Welcome to Market Mosaic, where, in this week's edition, we explore the nuclear era transforming data centres and consumer digital experiences and analyse how uncover how Chinese delivery giants are challenging Latin American markets with billion-dollar investments.

And more interestingly, we looked at the historic supply chain realignment that saw India capture 44% of U.S. smartphone shipments in just one year.

Now, let’s dive into the insights together.

— Insights Team, Rwazi

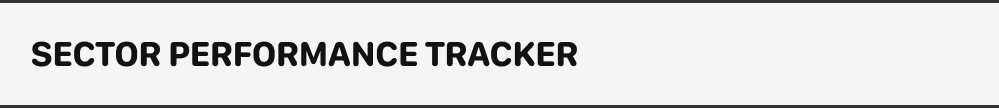

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

Analysed and compiled by Rwazi Insights

Can You Spot the Next Big Shift?

AI is already reshaping how products are built — but only a few leaders see what’s coming next. We analyzed 35+ pages of market data and predictions. Think you can guess what’s ahead?

Small Modular Reactors (SMRs) will now power AI

The data centres are undergoing a transformation as Small Modular Reactors (SMRs) emerge as the solution to AI's insatiable energy demands. Our data analysis shows that by 2050, China will operate 346 SMRs, followed by India with 154 units, fundamentally reshaping how consumers interact with cloud services.

Tech giants like Amazon, Google, and Microsoft are investing billions in SMR technology, driven by consumer expectations for always-available, sustainable digital services.

Market Dynamics:

China's aggressive SMR rollout (from 2 units in 2025 to 346 by 2050) signals its commitment to dominating the AI-powered economy

The U.S.'s slower adoption (100 units by 2050) may create competitive disadvantages in energy-intensive AI applications

European consumers will benefit from 101 SMR units by 2050, supporting the region's sustainability goals

Key Insights

The SMR revolution will democratize access to clean, stable energy for data centers, ultimately delivering faster, more reliable digital services to consumers while reducing the environmental footprint of their digital lives.

Chinese delivery giants disrupt Latin American markets

Meituan's $1 billion commitment to Brazil signals a shift in global delivery economics. The Chinese delivery giant is disrupting Brazil's $23.7 billion food delivery market with aggressive consumer-friendly tactics that have proven successful in Hong Kong and Saudi Arabia.

The competition is evolving. Brazil's dominant player iFood, controlling over 80% market share with fees reaching 27% per order, now faces Chinese competitors offering dramatically lower commission rates and improved consumer benefits. Meituan's strategy involves higher rider pay, deeper consumer discounts, and reduced restaurant fees. China’s Meituan launches in Brazil, taking on iFood and Uber, directly addressing consumer pain points around pricing and service quality.

The ripple effects extend beyond Brazil. Latin America's delivery market, projected to grow from $23.7 billion to $36.7 billion by 2030, is a critical testing ground for Chinese delivery platforms' global ambitions. Success here could accelerate expansion across global markets where price sensitivity remains paramount.

Key Insights

Chinese delivery platforms are leveraging their scale economics and aggressive pricing strategies to reshape consumer expectations globally, forcing established players to prioritize consumer value over margin optimization.

Rideshare’s price sensitivity drives market dynamics in Mexico

Our proprietary data from Mexico shows fascinating consumer behavior patterns in the rideshare market, where price sensitivity trumps brand loyalty. The data shows Uber commanding premium pricing at $161 MXN per ride, while DiDi ($85) and inDrive ($92) capture price-conscious consumers.

Consumer switching behaviours:

51% of users take 6+ rides monthly, indicating high engagement

App switching behaviour shows 31.3% user fluidity, suggesting low brand loyalty

Fixed pricing dominates at 78.8% usage vs. 21.2% negotiable pricing

Uber's fixed-pricing model captures 70% of usage despite higher costs, while DiDi's dual approach (fixed and negotiable) offers flexibility that appeals to diverse consumer segments.

Key Insights

Mexican consumers demonstrate sophisticated price optimization behaviors, actively switching between platforms to maximize value, suggesting that sustainable market leadership requires balancing premium service with competitive pricing.

India overtakes China in the U.S. smartphone supply chain

This shift in smartphone supply chains is one of the most significant geopolitical trade realignments in recent history. India's rise from 13% to 44% of U.S. smartphone shipments in just one year is both geopolitical tensions and consumer demand for supply chain resilience.

How the supply chain has transformed:

India's 240% year-over-year manufacturing volume increase signals massive capacity building

Vietnam maintains steady growth, capturing 30% market share

China's dramatic decline from 61% to 25% represents $billions in redirected manufacturing

Consumer impact analysis: While consumers may not immediately notice country-of-origin changes, the supply chain diversification enhances product availability and potentially reduces prices through increased competition among manufacturing hubs.

Key Insights

The great supply chain realignment represents a new era of manufacturing diversification that will enhance consumer choice and product availability while potentially moderating the impact of future geopolitical disruptions.

Which trend will impact your purchasing decisions most in 2025?

Spotting trends is easy. Acting on them before your competitors do, that’s the challenge.

Sena was built to help teams move from insight to action faster, whether it’s entering new markets, reallocating resources, or adjusting strategy in real time.

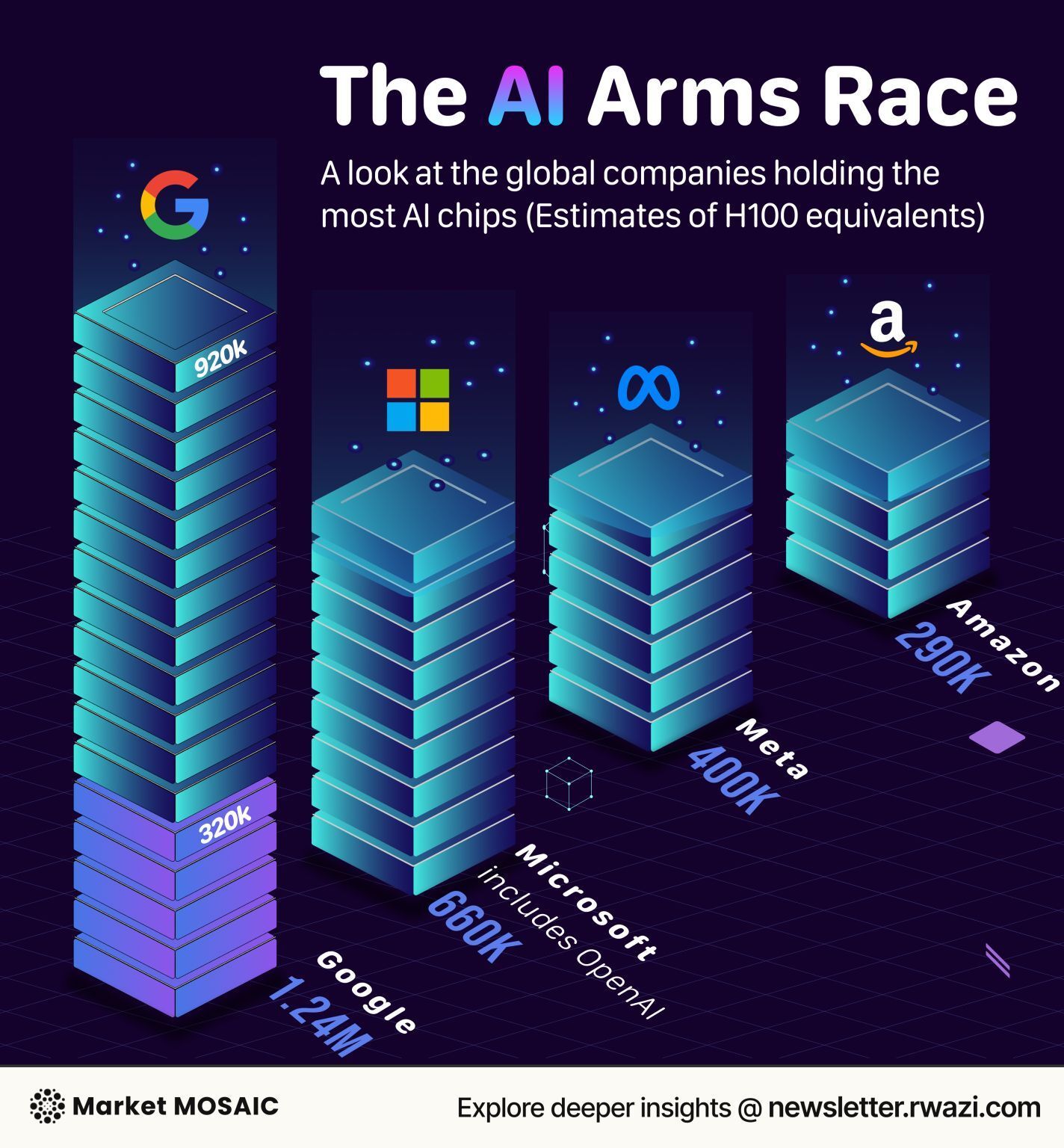

Here are the insightful visuals we shared on LinkedIn. Feel free to check them out, comment or repost if it hits home for you.

By Q4, your competitors will already be executing this

Top executives are redressing their 2025 strategies with insights from our Consumer Insights Report: H1 2025, a 35+ page analysis, predictions, and real-time market data fueling AI-driven innovation.

Inside this consumer insight report:

AI + consumer feedback reshaping product innovation

Untapped global market opportunities

Benchmarks from companies already moving ahead

This is your opportunity to access the same intelligence guiding C-suite decisions worldwide.

Share the Market Mosaic with decision-makers in your circle. After 3 successful referrals, you will gain direct access to our insights discovery call with our experts designed to help leaders like you turn insights into strategy.

Your referral count: {{rp_num_referrals}}

If you see this newsletter delivered in your promotions or spam folder, kindly move it to your inbox. Also, if the email is in your spam folder, please mark it as not spam.