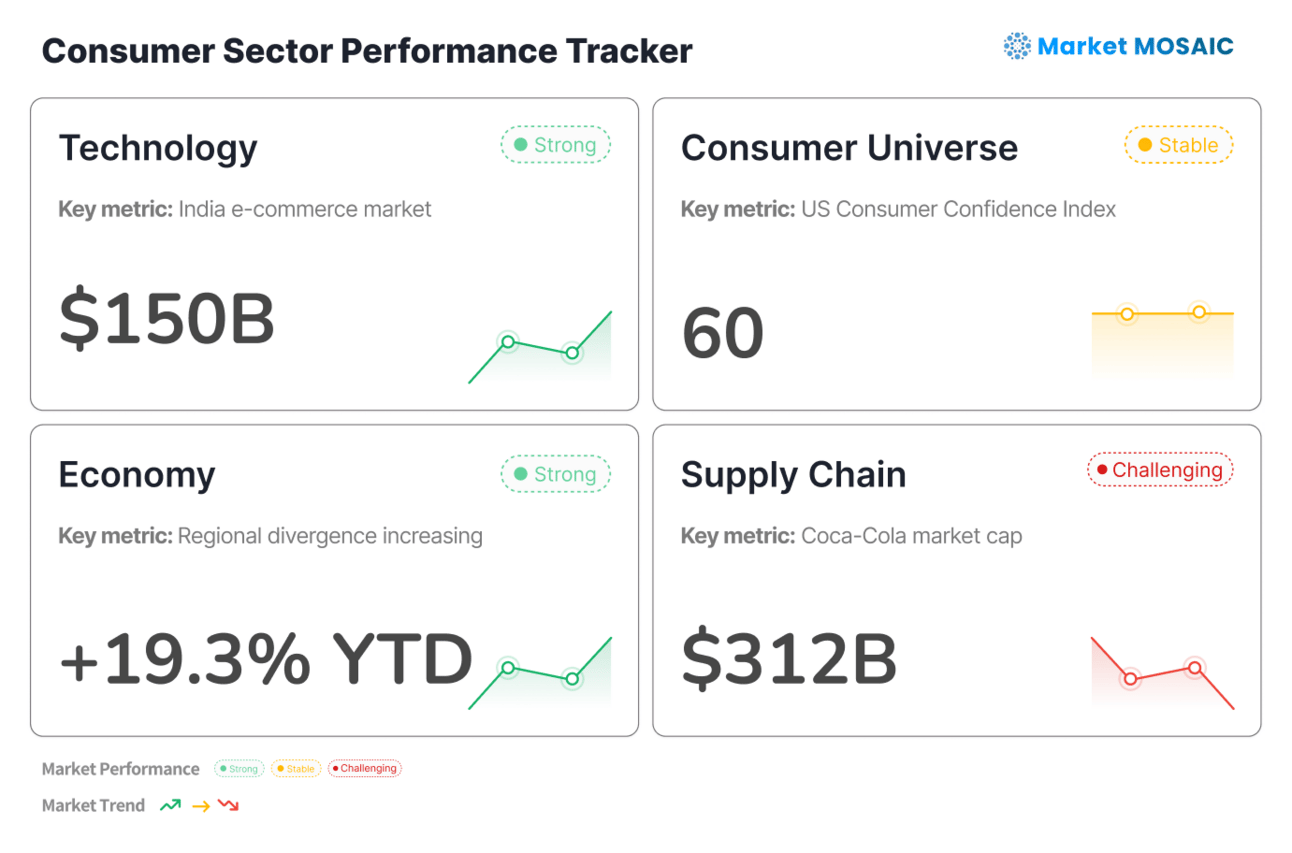

Welcome to Market Mosaic, where, in this week's edition, we dig into India's explosive $150 billion e-commerce market, driving unprecedented consumer behavior shifts. We also explore how global market divergence shows deeper regional consumer priorities, with Hong Kong surging 19.3% while the US stagnates.

Plus, we analyze how America's consumer confidence crash to a 2-year low of 60 points is challenging spending patterns across demographics.

Now, let’s dive into the insights and enjoy.

— Insights Team, Rwazi

In our edition this week:

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

This weekly global market performance snapshot was analysed by Rwazi Insights

|

TECHNOLOGY India's $150 Billion e-commerce market explosion |

Data visualization by Rwazi Insights

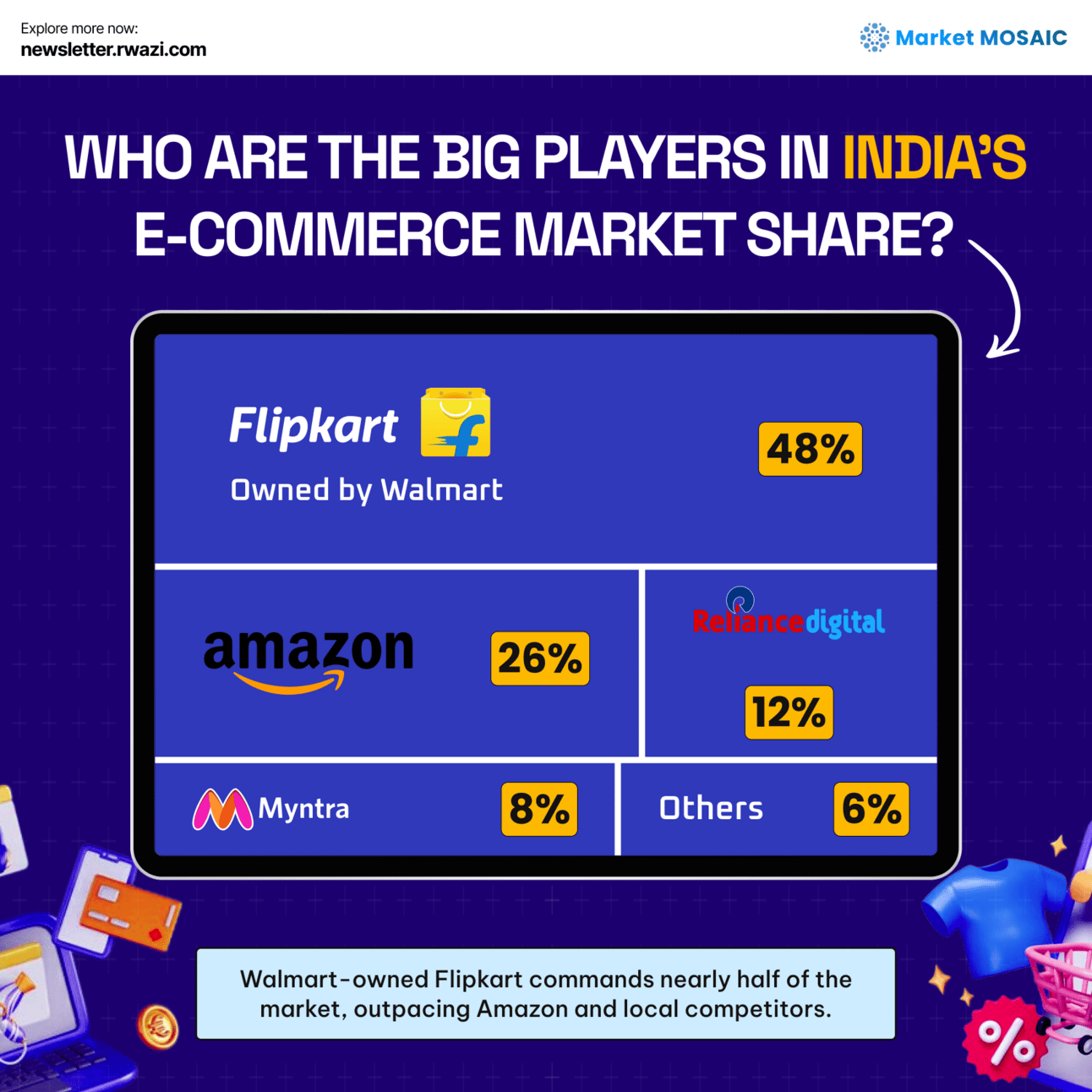

India's digital transformation is creating unprecedented opportunities for consumer engagement and market expansion. With the e-commerce sector projected to surpass $150 billion in 2024, we are observing a major shift in how Indian consumers discover, evaluate, and purchase products.

Our analysis shows that Flipkart commands nearly half the market (48%), followed by Amazon (26%). However, the real story lies in the tier 2 and tier 3 cities, where localised preferences drive innovation in vernacular content, payment solutions, and last-mile delivery.

The rise of Direct-to-Consumer (D2C) brands is particularly noteworthy, with social commerce integration changing traditional shopping behaviours. Consumers are increasingly making purchase decisions based on peer recommendations and social proof, rather than traditional advertising channels.

Key Insights

India's e-commerce growth represents more than market expansion, it's a blueprint for how emerging markets can leapfrog traditional retail infrastructure to create consumer-centric digital ecosystems that prioritize accessibility, localization and trust.

|

ECONOMY Global markets diverge as regional consumer priorities challenge investment flows |

The stark performance differences across global markets go to show how regional consumer trends influence capital allocation and investment strategies. Hong Kong's Hang Seng Index surge of 19.3% year-to-date, driven by tech optimism around innovations like DeepSeek, contrasts sharply with the S&P 500's modest 1.6% gain amid trade uncertainty.

This divergence shows deeper consumer behaviour patterns. In Asia, consumers are increasingly embracing AI-powered services and fintech solutions, driving investor confidence in regional tech companies. Meanwhile, European markets like Germany's DAX (18.1% returns) benefit from increased defence spending, reflecting consumer concerns about security and geopolitical stability.

The positioning of Hong Kong as the world's top IPO destination in 2025 signals a major shift in how global consumers and investors view market opportunities. Companies like Shein's potential shift away from London challenge how consumer-facing brands are following capital flows to markets that better understand their customer bases.

Key Insights

Market performance is increasingly reflecting regional consumer priorities and behaviors, with investors gravitating toward markets that demonstrate the strongest alignment between local consumer trends and business innovation.

|

CONSUMER UNIVERSE US consumer sentiment hits multi-year lows |

American consumer confidence has fallen to its lowest level in over two years, with the Consumer Sentiment Index dropping to 60, a dramatic decline that reflects deep-seated concerns about economic policy and inflation. This 18% drop in the Index for Consumer Expectations signals that consumers are not just worried about current conditions, but are increasingly pessimistic about the future.

The breadth of this decline is particularly striking, affecting all demographic and political affiliations. Consumers are expressing heightened concerns about personal finances, business conditions, unemployment, and inflation—a comprehensive worry that suggests fundamental shifts in spending behaviour are likely.

Historical context shows this level of pessimism approaching the all-time low recorded in June 2022 when inflation peaked at nearly 9%. However, unlike that period, current concerns are more forward-looking, focusing on potential policy impacts rather than immediate price pressures.

Key Insights

This sentiment shift is already manifesting in consumer behaviour, with delayed purchases, increased savings rates, and a flight to essential goods over discretionary spending. Brands and retailers are reporting longer decision-making cycles and increased price sensitivity across categories.

|

SUPPLY CHAIN Beverage giants navigate consumer premiumization demands |

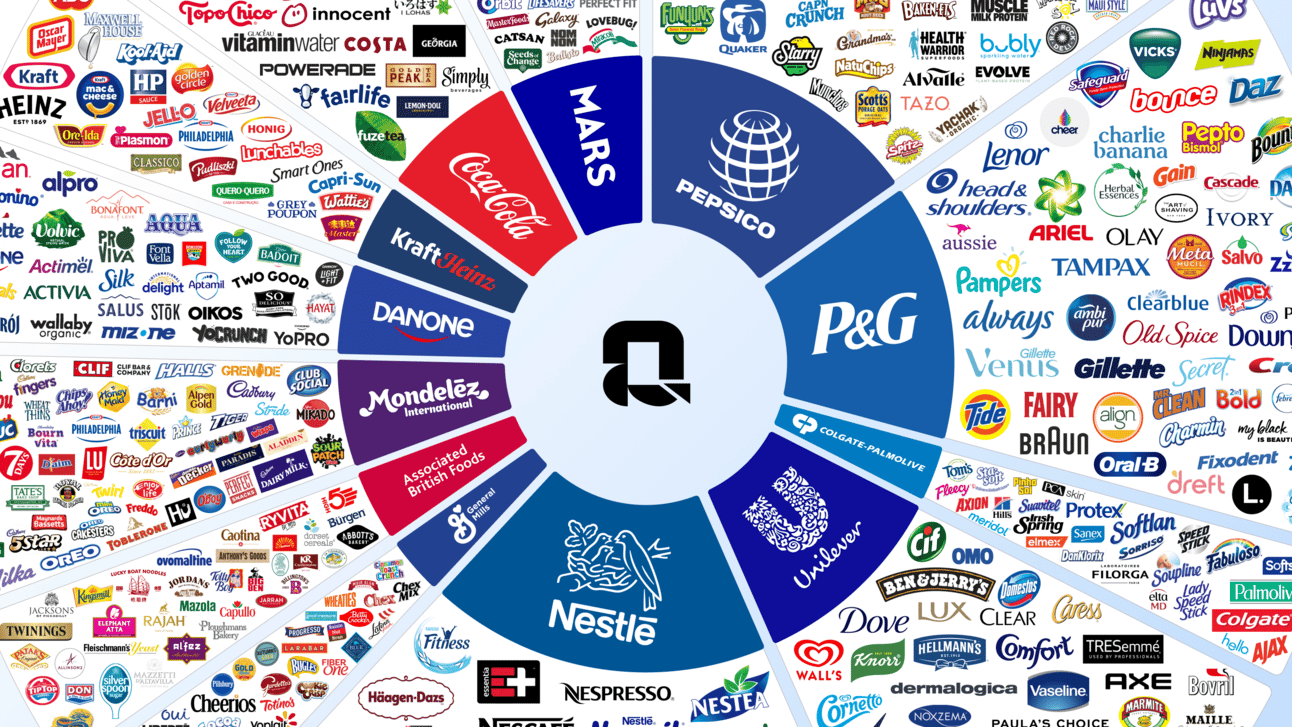

The global beverage industry's market leaders, Coca-Cola ($312.09B), Kweichow Moutai ($267.38B), and PepsiCo ($185.52B), are adapting their supply chains to meet evolving consumer preferences for premium products and sustainable packaging.

Coca-Cola's dominance across 200+ countries with 33.3 billion drink cases sold challenges the power of global supply chain optimisation. However, the company's revenue split, 50% from sparkling soft drinks and 20% from diversified beverages, shows how consumer health consciousness is driving portfolio diversification.

However, Kweichow Moutai's 16% growth and expansion into alcohol-infused products like ice cream and coffee mirror how traditional brands are innovating to reach new consumer segments. This premiumization trend is evident across the sector, with consumers willing to pay higher prices for unique experiences and quality.

From Starbucks' 4 billion coffee cups annually requiring sustainable sourcing solutions to Monster's $7.49B in energy drink sales demanding recyclable packaging, companies are also investing billions in supply chain transformation to meet consumer environmental expectations.

Key Insights

The beverage industry's supply chain evolution reflects broader consumer trends toward premiumization, sustainability, and localization—forcing global giants to balance scale efficiency with responsiveness to increasingly sophisticated and environmentally conscious consumer demands.

|

📊 MARKET MOSAIC PULSE CHECK |

Which trend do you believe will have the greatest impact on your business strategy?

|

CONVERSATIONS WITH MARKET MOSAIC ICYMI: Perspectives from our industry leaders building and deciding with data |

Meet Ashton Slatev, VP of Product at Rwazi — a product leader and innovator who's built AI-powered products across healthcare, supply chain, and market intelligence.

🟣 Market Mosaic: If a product or brand manager has just 30 minutes with you to better understand how to leverage AI for consumer or user insights across different international markets, what's the one thing you would tell them to do?

🟢 Ashton: Most teams treat consumer insights as a one-time input—something you gather at the beginning of a campaign or product cycle. But in a world that’s moving this fast, the real edge comes from building a continuous feedback loop between consumers and your product strategy.

The smartest teams are using AI to not just analyze static datasets, but to dynamically identify gaps in their understanding and trigger new data collection in real time. That shift — from passively analyzing what's already there to actively closing knowledge gaps as they emerge — is what separates reactive teams from truly adaptive ones. It’s how we have built Rwazi to operate, and it’s where the industry is headed.

Know an industry expert we should feature?

Share their details with us — your suggestion could shape our next conversation and bring fresh insights to the community.

shared.image.missing_image

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

|

WHAT IS HAPPENING AT RWAZI? |

Just 2 minutes of your time and we save you months & $'000s in scale-up!

We are excited to announce the launch of our new campaign designed to connect with business leaders who are looking to scale efficiently while avoiding costly market intelligence mistakes.

|

ICYMI ON LINKEDIN |

Here are the insightful visuals we shared on LinkedIn — feel free to check them out, comment or repost if it hits home for you.

We are witnessing the most significant restructuring of the global economy in decades…

Markets embracing digital payment innovation are gaining competitive advantages that traditional card-based systems simply can't match…