We are happy to share that we are planning a fresh look for our newsletter and experimenting with a unique content model you should watch out for soon. Welcome to Market Mosaic, where you enjoy an essential brief of cutting-edge market insights and global economic trends.

In case you missed it, we have launched our groundbreaking Consumer Insights Report 2024, exploring the complex market dynamics in emerging economies and unpacking global consumer trends in volatile markets here. 📈 🤝

Do you know what? The fintech space in emerging markets, evolving at a fast pace, is shaped by fast-shifting consumer preferences. This week’s edition explores how this is driving the growth of innovative payment solutions and reshaping the financial services industry across different regions.

— Insights Team, Rwazi

DATA SPOTLIGHT

The mobile money revolution in emerging markets

We found that Kenya's fintech journey offers a good lesson in how regulatory flexibility can catalyze transformative change. Our data analysis found a major percentage of Kenyan adults now use mobile money services like M-Pesa, a figure that would have seemed impossible just a decade ago. This meteoric rise can be traced back to a pivotal decision by the Kenyan government to allow telecom companies to offer financial services.

The impact has been profound. In rural areas where traditional banking infrastructure is sparse, mobile money has become a lifeline, enabling everything from peer-to-peer transfers to bill payments and even savings accounts. Small businesses, once operating entirely in cash, now have access to digital financial tools that expand their reach and streamline operations.

Key Insight: Regulatory flexibility, when aligned with existing consumer behaviours and infrastructure, can unlock explosive fintech growth. The Kenyan model demonstrates how tailoring solutions to local contexts can drive adoption rates that surpass even those of developed markets.

THE PULSE

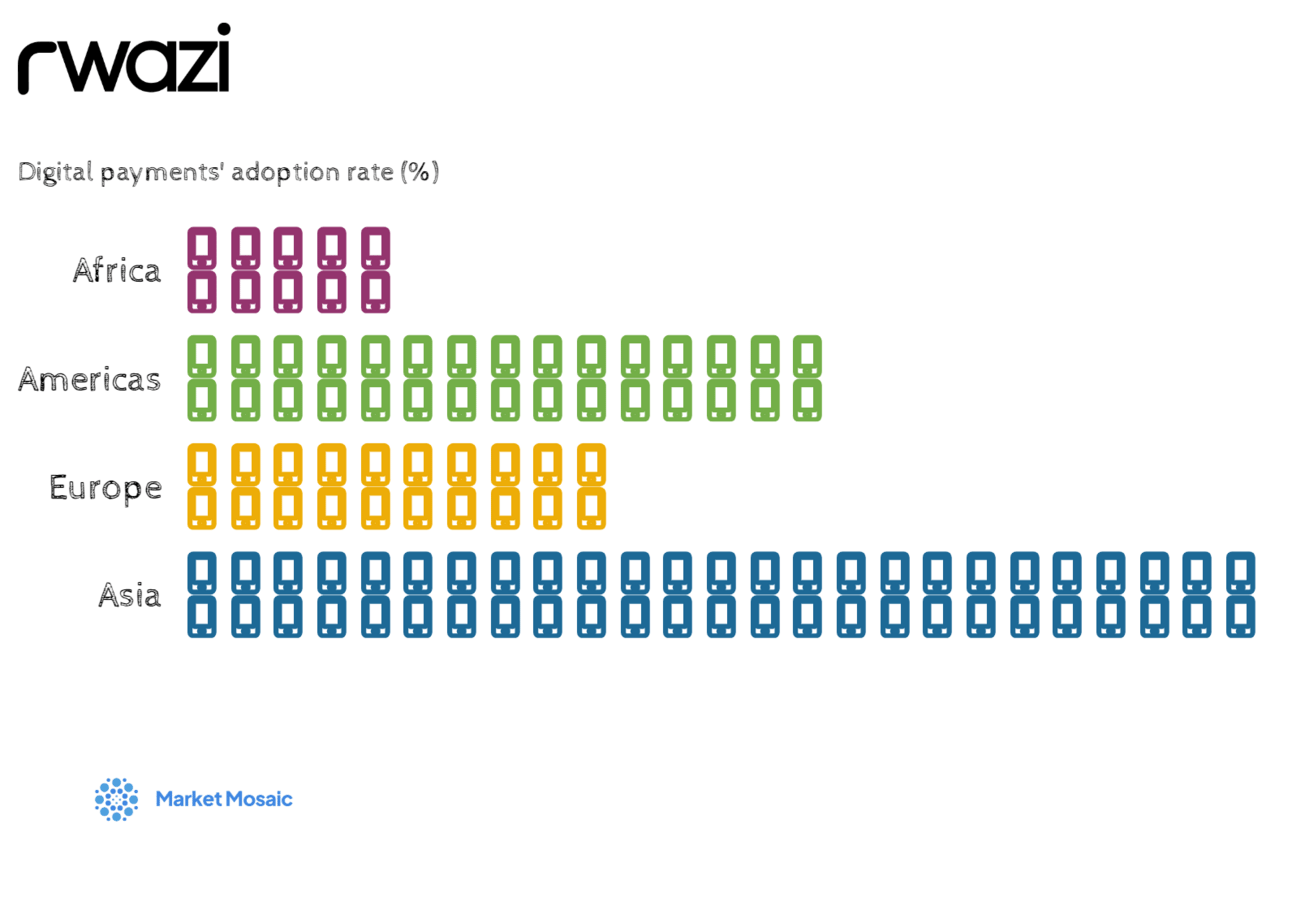

Featured Chart: Asia has the world’s highest fintech adoption rate in transaction value

Analysis: Rwazi Insights

SECTOR SCAN

Global integration is driving local growth

Our data analysis found a fascinating trend: fintech players who successfully integrate with global payment networks see an average 35% increase in transaction volumes. This integration is opening up new possibilities, allowing consumers to use their preferred local payment methods for global services, from software subscriptions to international travel bookings.

This global-local synergy is creating a virtuous cycle. As local payment methods become more versatile, they attract more users, which in turn attracts more global services to integrate with these payment systems. The result is a rapidly expanding ecosystem that benefits consumers, local fintech players, and global service providers alike.

Key Insight: Expanding the utility of local payment methods through global integrations can significantly boost adoption and usage rates. Fintech players who can successfully bridge the local-global divide are poised for substantial growth.

OUR COMPETITIVE WATCH

The rise of alternative payment methods

Across emerging markets, we are witnessing a decisive shift away from traditional card-based payments towards innovative alternatives. India's Unified Payments Interface (UPI) stands out as a prime example, now accounting for an impressive 64% of all digital transactions in the world's most populous country.

This trend is reshaping the very nature of financial transactions. In markets where credit card penetration has traditionally been low, these new payment methods are enabling millions to participate in the digital economy for the first time. From QR code payments in China to mobile wallets in Southeast Asia, alternative payment methods are driving financial inclusion at an unprecedented scale.

Key Insight: The future of payments in emerging markets is decidedly mobile-first, instant, and increasingly detached from traditional banking infrastructure. Fintech players who can tap into this trend stand to capture significant market share.

WHAT’S HAPPENING AT RWAZI?

Available for download: Our Consumer Insights Report 2024 📊

Unlock the future of emerging markets with the latest analyses and expert insights in our report is now available for immediate download.

🔍 This comprehensive report offers:

Cutting-edge insights into consumer behaviour

Data-driven trends shaping the market

Strategic implications for businesses

Actionable intelligence for decision-makers

Stay ahead of the curve in 2024 and beyond. Our report provides the vital information you need to navigate the complex landscape of emerging markets like Nigeria, one of the world’s biggest volatile markets

⚡ Download and grab your free copy now: bit.ly/DownloadConsumerReport

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights to decide with data. 📊 You can also go read an extended version here and the archive of our past editions here.

As we chart our course for the second half of 2024, we want to hear from you. What insights have been most valuable to your business?

Share your thoughts by participating in the poll below this newsletter.