Welcome to Market Mosaic, where, in this week's edition, we show you how consumer search behavior is challenging the technology sector despite AI advances and explore how global business networks are responding to consumer proximity demands over tax optimisation.

We also analyse how environmental consciousness is driving major changes in travel and food consumption patterns

Now, let’s dive into the insights and enjoy. Plus, we are excited to invite you to register for another edition of our Market Mosaic webinar here.

— Insights Team, Rwazi

In our edition this week:

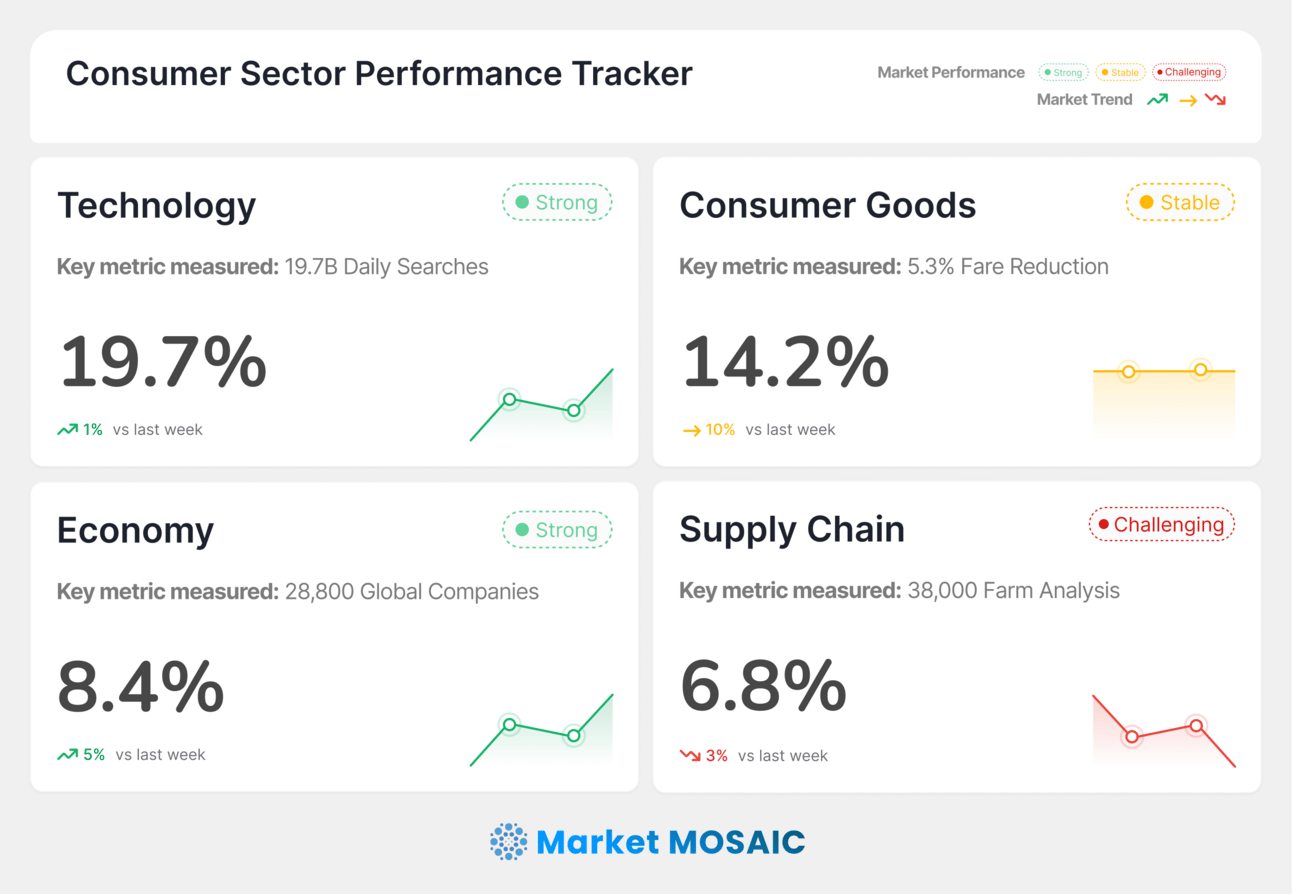

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

This weekly global market performance snapshot was analysed by Rwazi Insights

|

TECHNOLOGY How consumer information-seeking behavior influences online searches |

Data visualisation by Rwazi Insights

Despite the AI buzz, traditional search platforms continue to dominate consumer information-seeking behavior. ChatGPT's impressive 1 billion daily searches still places it far behind established platforms, revealing crucial insights about how consumers actually discover and consume information.

Google maintains its commanding lead with 13.7 billion daily searches, while social platforms like Instagram (6.5 billion) and Snap (4 billion) demonstrate that consumers increasingly seek information through visual and social channels. The data shows that consumers don't just search, asthey explore, discover, and engage through multiple touchpoints.

Notably, Amazon's 3.5 billion daily searches highlight how commerce and information discovery have merged, with consumers treating shopping platforms as search engines. This shift suggests that the traditional distinction between "search" and "shop" is rapidly dissolving in consumer behavior.

Key Insights

While AI tools like ChatGPT are gaining traction, consumers still prefer established platforms for information discovery, suggesting that AI adoption in search will be gradual rather than revolutionary, with integration into existing platforms likely proving more successful than standalone AI search tools.

|

ECONOMY The global tax haven network is where business really happens |

Our analysis of over 28,800 companies shows that modern business operates through complex global networks that extend far beyond traditional headquarters. Companies based in tax-friendly jurisdictions maintain an average of 3 secondary operations in other countries, creating intricate webs of international commerce.

The United States leads as the top operational hub with 10,180 secondary operations, followed by the United Kingdom (6,890) and the Netherlands (6,366). This data reveals that while companies may incorporate in tax havens, their actual business activities concentrate in major economic centers where consumers, talent, and infrastructure converge.

Interestingly, jurisdictions like the Netherlands, Hong Kong, and Singapore serve dual roles, appearing both as tax havens and as operational hubs.

Key Insights

Consumer markets, not tax benefits, ultimately determine where businesses operate. Companies increasingly structure themselves to be close to their customers while optimizing their corporate structures, suggesting that consumer proximity will continue to drive business location decisions more than regulatory arbitrage.

|

CONSUMER UNIVERSE The airline recession benefits budget-conscious travelers |

The airline industry's current struggles are creating unexpected opportunities for cost-conscious consumers. With airline CEOs declaring an industry recession, airfare prices have plummeted 5.3% year-over-year in March, making air travel one of the few categories to experience consistent price declines over the past 15 years.

Historical data shows airline fares peaked during the post-pandemic recovery in 2022, reaching levels not seen since the early 2000s. However, the current downturn is providing consumers with their most affordable flying options since 2019, fundamentally changing travel accessibility for price-sensitive segments.

This trend is particularly significant for younger consumers and emerging middle-class segments globally, who have been priced out of air travel during the post-pandemic surge. The fare reductions are enabling new consumer segments to access air travel, potentially challenging travel patterns and destination choices.

Key Insights

The airline industry's financial struggles are democratizing air travel access, creating opportunities for new consumer segments to engage with aviation while forcing airlines to compete more aggressively on price, potentially restructuring the entire industry around more price-sensitive consumer expectations.

|

SUPPLY CHAIN Food system emissions is now a big deal for consumer awareness |

A comprehensive analysis of greenhouse gas emissions across 29 food products shows dramatic variations in environmental impact, with beef generating significantly higher emissions than plant-based alternatives. This data, compiled from over 38,000 commercial farms across 119 countries, provides consumers with unprecedented transparency into their food choices' environmental consequences.

Our analysis shows that land use changes and farm-level production account for the majority of food-related emissions, while transport and packaging contribute relatively smaller amounts.

Consumer awareness of these environmental impacts is driving significant behavioral changes, with plant-based alternatives gaining market share and regenerative agriculture practices becoming selling points.

Key Insights

As consumers become more environmentally conscious, food production transparency is becoming a competitive advantage. Companies that can demonstrate lower-emission supply chains and provide clear environmental impact data will likely capture growing market share from sustainability-focused consumer segments.

|

📊 MARKET MOSAIC PULSE CHECK |

How do you primarily discover new products or services?

|

WHAT IS HAPPENING AT RWAZI? |

Upcoming edition of the Market Mosaic webinar series on LinkedIn Live

At Rwazi, we work at the intersection of data, technology, and market innovation, helping global organisations translate local insights into strategic advantage.

We are pleased to invite you to attend our Market Mosaic webinar on “Building with Data: How AI and market feedback drive product innovation.”

Alongside a high-level panel, this session will explore how today’s most forward-thinking companies can leverage agentic AI and real-time consumer market data to inform product decisions, accelerate iteration, and drive growth across global markets.

Platform: LinkedIn Live

Date: July 31, 2025

Time: 3 PM (GMT)

Meet Sena, your AI copilot for turning insight into execution.

After years of building the world's most comprehensive market intelligence platform and helping global enterprises understand "what's happening" and "what it means," we are now solving the final piece of the puzzle: "How do we act on this?"

Want to learn how Sena helps teams like yours execute strategic moves and explore market opportunities in real-time across functions?

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

|

ICYMI ON LINKEDIN |

Here are the insightful visuals we shared on LinkedIn. Feel free to check them out, comment or repost if it hits home for you.

We are witnessing the most significant restructuring of the global economy in decades…

Markets embracing digital payment innovation are gaining competitive advantages that traditional card-based systems simply can't match…