Welcome to Market Mosaic, where we are exploring in this week's edition th bipolar shift in global R&D investment between the U.S. ($784B) and China ($723B), analyze how fast food inflation has outpaced national averages with prices up 63% since 2014 and examine America's $1.11 trillion services export powerhouse.

These interconnected trends show a transforming global economy where innovation leadership, consumer value perception, and supply chain resilience will determine tomorrow's market winners.

In case you also missed it, we recently released a fresh look for our newsletter.

— Insights Team, Rwazi

In our edition this week:

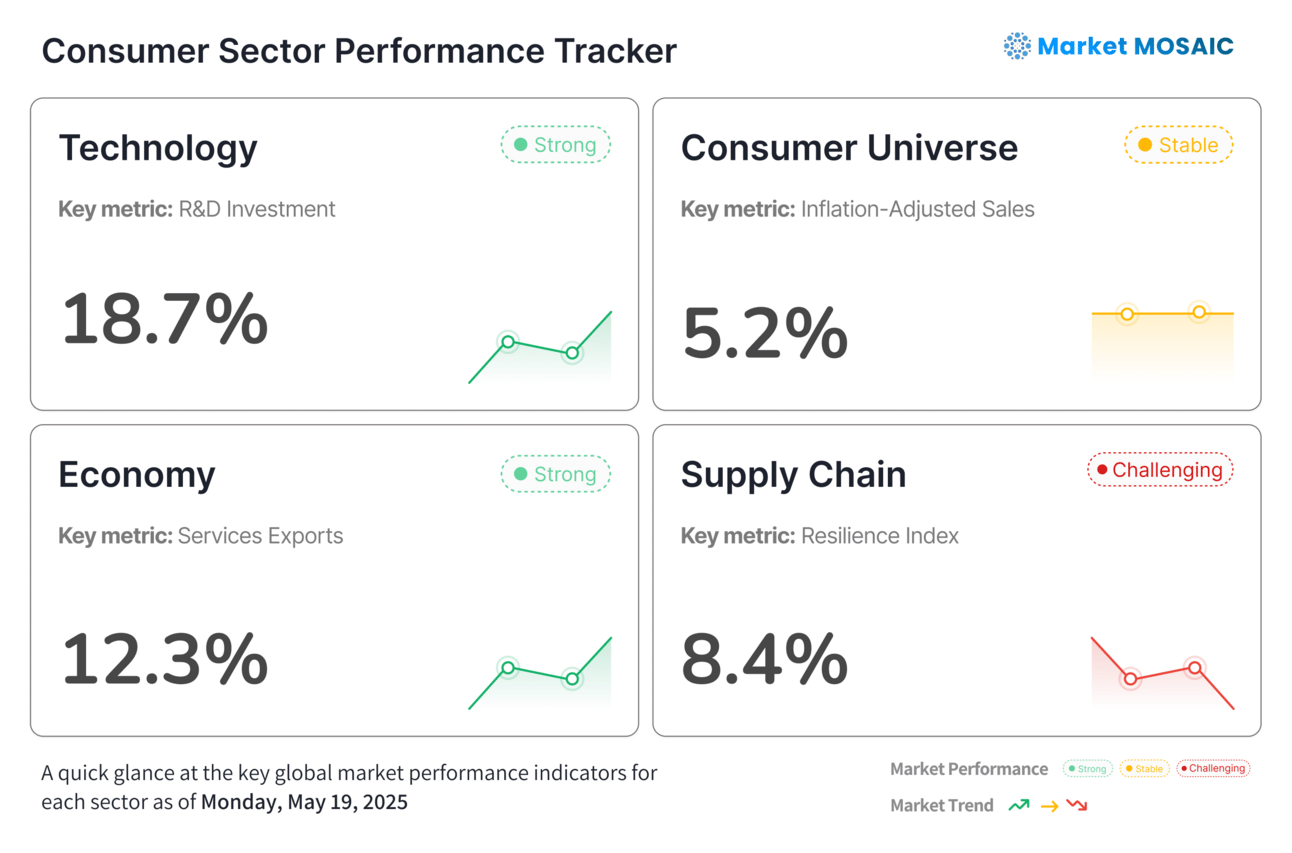

Sector Performance Tracker

Technology

Economy

Consumer Universe

Supply Chain

This weekly market snapshot was compiled and analysed by Rwazi Insights

|

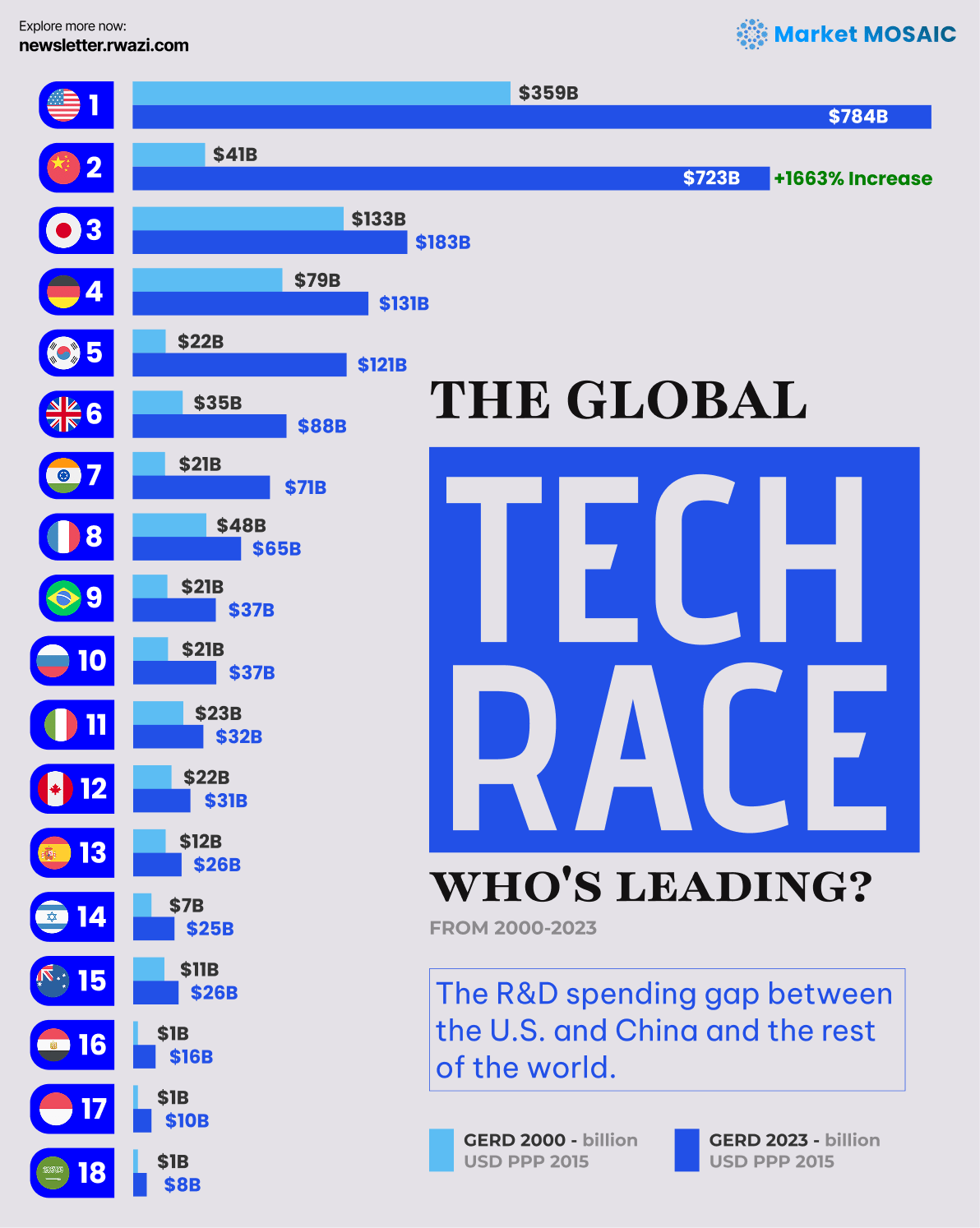

TECHNOLOGY Global R&D shows shifting power dynamics in tech |

Data visualisation by Rwazi Insights

The global research and development ecosystem has undergone a dramatic transformation over the past two decades. Total R&D spending has nearly tripled in real terms, reaching an unprecedented $2.75 trillion in 2023. What's particularly striking is the redistribution of innovation power centres across the globe.

The United States maintained its leadership position with approximately $784 billion in R&D expenditure for 2023, but China's meteoric rise cannot be overlooked. From representing just 4% of global R&D investment in 2000, China now commands 26% of worldwide research spending at $723 billion, nearly matching U.S. levels.

This shift has created a distinctive two-tier global innovation landscape. While Japan ($183 billion) and Germany ($131 billion) maintain significant investments, the gap between these traditional innovation powerhouses and the new "Big Two" continues to widen. Perhaps most revealing is that the entire European Union's combined R&D spending of $410 billion now amounts to just over half of either the U.S. or China's investment.

Key Insights

The emergence of a bipolar innovation landscape between the U.S. and China is reshaping global product development strategies, with significant implications for technological standards, consumer electronics, and digital services.

Companies that fail to navigate these dual innovation streams risk losing competitiveness in major global markets.

|

ECONOMY U.S. services exports highlight knowledge economy dominance |

The United States continues to cement its position as the global leader in high-value service exports, with total services exports reaching $1.11 trillion in 2024. This impressive figure underscores America's transition to a knowledge-based economy and its competitive advantage in sectors requiring advanced expertise and intellectual capital.

Four key categories account for a striking 69% of all U.S. services exports:

Travel (personal and business): $215 billion

Financial services: $191 billion

Professional and management consulting: $164 billion

Intellectual property charges: $144 billion

This concentration reveals the United States' particular strengths in financial innovation, consulting expertise, intellectual property development, and tourism appeal. The substantial intellectual property revenue ($144 billion) specifically highlights the country's continued leadership in creating and monetising innovation.

Key Insights

The composition of U.S. services exports reflects a strategic advantage in high-value, knowledge-intensive sectors that are less vulnerable to cost competition. This suggests businesses should prioritize investments in intellectual property development and specialized expertise to capitalize on global demand for premium services.

|

CONSUMER UNIVERSE Fast food inflation outpaces overall food-away-from-home costs |

Our analysis reveals a concerning trend for consumers: major fast food chains have increased their prices by an average of 63% over the past decade (2014-2024), significantly outpacing the overall food-away-from-home inflation rate of 48.5%.

McDonald's leads this inflationary surge with a staggering 100% average price increase across sampled menu items – effectively doubling their prices in ten years. Other major chains showing substantial increases include Popeye's (86%), Taco Bell (81%), and Chipotle (75%).

This pricing pattern is particularly noteworthy as fast food has traditionally positioned itself as an affordable dining option. The data suggests a fundamental shift in the quick-service restaurant industry's value proposition, with potential implications for consumer behaviour and market segmentation.

Key Insights

The dramatic price escalation in fast food challenges the industry's traditional value positioning and opens opportunities for new market entrants offering genuine budget options.

Brands that can deliver perceivable value while managing price increases will likely capture market share from those implementing more aggressive pricing strategies.

|

SUPPLY CHAIN Pharmaceutical supply chain concentration creates vulnerability |

An analysis of facilities producing active pharmaceutical ingredients (APIs) for U.S.-approved medications reveals concerning concentration risks in the global pharmaceutical supply chain.

India dominates API production with 183 facilities generating more than 10 active U.S.-approved API products. The European Union follows with 83 such facilities, while China (35) and the United States itself (19) have significantly fewer. This concentration means that approximately 54% of high-volume API production facilities for U.S. medications are located in India alone.

Our analysis indicates growing consumer awareness of pharmaceutical supply chain issues, with 67% of U.S. consumers expressing concern about medication availability and 59% showing interest in country-of-origin information for their prescriptions.

Key Insights

The extreme concentration of pharmaceutical ingredient production presents both risks and opportunities. For healthcare systems, it signals the need for supply chain diversification and resilience planning.

For pharmaceutical companies, communicating supply chain security measures and considering reshoring or nearshoring certain production could become a competitive advantage as consumer awareness grows.

|

POLL |

Which trend from this week's newsletter will have the greatest impact on your business strategy in 2025?

- 🔴 The U.S.-China R&D duopoly creating a two-track innovation landscape

- 🟠 Fast food price inflation (63% average) signaling broader consumer spending pressures

- 🟡 America's $1.11T services exports revealing opportunities in knowledge-based sectors

- 🟢 Pharmaceutical supply chain concentration (54% of facilities in one country)

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

|

WHAT IS HAPPENING AT RWAZI? |

Last week, we held a LinkedIn Live conversation on trade disruption strategies for global businesses.

Our audience discovered actionable strategies to mitigate risks from trade disruptions, maintain market presence amid shifting trade policies and identify new opportunities in reconfigured global trade networks.

Sharp Insight. Bold Conversations. Real Impact.

Ready to explore a new challenge and take the next step in your career?

Each week, we share open roles at Rwazi for business professionals like you looking to make an impact in the AI market intelligence with us. Here’s what’s open this week:

Director of Finance

Perfect for someone looking to drive efficiency with market intelliegnce focus.

Due: Rolling

Product Marketing Manager

Help shape how we market our products in best ways to our users

Due: Rolling

|

ICYMI ON LINKEDIN |

Here are the insightful visuals we shared on LinkedIn — feel free to check them out, comment or repost if it hits home for you.

Chinese cloud providers have captured 37% of new contracts in the Middle East over the past six months…

Retail employment has transformed dramatically since 2010, but not in the ways many predicted…