In case you missed the good news, Market Mosiac now has our readers on board as contributors to continue serving you with even more diverse, richer, cutting-edge market insights and global economic trends to decide with data. 📈 In case you missed the announcement earlier, we are calling for contributors.

In this week's edition, we spotlight the innovative e-commerce models and disruptors emerging from outside the Silicon Valley bubble. From the rise of social commerce giants to the live-streaming "shoppertainment" concept, we'll explore the dynamic retail tech companies beating the West at their own game – and the factors driving this global shift in e-commerce innovation.

Let's dive into these insights together!

— Insights Team, Rwazi

Our Edition this week:

DATA SPOTLIGHT

E-commerce superstars beating Silicon Valley

The numbers don't lie - embedded social shopping experiences are having a breakout moment, becoming the norm and disruptively emerging from niche to mainstream worldwide. Its growth trajectory is only accelerating, with social commerce projected to become a $3.37 trillion market by 2028 with an expected compound annual growth rate (CAGR) of 13.7%.

While Silicon Valley wrestles with the latest overhyped tech trends, a new breed of e-commerce disruptors is quietly redefining the rules of e-commerce beyond Western borders:

Shein and Temu have reinvented e-commerce into a hyper-affordable, hyper-responsive model deeply embedded within social platforms like TikTok and Instagram, serving as a catalyst between content consumption and instant gratification through seamless shopping experiences.

Despite concerns around sustainability and labour practices, the success of these online retailers is undeniable, fueled by their ability to quickly translate social media trends into shoppable products at unprecedented speeds and low costs.

Key Insight: By leveraging the power of social media integration and lean supply chains, these disruptors have unlocked a new era of e-commerce that legacy Western retailers have struggled to replicate.

Key Stats

Share of global e-commerce sales from emerging markets: 38%

Projected social commerce market size (2028): $3.37 trillion

Mobile live-streaming e-commerce users in China (2022): 384 million

THE PULSE

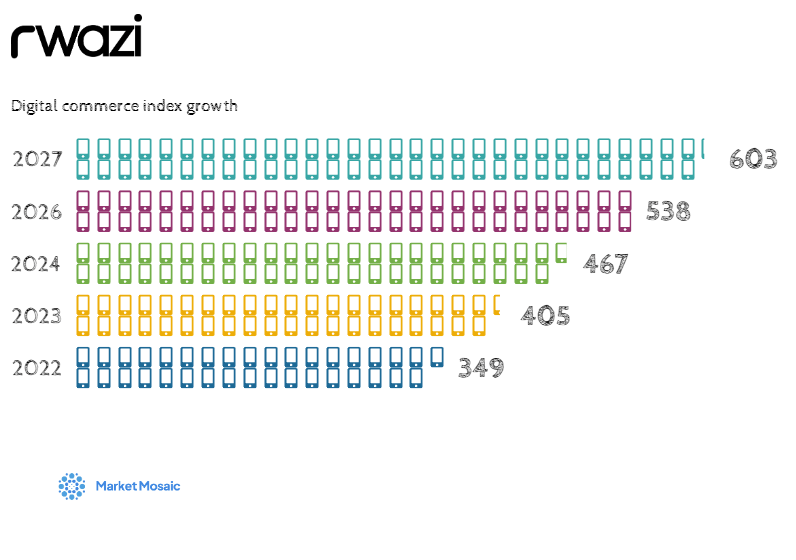

Featured Chart: Digital Commerce Index growth for rising markets (2023-2027)

Source: Ebanx’s Beyond Borders 2024 report • Data analysis: Rwazi Insights

SECTOR SCAN

"Shoppertainment" and the live-streaming commerce boom

A new breed of "shoppertainment" platforms is also gaining significant traction, blending entertainment, influencer marketing, and direct sales into an immersive live-streaming experience:

Shopee, the $70 billion Singaporean e-commerce giant, has pioneered this model, enlisting popular online personalities to compete in real-time sales events, driving remarkable engagement and revenue growth across Asia and Latin America.

The success of shoppertainment underscores the power of leveraging existing consumer behaviours and preferences, meeting audiences where they already are rather than trying to funnel them into traditional e-commerce funnels.

Key Insight: By fusing commerce with entertainment and leveraging the authenticity of influencers, these live-streaming platforms have unlocked a level of customer engagement that eludes many Western e-commerce incumbents.

OUR COMPETITIVE WATCH

Emerging market innovators reshaping global e-commerce

A diverse array of innovative e-commerce models is also taking root across emerging markets, from Africa to Latin America:

Jumia has cracked the code on facilitating cash-on-delivery in Africa, a critical solution for regions with low banking penetration.

In Latin America, Oxxo is evolving from a brick-and-mortar convenience store chain into an ambitious online bank and e-commerce platform akin to a "PayPal meets 7-Eleven" model.

Even within China, upstarts like Pinduoduo are already threatening to unseat established social commerce giants with unique spins on the model.

Key Insight: By tailoring their approaches to the unique needs and nuances of local markets, these emerging innovators are capturing lucrative regional opportunities and pioneering models with global disruptive potential.

WHAT’S HAPPENING AT RWAZI?

Get more smart bites from Market Mosaic on LinkedIn

We are excited to announce that in addition to the in-depth, forward-looking analyses we publish in our Market Mosaic newsletter, we have now started sharing bite-sized insights on our LinkedIn page!

Each weekday, we post compelling data points, charts, analyses, and poll questions about the latest trends featured in our newsletter editions to help you stay plugged into the disruptive forces shaping various consumer sectors.

Please give us a follow on LinkedIn today here!

You can also like, share, and comment on our posts to spark conversations. Don't miss out on our engaging polls, where you can weigh in with your perspectives.

If you missed it, you can also visit our new website and experience the future of consumer market intelligence.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights for deciding with data. 📊

You can read the more extended version of this newsletter edition with detailed insights here.

If you missed the insights in our previous editions, you can catch up on them here on our newsletter blog.

What topics would you like to see covered in our newsletter?

- Sustainability trends

- Geopolitical risks and their impact on markets

- Regulatory changes affecting specific industries

- Future-of-work trends

- Consumer psychology and decision-making

- Fintech, cryptocurrency, regulations, future of banking

- E-commerce trends, supply chain optimization

- Artificial intelligence, cybersecurity, blockchain

- Telemedicine, healthcare access, pharmaceutical trends

- Electric vehicles, autonomous vehicles, future of mobility