Welcome to Market Mosaic, where, in this week's edition, we dig into the $16.4 trillion frontier technology explosion driven by AI's meteoric 300% market share growth and explore how America's $62.2 trillion market dominance is challenging global consumer behavior.

We also analyze how the $85 billion railroad merger will transform supply chains for nearly half of all US consumer goods.

Let’s now dive into the actionable insights together.

— Insights Team, Rwazi

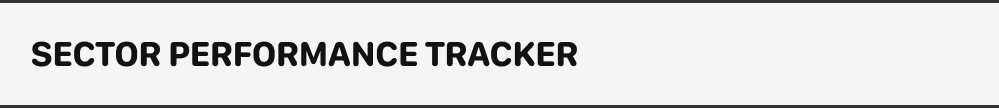

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed, compiled and updated by Rwazi Insights

Can you spot the next big shift?

AI is already challenging how products are built, but only a few leaders see what’s coming next. We compiled 35+ pages of market data and predictions. Now, you can know what’s ahead.

Inside the $16.4 trillion frontier tech market

The frontier technology market is experiencing unprecedented transformation, with projections showing explosive growth from $2.5 trillion in 2023 to $16.4 trillion by 2033. This sixfold expansion is being driven primarily by artificial intelligence, which is set to evolve from a minor player to the dominant force in the sector.

The dramatic market share evolution tells a compelling story: AI is projected to leap from 7% of the frontier tech market in 2023 to 29% by 2033, representing $4.8 trillion in value. Meanwhile, IoT, previously the sector leader at 36% market share, is forecast to decline to 19% as consumer preferences shift toward more sophisticated, AI-powered solutions.

Blockchain technology emerges as a significant player, growing from near-zero to 14% market share, driven by consumer demand for transparency in supply chains and financial transactions. Interestingly, electric vehicles and solar PV are projected to see declining market shares despite growing in absolute terms, suggesting these technologies are becoming commoditised as they mature.

Key Insights

The consumer-driven AI era is fundamentally reorganizing the technology landscape, with businesses that fail to integrate AI-powered personalization and predictive capabilities risking obsolescence in the next decade.

Global stock market validates consumer investment patterns

The global stock market's $127 trillion value tells a compelling story about consumer behavior and investment preferences while showcasing a stark geographic concentration. Nearly half of this value, $62.2 trillion, resides in US markets, showing both institutional strength and global consumer confidence in their innovation and consumption patterns.

Over 73% of international investors view US markets as their primary growth vehicle, driven by the perception of American consumers as early adopters and trend-setters. This creates a self-reinforcing cycle: global capital flows toward US companies that serve increasingly sophisticated consumers, who in turn drive innovation that attracts more investment.

The geographic distribution of market capitalization mirrors consumer spending power and digital adoption rates. China's $11.8 trillion market cap (9.3% of global total) shows its massive consumer base, while the EU's $11.1 trillion (8.7%) also shows mature but slower-growing consumer markets. Emerging markets like India ($5.1 trillion, 4.1%) also show the potential of fast-rising consumer preferences.

Key Insights

Stock market valuations increasingly reflect not just economic fundamentals but consumer behavior patterns, with markets serving digitally-native, innovation-hungry consumers commanding premium valuations.

Digital nomad boom set to scale Latin America’s urban dynamics

The digital nomad phenomenon has created a complex consumer ecosystem across Latin America, generating both economic opportunities and social tensions. Mexico City leads the regional rankings despite facing local protests against rising living costs driven by remote workers with foreign currency salaries.

Our data analysis shows that digital nomads in Latin America spend an average of $1,847 monthly, significantly higher than local median incomes. Mexico City nomads spend $1,971 monthly with internet speeds of 13 Mbps, making it the top-ranked destination despite infrastructure challenges. This spending power, while beneficial for local businesses, creates affordability issues for local residents.

Interestingly, there is an inverse relationship between internet speed and nomad satisfaction. Cities like Cuenca, Ecuador (8 Mbps, $1,332 monthly spend) and Medellín, Colombia (9 Mbps, $1,448 monthly spend) rank higher than São Paulo (15 Mbps, $1,804 monthly spend), showing that cost of living, culture, and quality of life often outweigh pure connectivity metrics.

Key Insights

The digital nomad economy represents a new consumer category that requires careful balance between economic benefits and social sustainability, with successful destinations being those that manage growth while preserving local affordability and culture.

Railroad merger creates new consumer goods distribution network

The proposed $85 billion merger between Union Pacific and Norfolk Southern is now a shift in US supply chain infrastructure, with direct implications for consumer goods distribution. The combined entity would operate nearly 50,000 miles of track across 43 states, creating what amounts to a transcontinental logistics network.

This development is particularly significant given that 48% of freight rail cargo consists of consumer goods and miscellaneous products. Our data analysis of consumer delivery expectations shows growing demand for faster, more reliable shipping, with consumers willing to pay premium prices for guaranteed delivery windows.

The merger's impact on retail supply chains could be transformative. Many consumer goods currently move as intermodal traffic, transferring between rail, truck, and air transportation. A unified rail network could reduce transfer points, potentially lowering costs and delivery times for consumer products.

Key Insights

Supply chain consolidation through major infrastructure mergers could improve efficiency and reduce costs for consumer goods, but also creates concentration risks that could impact product availability and pricing if not carefully managed.

Given AI's projected jump from 7% to 29% of the $16.4 trillion frontier tech market by 2033, which sector do you think will be most transformed?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

By Q4, your competitors will already be executing this

Top executives are redressing their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a 35+ page analysis, predictions, and real-time market data fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts, designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

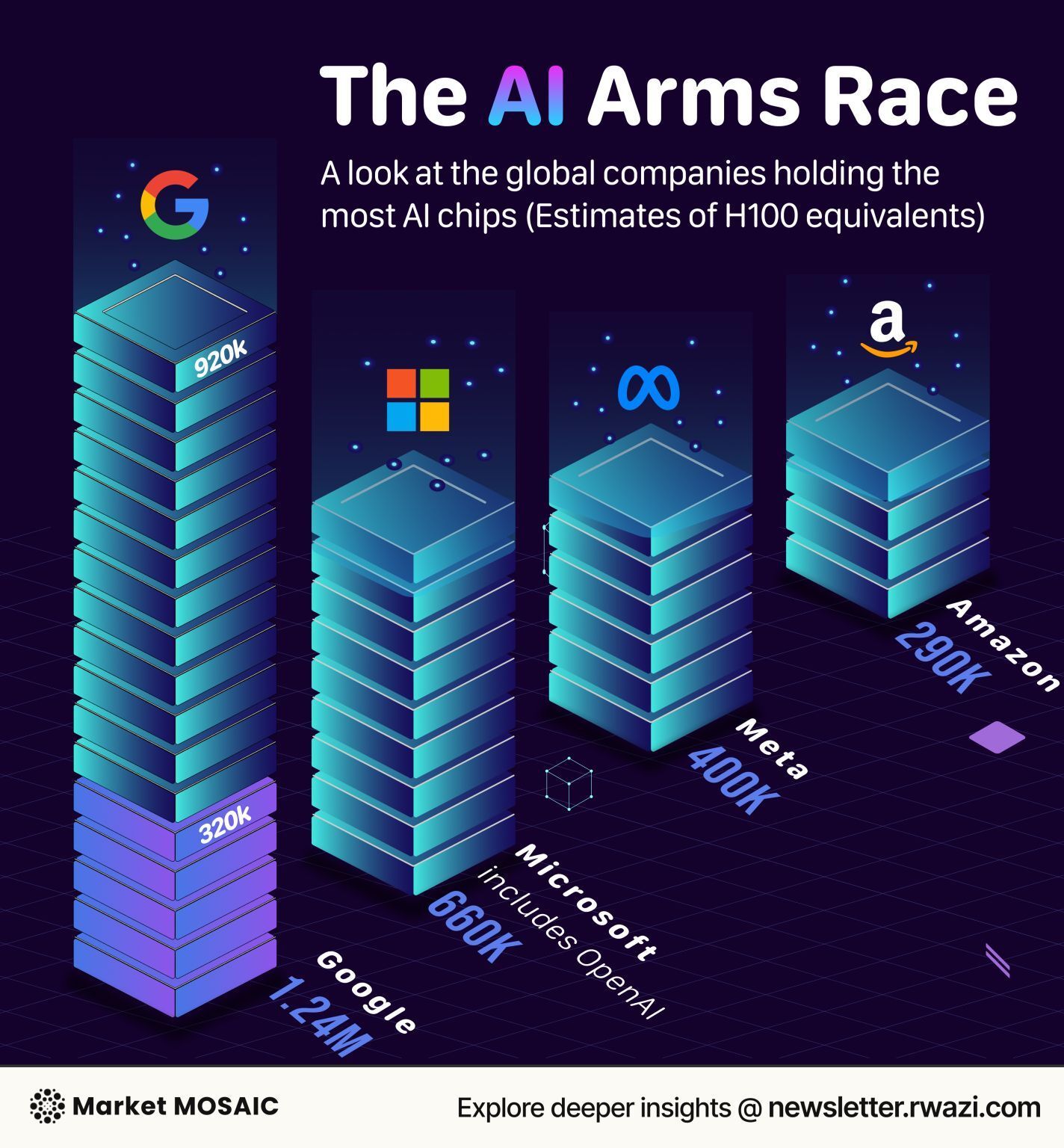

Here are the insightful visuals we shared on LinkedIn. Feel free to check them out, comment or repost if it hits home for you.