You are welcome to Market Mosaic, where we are analysing in this week's edition the fierce competition for TikTok's $100 billion acquisition as ByteDance faces a critical deadline and how market turbulence is reshaping consumer confidence across global economies.

We are also exploring Apple's deepening challenges in the Chinese market amid AI integration delays and diving deep into how retailers are leveraging private labels to combat inflation as traditional CPG manufacturers struggle to articulate their value propositions beyond price.

Let’s get into these analyses and insights together.

— Insights Team, Rwazi

In this edition:

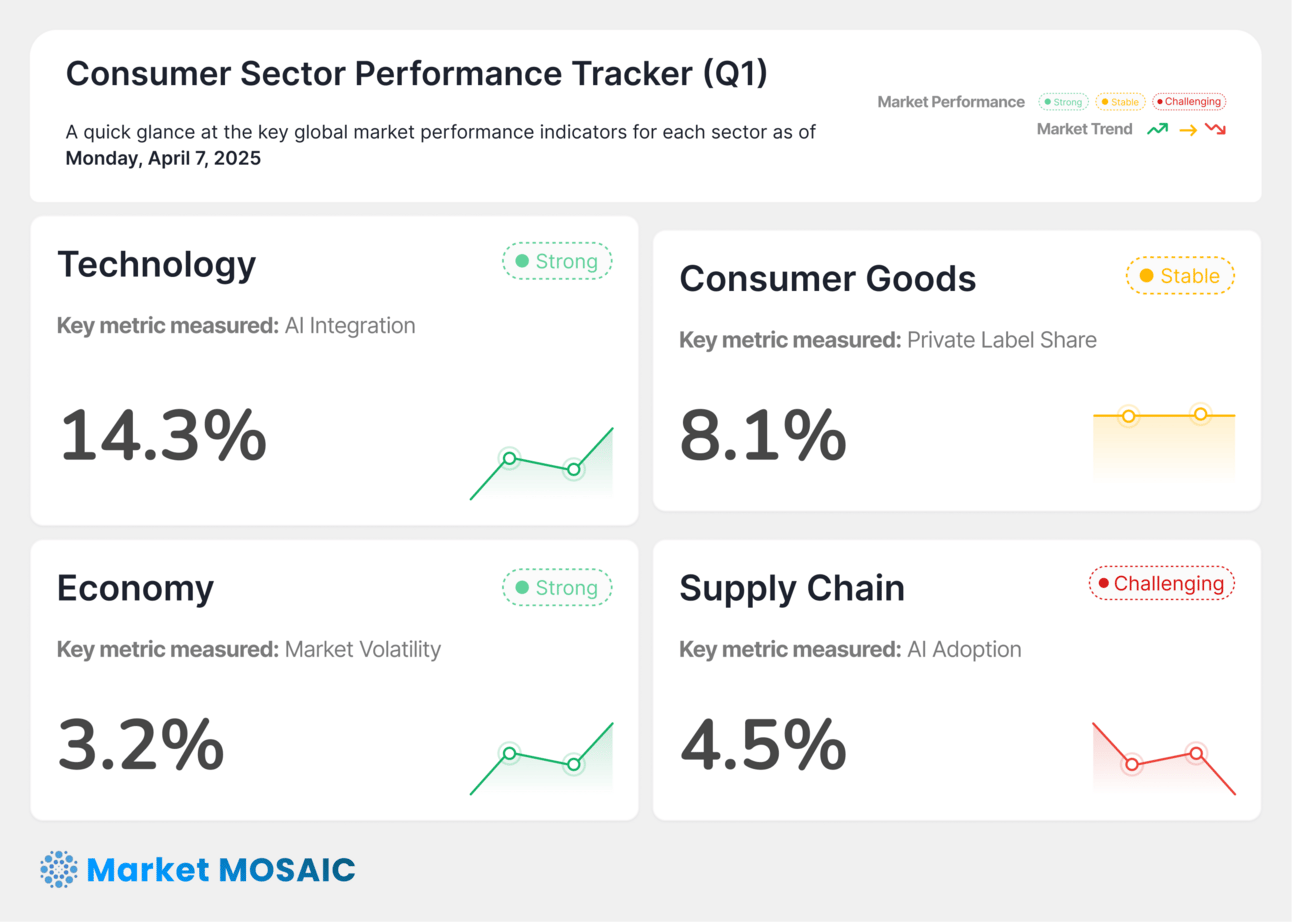

SECTOR PERFORMANCE TRACKER

This weekly market snapshot was compiled and analyzed by Rwazi Insights

TECHNOLOGY & INNOVATION

The TikTok acquisition race intensifies

As ByteDance's deadline to sell TikTok or face a US ban approaches, a flurry of American companies are jostling to acquire the social media giant, which is valued at approximately $100 billion. This unprecedented race for ownership reflects the immense value placed on TikTok's vast user base and powerful algorithm.

Our consumer panel data indicates that TikTok has become an integral part of the digital ecosystem for many Americans, with users spending an average of 95 minutes per day on the platform—significantly higher than competing social media apps. More importantly, 68% of TikTok users report that the platform influences their purchasing decisions, making it a critical channel for brands looking to connect with younger consumers.

The potential acquisition raises important questions about the future of the platform's algorithm, which has been remarkably successful at predicting user preferences and creating highly addictive content feeds. Any significant changes to this algorithm could disrupt user engagement patterns and potentially alienate the platform's core audience.

Key Insight: The intense competition for TikTok ownership demonstrates that despite regulatory challenges, the platform's unique ability to influence consumer behavior and purchasing decisions remains unmatched in the social media landscape.

ECONOMY

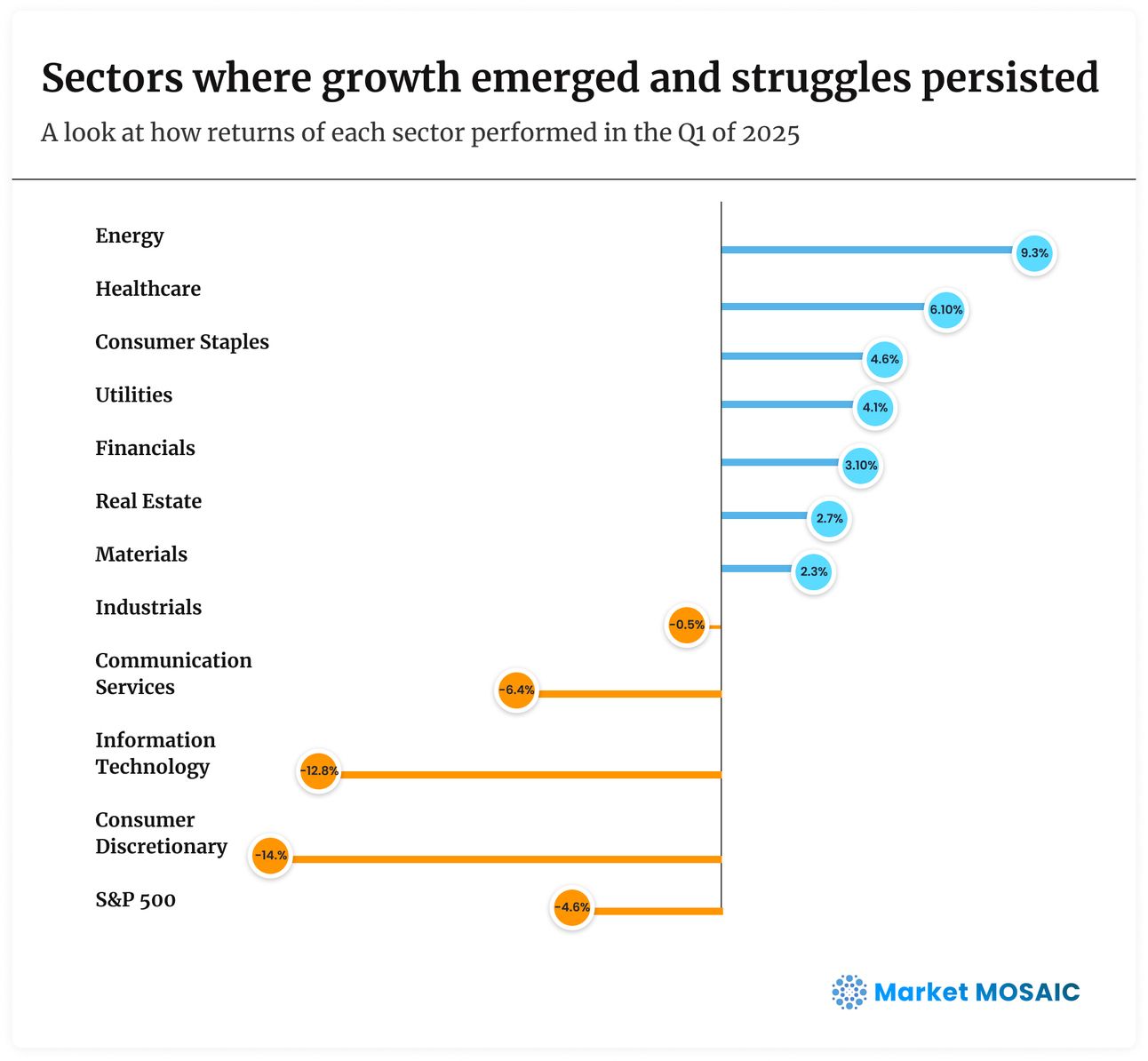

Sectors of global markets navigate turbulent waters

Global investors are preparing for continued market volatility following the implementation of US tariffs. Chinese markets experienced significant declines, while Taiwan implemented temporary controls on short-selling to mitigate the turmoil. Meanwhile, Middle East markets recorded their worst performance since 2020, potentially foreshadowing challenges for Wall Street.

Our analysis shows that consumer confidence has declined by 12% in regions most affected by trade tensions, leading to more cautious spending behaviors. Specifically, discretionary purchases have decreased by 18% in these areas, with consumers prioritizing essential goods and services.

The uncertainty is also impacting the IPO market, with several companies postponing their public offerings. This hesitation signals broader concerns about market stability and could potentially limit access to capital for growth-stage companies, ultimately affecting innovation and job creation.

Key Insight: As market volatility persists, consumer spending patterns are shifting toward value-oriented purchases and essential goods, creating both challenges and opportunities for businesses that can effectively address these changing priorities.

CONSUMER GOODS & RETAIL

Apple loses ground in China as iPhone faces multiple headwinds

Apple's position in the Chinese market continues to deteriorate as local consumers increasingly opt for domestic brands offering more advanced features. This shift is driven by multiple factors, including a growing sense of nationalism, the appeal of Chinese-made alternatives, and Apple's perceived lag in AI integration.

Our consumer survey data reveals that 45% of recent smartphone purchasers in China who switched from Apple to a local brand cited advanced AI features as their primary motivation. This trend is particularly pronounced among younger consumers, with 62% of Gen Z respondents indicating that AI capabilities are "very important" in their smartphone purchasing decisions.

The situation could be further complicated by new tariffs, which analysts predict could increase iPhone prices in the US by approximately 40%. This price pressure comes at a particularly challenging time for Apple, as it already faces criticism for falling behind competitors in AI implementation.

Key Insight: The smartphone market is increasingly becoming AI-driven, with consumers worldwide prioritizing intelligent features over brand loyalty. Companies that fail to keep pace with AI integration risk losing market share regardless of their historical brand strength.

SUPPLY CHAIN & LOGISTICS

Retailers pivot to private labels amid inflationary pressures

Nearly 60% of retailers are expanding their private label portfolios as a strategic response to inflation, aiming to build customer loyalty while improving profit margins. This trend represents a significant shift in the retail landscape, with 16% of retailers actively reducing their reliance on national brands.

Our data indicates that consumer perception of private label products has improved dramatically, with 72% of shoppers now considering store brands to be equal or superior in quality to national brands—a 24% increase from just three years ago. Price sensitivity remains a key driver, with 81% of consumers reporting that they regularly compare prices between private label and national brands before making purchasing decisions.

This shift is putting considerable pressure on CPG manufacturers, with 70% relying on discounting strategies to remain competitive. Also, 40% are introducing "value-tier" products to address consumer demand for affordability.

To address these challenges, 60% of firms are exploring investments in AI and automation. However, implementation hurdles remain significant, with 44% struggling to find qualified talent, 43% facing budget constraints, and 39% dealing with poor data quality.

Key Insight: The rising prominence of private labels represents a fundamental restructuring of retail power dynamics, with retailers gaining leverage over manufacturers. Brands that fail to articulate their value proposition beyond price will face increasing challenges.

As we continue the second quarter of 2025, we will be tracking these developments closely and providing you with actionable insights in our next edition.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for decisions with data. 📊

How has Market Mosaic impacted your business decision-making?

WHAT IS HAPPENING AT RWAZI?

ICYMI: Rwazi’s AI-powered market intelligence gains feature in global media

In a recent feature by TechTimes, we shared groundbreaking insights into the future of consumer market research. The story, "Leveraging Hyper-Localized Data: The Future of Consumer Intelligence in a Globalized World," underscores our revolutionary approach to understanding consumer behaviour worldwide.

In an era where brand loyalty is declining and consumer preferences shift at unprecedented speeds in an increasingly complex global market, our AI-powered, zero-party market intelligence platform offers global businesses a critical competitive advantage by tracking consumer trends in real time.