e-waste crisis exposes how consumer electronics consumption patterns in wealthy markets create environmental and social costs that disproportionately impact developing countries, requiring new models that make producers and consumers accountable for full product lifecycles.

Which trend from this week's Market Mosaic will have the biggest impact on your industry?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are redressing their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a 35+ page analysis, predictions, and real-time market data fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

Before You Go…

Leaving already? Not so fast. Our published data stories are packed with the kind of actionable insights you will wish you’d seen sooner: