Welcome to Market Mosaic, where, in this week's edition, we dig into Asia's meteoric rise as a global innovation powerhouse while traditional hubs face new competition and explore how $822 billion in private money flows are quietly accelerating developing economies at 3X the rate of foreign aid.

Plus, we also analyze how extreme supply chain concentration in critical commodities is creating both massive consumer vulnerabilities and unprecedented market opportunities.

Now, let’s dive into the insights and enjoy.

— Insights Team, Rwazi

In our edition this week:

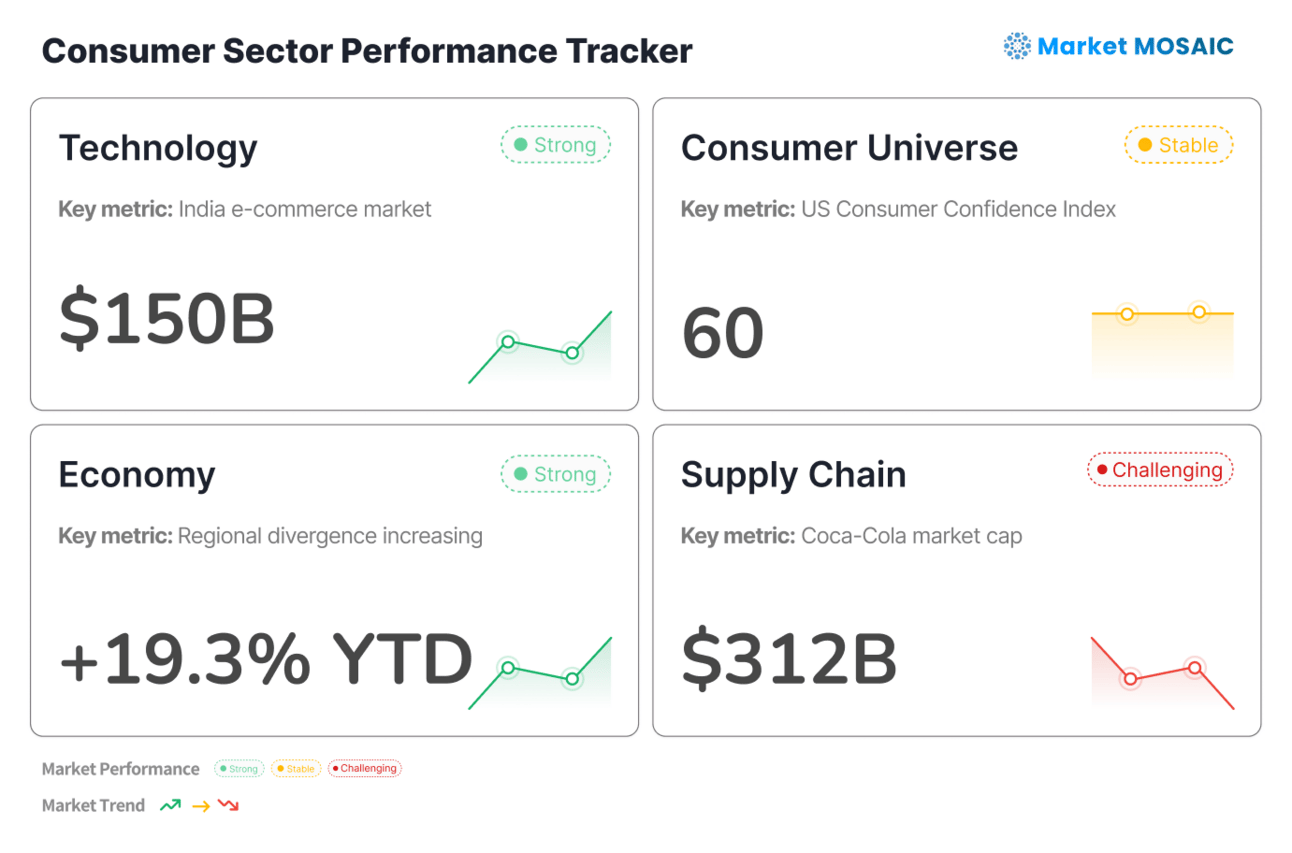

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

This weekly global market performance snapshot was analysed by Rwazi Insights

|

TECHNOLOGY Asia's rise challenges Western startup dominance |

Data visualization by Rwazi Insights

While San Francisco Bay Area maintains its position as the world's leading startup ecosystem with an Index score of 853, our analysis shows that Asian markets are gaining prominence.

Singapore's remarkable four-spot jump in global rankings now shows a shift in how multinational tech companies view Asia-Pacific operations. OpenAI's decision to establish its regional headquarters in Singapore shows the city-state's advanced technological infrastructure and regulatory environment that appeals to cutting-edge AI companies.

The data also shows particularly compelling insights about India's growing influence. Bangalore and New Delhi's placement in the top 11, ahead of established hubs like Tokyo, Berlin, and Seattle, signals a democratization of global innovation. This positioning is supported by India's vast AI talent workforce, which has become increasingly attractive to international companies seeking skilled technical professionals at competitive costs.

Key Insights

The global startup ecosystem is becoming increasingly multipolar, with Asian markets offering compelling alternatives to traditional Western hubs through superior talent availability, supportive regulatory frameworks, and proximity to rapidly growing consumer markets.

|

ECONOMY Migrant remittances now beat foreign aid in global impact |

A striking economic reality has emerged from our analysis: private money transfers from international migrants reached $822 billion in 2023, nearly tripling the $288 billion provided through official foreign aid channels. This massive flow of private capital is now one of the most significant yet underappreciated forces in global economic development.

Unlike traditional foreign aid, which often comes with governmental strings and structural requirements, migrant remittances flow directly to families for immediate needs like food, healthcare, education, and housing.

Consumer spending patterns in recipient countries show that remittances fuel local economies differently than aid. While foreign aid typically targets infrastructure and institutional development, remittances immediately boost consumer demand for goods and services, creating multiplier effects throughout local economies.

The distribution patterns show important consumer insights: most migrant money flows from high-income to middle-income countries, but low-income countries show higher dependence relative to their GDP. This suggests that for many developing economies, migrant remittances is a critical lifeline that directly supports consumer purchasing power.

Key Insights

Private remittances have become a more powerful economic force than official development assistance, creating direct consumer impact and demonstrating the effectiveness of decentralized, family-driven economic support systems.

|

CONSUMER UNIVERSE Music industry reaches new heights for consumers as digital innovation grows |

The global music industry has achieved remarkable growth, with recorded music revenues expanding 4.8% to reach $29.6 billion. This growth story shows fascinating consumer behavior shifts that extend far beyond entertainment consumption.

Streaming's dominance continues to solidify, crossing the $20 billion threshold for the first time and representing 69% of total industry revenue.

Perhaps most intriguingly, Vinyl Records experienced their 18th consecutive year of growth at 4.6%, showing the world that digital dominance doesn't eliminate demand for premium, tactile experiences.

The 7.4% growth in sync licensing revenue also shows how content creators and brands increasingly recognize music's power to enhance engagement. This growth is the explosion of video content across social media platforms and streaming services, where music selection significantly impacts consumer engagement and brand recall.

Performance rights revenue recovery of 5.3% signals that public consumption of music like in restaurants, retail stores, and events has not only returned to pre-pandemic levels but exceeded them, indicating robust consumer confidence in shared experiences.

Key Insights

The music industry's multi-format success demonstrates that consumers increasingly demand both digital convenience and premium physical experiences, suggesting that successful businesses must offer omnichannel approaches that serve both efficiency and authenticity needs..

|

SUPPLY CHAIN Palm oil concentration now creates global vulnerability in supply chain |

Indonesia's commanding 58% share of global palm oil production, combined with Malaysia's 24.7%, creates a remarkable supply chain concentration where two Southeast Asian nations control over 80% of a commodity essential to countless consumer products. This concentration presents both opportunities and risks for global supply chains.

Palm oil's ubiquity in consumer goods, from food products to cosmetics to biofuels, means that production disruptions in these two countries can immediately impact global consumer prices and product availability. Recent supply chain disruptions have heightened consumer awareness of ingredient sourcing, with 67% of consumers now expressing concern about supply chain transparency.

The environmental and social costs associated with palm oil production have created a growing consumer backlash. Sustainable palm oil certification has become increasingly important, with consumer demand for certified sustainable palm oil growing 23% year-over-year.

The concentration also shows opportunities for diversification. Countries like Colombia, Nigeria, and Guatemala are expanding production, potentially offering supply chain resilience for companies seeking to reduce dependency on Indonesian and Malaysian sources.

Key Insights

Extreme supply chain concentration in critical commodities like palm oil creates both vulnerability and opportunity, as conscious consumers drive demand for sustainable alternatives while companies seek supply diversification to manage risk.

|

📊 MARKET MOSAIC PULSE CHECK |

Where do you predict the next major global innovation breakthrough will come from in the next 2 years?

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

|

WHAT IS HAPPENING AT RWAZI? |

Just 2 minutes of your time and we save you months & $'000s in scale-up!

We are excited to announce the launch of our new campaign designed to connect with business leaders who are looking to scale efficiently while avoiding costly market intelligence mistakes.

|

ICYMI ON LINKEDIN |

Here are the insightful visuals we shared on LinkedIn — feel free to check them out, comment or repost if it hits home for you.

We are witnessing the most significant restructuring of the global economy in decades…

Markets embracing digital payment innovation are gaining competitive advantages that traditional card-based systems simply can't match…