We are now just one week away from our newsletter’s fresh look to experience unique insights content like never before. Welcome to Market Mosaic, where we deliver cutting-edge market insights and global economic trends to your inbox every week. 📈 🤝

In this week's edition, we dive into the complex landscape of government involvement in fintech, exploring the challenges and pitfalls of state-driven consumer payment solutions. We analyze the contrasting outcomes of public and private sector initiatives and uncover key insights for the future of digital finance.

— Insights Team, Rwazi

DATA SPOTLIGHT

The fintech investment boom

The African fintech sector has experienced exponential growth in recent years, attracting a flood of venture capital that has transformed the continent's digital finance landscape. Some notable historical numbers to take a look at here:

2016: A modest $130 million invested in fintech startups

2021: A staggering $2.3 billion poured into the sector

This represents a 1,669% increase in just five years, highlighting the private sector's growing dominance in digital finance.

Behind these figures lies a story of entrepreneurial dynamism and investor confidence. Companies like Flutterwave, Chipper Cash, and OPay have become household names, reimagining financial services for millions of underserved.

Key Insight: The surge in private investment signals a shift in the balance of power in African fintech, with venture-backed startups increasingly outpacing government initiatives in innovation and market penetration and struggling to remain relevant.

THE PULSE

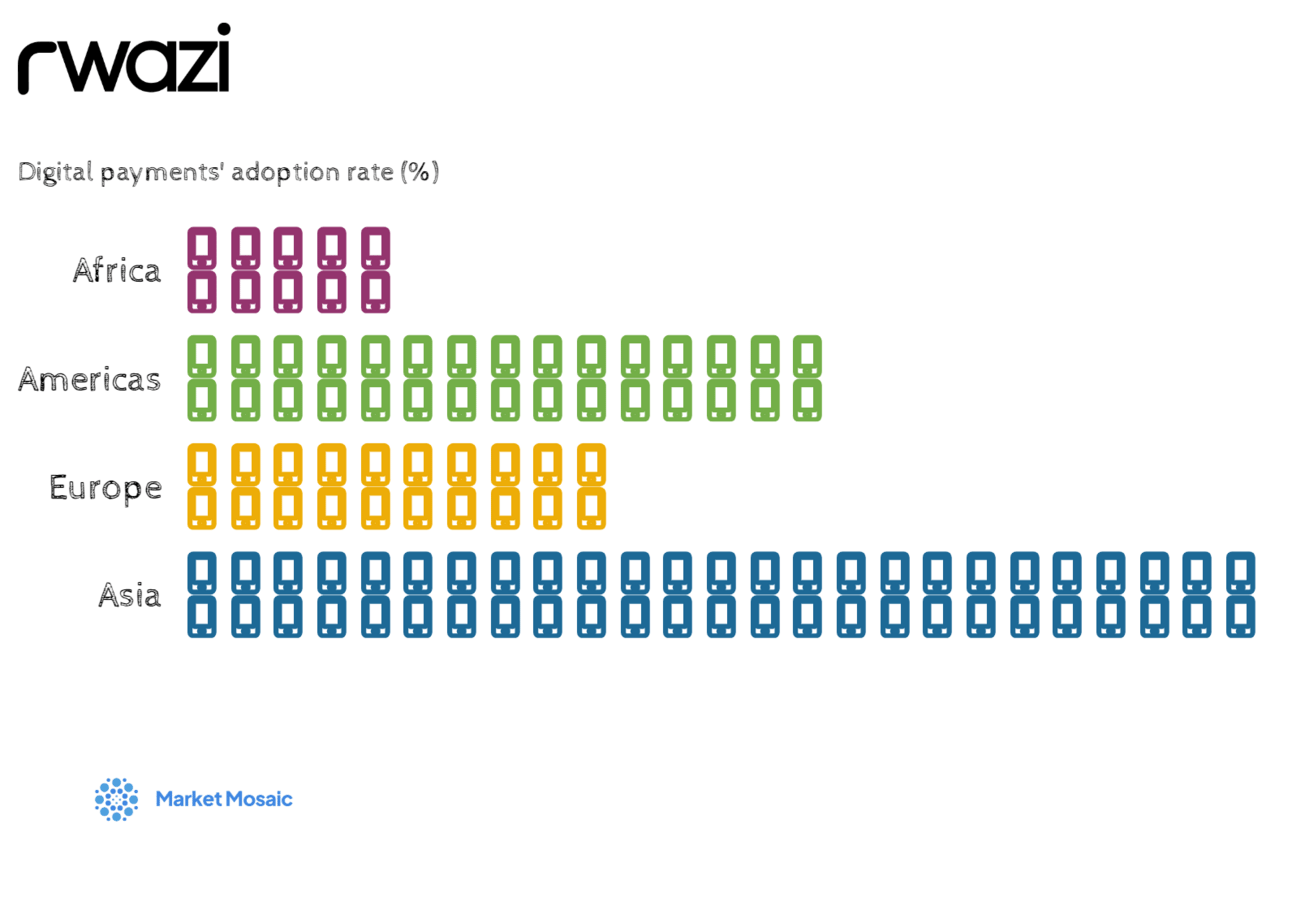

Featured Chart: Africa has the lowest fintech adoption rate in the world

Analysis: Rwazi Insights

SECTOR SCAN

Government-led digital finance initiatives

As private sector fintech flourishes, several African governments have attempted to enter the consumer fintech space, with results that can be described as mixed:

Ghana's e-Zwich: Less than 10% population coverage, with declining usage

Kenya's Huduma Card: 12.5% population coverage, with 40% of issued cards uncollected

Tunisia's e-Dinar (2015): Failed to gain significant traction

Senegal's eCFA (2016): Discontinued due to pressure from regional central bank

In contrast, government-driven enterprise payment systems have shown more promise:

Nigeria's NIBSS (Nigeria Inter-Bank Settlement System): This backbone of Nigeria's electronic payment infrastructure saw a 50% increase in electronic fund transfer value and a 77% growth in volumes.

Key Insight: Governments have found significantly greater success in building infrastructure and facilitating inter-bank transactions rather than directly competing in the consumer-facing fintech space. This pattern suggests a natural division of roles, with the public sector as an enabler and the private sector as an innovator.

OUR COMPETITIVE WATCH

Private Sector vs. Central Bank Digital Currencies

To truly understand the dynamics at play, let's zoom in on a revealing case study: Senegal's Wave vs. eCFA

Wave: Rapidly grew to nearly 5 million subscribers

eCFA: Struggled to sign up a few thousand users

Wave's success as a private-sector mobile money provider in a remarkably short time had it grow to nearly 5 million subscribers, transforming the way Senegalese citizens handle money. The company's user-friendly interface, aggressive pricing, and innovative features resonated strongly with consumers.

In stark contrast, the government-backed eCFA struggled to sign up even a few thousand users. Despite the backing of the state and integration with existing financial systems, it failed to capture the public's imagination or trust.

Key Insight: Private sector fintech companies have demonstrated superior agility and user adoption when operating within government-created infrastructures, outperforming direct government attempts at consumer-facing solutions.

WHAT’S HAPPENING AT RWAZI?

Download our Consumer Insights Report 2024 📊

Unlock the future of emerging markets with the latest analyses and expert insights in our report is now available for immediate download.

Stay ahead of the curve in 2024 and beyond. Our report provides the vital information you need to navigate emerging markets.

⚡ Download and grab your free copy now: bit.ly/DownloadConsumerReport

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights to decide with data. 📊 You can also go read an extended version here and the archive of our past editions here.

As we chart our course for the second half of 2024, we want to hear from you. What insights have been most valuable to your business?

Share your thoughts by participating in the poll below this newsletter.