Welcome to Market Mosaic, where, in this week's edition, we analyse the massive infrastructure investments powering digital transformation and explore how India's economic ascent is redefining global consumer markets.

We also look at how e-wallets are challenging transaction economics while strategic caution dominates corporate deal-making.

Let’s dive into the market reality check!

— Insights Team, Rwazi

In our edition this week:

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

This weekly market snapshot was compiled and analysed by Rwazi Insights

|

TECHNOLOGY The power-hungry future of digital infrastructure in the U.S. |

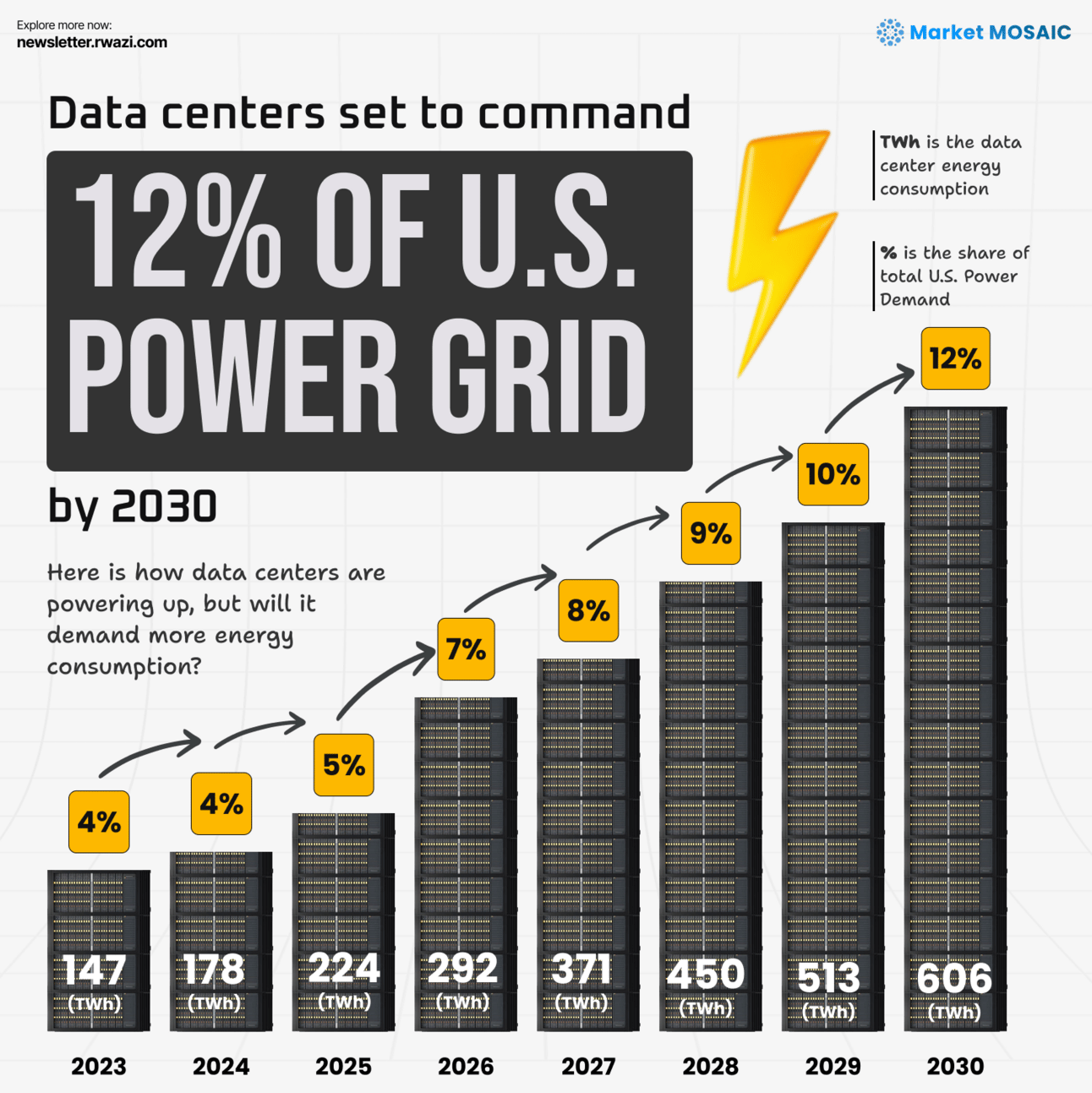

Chart by Rwazi Insights for Market Mosaic

The digital transformation driving consumer experiences comes with a massive hidden cost: energy consumption. And according to analysis by Market Mosaic, data centres in the United States will consume 606 terawatt-hours of energy, 12% of the nation's power by 2030, up from just 3% today, equivalent to powering 57 million homes annually.

For consumers, this infrastructure buildout translates to both opportunities and challenges. The $500 billion investment required to meet this demand will likely drive innovation in renewable energy solutions and smart grid technologies. However, it also signals potential increases in digital service costs as companies factor in rising energy expenses.

The consumer behaviour driving this surge is clear: demand for AI-powered personalisation, cloud gaming, streaming services, and instant digital interactions continues to accelerate as consumers now expect sub-second response times from digital applications.

Key Insights

The exponential growth in data centre power consumption reflects consumers' insatiable appetite for digital experiences, but will ultimately reshape pricing models and sustainability strategies across the tech sector.

|

ECONOMY India's export slowdown rebounces |

Market Mosaic believes India's journey from the world's 16th largest economy in 1997 to its projected 4th place ranking in 2025 is one of the most significant global economic transformations this decade. However, beneath this impressive growth lies a more complex story of export challenges and its consumer market.

While India's economy continues its upward trajectory, goods’ exports have plateaued, growing at only 3% annually since 2011 compared to 19.5% from 1999-2011. This shift reflects India's transition toward a services and domestic consumption-driven economy, creating massive opportunities for consumer brands.

With over 1.4 billion consumers and a fast-expanding middle class, India is now the world's largest untapped consumer market. Analysis by Market Mosaic shows that Indian consumers are increasingly embracing digital-first experiences, sustainable products, and premium brands.

Key Insights

These trends will reshape global consumer goods strategies as India's economic rise signals a fundamental shift from export-led to consumption-led growth. This will then create unprecedented opportunities for global brands that can successfully navigate this diverse and fast-rising consumer markets.

|

CONSUMER UNIVERSE E-wallets are transforming the transaction economics/p> |

The global payments are experiencing a major shift that impacts both retailers and consumers. E-wallet services now charge significantly lower fees than traditional credit cards, with platforms like Alipay (0.55%) and WeChat Pay (0.60%) leading.

This fee differential has implications for consumer behaviour and market dynamics. In places like China, e-wallets account for 56% of transaction value compared to just 18% for credit cards. The lower transaction costs enable retailers to offer better prices or invest more in customer experience, creating a cycle of adoption.

For consumers, e-wallets offer not just convenience but also access to integrated financial services, loyalty programs, and personalised offers that traditional payment methods cannot match.

Key Insights

The dominance of low-fee e-wallet services is reshaping retail economics and consumer expectations, creating competitive advantages for markets that embrace digital payment innovation over traditional card-based systems.

|

SUPPLY CHAIN Mergers and acquisitions (M&A) caution reflects consumer uncertainty |

The consumer products sector's merger and acquisition activity shows a market in transition, with companies pursuing only low-risk deals while waiting for greater economic and consumer stability.

Despite headline-grabbing acquisitions like Pepsi's near-$2 billion Poppi purchase and E.l.f's $1 billion Rhode acquisition this year, overall deal volume dropped 18% quarter-over-quarter.

This cautious approach reflects deeper consumer trends that smart business executives are recognising. The deals that are proceeding, in functional beverages, beauty, and wellness, target segments where consumer demand has proven resilient despite economic uncertainty.

The concentration of successful deals in specific categories also shows where consumer loyalty remains strong. Beauty and personal care, functional beverages, and ready-to-eat solutions represent areas where consumers continue to prioritise value and innovation over price sensitivity.

Key Insights

The selective M&A environment indicates that companies are prioritising organic growth and operational efficiency over expansion through acquisition, suggesting a more mature approach to building consumer-centric businesses

|

📊 MARKET MOSAIC PULSE CHECK |

Which of these trend will have the biggest impact in 2025?

- 🔋 The AI Power Surge - Data centers consuming 12% of U.S. power by 2030, driving up digital service costs

- 💳 The Payment Revolution - E-wallets charging 0.55% vs credit cards at 3.3%, reshaping transaction economics

- 🇮🇳 India's Economic Rise - Moving from 16th to 4th largest economy, creating massive new consumer markets

- 🤝 Strategic M&A Caution - 18% drop in deal volume as companies prioritize low-risk, trend-based acquisitions

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

|

WHAT IS HAPPENING AT RWAZI? |

Just 2 minutes of your time and we save you months & $'000s in scale-up!

We are excited to announce the launch of our new campaign designed to connect with business leaders who are looking to scale efficiently while avoiding costly market research mistakes.

Our team has developed a streamlined form experience that captures the essential information we need to understand how Rwazi's AI-powered market intelligence platform can help businesses accelerate their growth strategies. The form is designed to be completed in under 2 minutes while providing maximum value to potential clients.

Ready to explore a new challenge and take the next step in your career?

Each week, we share open roles at Rwazi for business professionals like you looking to make an impact in the AI market intelligence with us. Here’s what’s open this week:

Director of Finance

Perfect for someone looking to drive efficiency with market intelliegnce focus.

Due: Rolling

Product Marketing Manager

Help shape how we market our products in best ways to our users

Due: Rolling

|

ICYMI ON LINKEDIN |

Here are the insightful visuals and posts we shared on our LinkedIn page — feel free to check them out, comment or repost if any hits home for you.

The race for AI supremacy is now about who will control the consumer experiences of tomorrow.

Electric vehicles now make up 13% of all UAE car sales — a meteoric rise from just 0.7% in 2021. 🚗⚡