You are welcome to Market Mosaic, where we are analysing in this week's edition how geopolitical tensions are challenging global manufacturing hubs, exploring the dramatic impact of ending de minimis provisions on e-commerce giants, and analysing how Vietnam and Malaysia are positioning themselves in the fast-rising and intensely competitive tech spaces.

As always, we offer key insights on the forces transforming global supply chains and consumer markets.

— Insights Team, Rwazi

In our edition this week:

SECTOR PERFORMANCE TRACKER

This weekly market snapshot was compiled and analysed by Rwazi Insights

TECHNOLOGY

Malaysia's data centre boom creates challenges within opportunities

Malaysia is now emerging as a key data centre hub in Southeast Asia, with major tech firms including Google, Amazon, and Nvidia establishing operations, particularly concentrated in Johor state. This development is creating thousands of new jobs and transforming local economies.

While the economic benefits are substantial, our analysis, however, shows growing concerns by local communities and authorities about resource allocation and infrastructure capacity.. Power consumption for these facilities is expected to increase state electricity demand by 24% within three years. Water usage concerns are mounting, with data centres potentially consuming up to 3% of the state's water supply.

In response, the Malaysian government has introduced new guidelines for data centre developments, mandating sustainability measures including renewable energy adoption and water recycling systems.

Key Insight: For tech companies considering regional expansion, this presents both opportunities and challenges. While Malaysia offers strategic connectivity and relatively lower operational costs, companies must now navigate stricter regulatory requirements and growing community concerns. Companies that proactively address these concerns through green technologies and community engagement will gain significant competitive advantages.

ECONOMY

India's pharmaceutical industry changes the market game

Chart by Rwazi Insights

India's pharmaceutical sector continues its remarkable growth trajectory, with our analysis showing the market is on track to reach $65 billion in 2024, nearly doubling from $32 billion in 2019. The country's strategic position as a global pharmaceutical powerhouse is strengthening, with 34.4% of its pharmaceutical exports heading to the United States.

Our analysis also shows that 77% of India's pharmaceutical industry focuses on formulations, while bulk drugs account for the remaining 23%. This distribution highlights India's evolution from being primarily a generic drug producer to developing more sophisticated formulations with higher profit margins.

Key Insight: India's pharmaceutical market growth is a shift in global healthcare supply chains, offering both diversification from China-centric production and potential cost advantages for healthcare systems worldwide. For pharmaceutical companies, India presents manufacturing opportunities with increasing potential as a consumer market, as healthcare spending rises across its population.

CONSUMER RETAIL

Vietnam's delicate balance in the U.S.-China trade war

Vietnam now finds its market in a precarious market position as U.S.-China trade tensions escalate. Once a clear beneficiary of manufacturing relocation from China, Vietnam now faces considerable uncertainty with the threat of 46% tariffs from the U.S., temporarily suspended for a 90-day negotiation period.

Our analysis shows major tech companies, including Apple, Samsung, and numerous Chinese suppliers, have expanded their Vietnamese operations in recent years. This has created a complex ecosystem of interconnected supply chains spanning China and Vietnam.

In the automotive sector, Vietnamese EV manufacturer VinFast provides a case study in adapting to this uncertainty. After struggling in the U.S. market, VinFast is pivoting to focus on Southeast Asia, India, and the Middle East — regions with rising EV demand but different competitive markets.

Key Insight: Vietnam's experience demonstrates how quickly geopolitical shifts can transform apparent advantages into vulnerabilities. For businesses with global supply chains, this underscores the importance of not just diversification but strategic flexibility that accounts for potential policy volatility.

SUPPLY CHAIN

The end of ultra-cheap e-commerce as Shein and Temu face the new reality

The era of ultra-low-priced direct-from-China e-commerce is coming to an end as regulatory changes eliminate a key competitive advantage for platforms like Shein and Temu. Starting April 25, both companies have announced price increases in response to the elimination of the "de minimis" exemption, which previously allowed packages valued under $800 to enter the US without duties or tariffs.

Our analysis shows the significant impact this will have de minimis shipments currently account for over 90% of US imports. Shein and Temu alone represent approximately 60% of these shipments as combined duties and tariffs on some items (like sweaters) could reach nearly 170%. Both platforms have been preparing by developing domestic supply chains and manufacturing in countries like Brazil and Turkey.

Temu has already begun shifting its strategy, moving away from direct-to-China supply models toward a partially managed marketplace focused on US-based fulfilment. Meanwhile, Shein continues to pursue its long-delayed IPO plans despite these challenges.

Key Insight: The regulatory changes will fundamentally alter the economics of cross-border e-commerce, likely leading to market consolidation and pushing remaining players to develop more sophisticated multi-country supply networks. Businesses that have already invested in building resilient, geographically diverse supply chains will gain significant competitive advantages as these changes take effect.

EXCLUSIVE OPPORTUNITY

Share your luxury preferences & win a luxury perfume as a reward 📊🎁

We are taking our market intelligence capabilities to the next level with exclusive insights research focused on Malaysia's unique luxury market. Why Malaysia? As one of Southeast Asia's most dynamic luxury goods markets, Malaysia is growing with contemporary preferences that we are excited to understand.

By participating in our quick survey, you will contribute to the most comprehensive intelligence available anywhere while winning a premium luxury perfume fragrance. Plus, all participants will receive early access to our upcoming report later this month.

This window closes in just 2 days. Feel free to share this opportunity with colleagues and others in your network. As a Market Mosaic subscriber, you are a part of our trusted network of market insiders whose perspectives shape global commerce.

As trade tensions and regulatory changes disrupt global markets, the developments highlighted in our edition this week point to a future where geographic diversification of manufacturing and supply chains will become increasingly important.

Particularly where competitive advantages based solely on regulatory arbitrage will prove less sustainable than those built on innovation and consumer value.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

How has Market Mosaic impacted your business decision-making?

WHAT IS HAPPENING AT RWAZI?

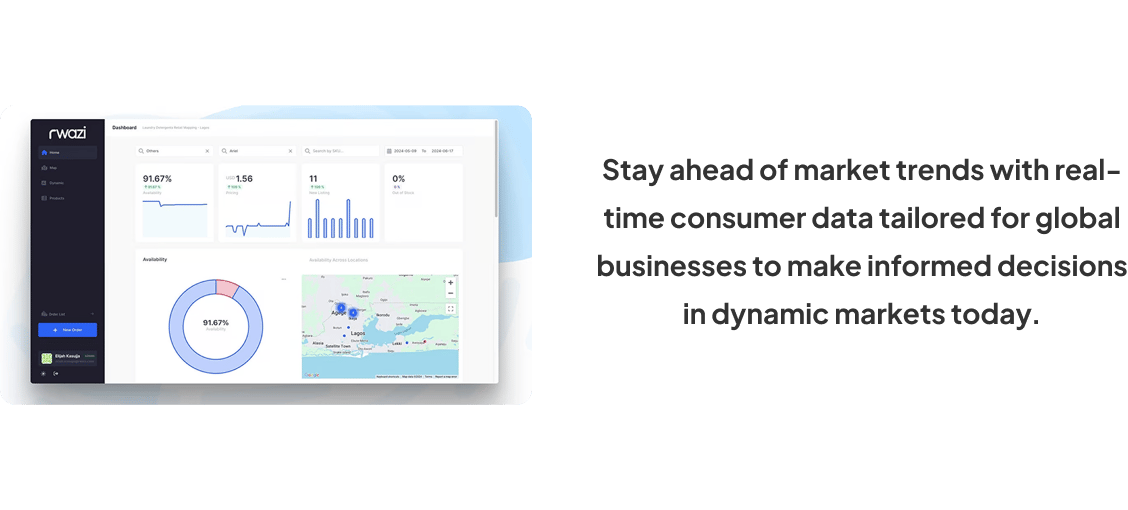

Digital Trends features Rwazi's hyper-local, AI-powered product

We are excited to share that Rwazi has been featured in Digital Trends, telling the story of our pioneering work and unique approach to market intelligence for global businesses to leverage hyper-local consumer insights to drive business growth and market innovation.

The feature also showcases our suite of specialised tools, including the Brand Intelligence tool, our Consumer Behaviour Intelligence platform, Lumora, and our innovative Retail Mapping product. Our AI-powered platform streams real-time data from millions of consumers across hundreds of countries, capturing granular details about purchasing habits, product usage, and brand interactions.