It’s another global intelligence briefing of Market Mosaic by Rwazi. We are excited you have continued reading our cutting-edge market insights and global economic trends. 📈

In this week's edition, we explore the efforts underway to strengthen global supply chain resilience and efficiency. From the growing role of artificial intelligent systems to shifts in manufacturing location strategies, we unpack the key trends and technologies shaping the future of global logistics and production flows.

Let's dive into the insights together!

— Insights Team, Rwazi

Our Edition this week:

DATA SPOTLIGHT

Intelligent systems key to supply chain resilience

Our data analysis of manufacturing and logistics firms found 42% plan to expand investments in AI and automation towards optimising networks amid continued cost and labour challenges over the next 2 years.

With predictive analytics, sensors, and autonomous vehicles advancing rapidly, companies are positioning intelligent systems as a core pillar of supply chain modernisation efforts. We predict an increase in the deployment of warehouse management AI and route optimisation ML adoption by 2025.

The expansion of smart supply chains appears inevitable. As computing power improves and integration challenges are overcome, these technologies can drive end-to-end efficiency, agility, and cost gains at scale.

Key Insight: Smart systems like predictive intelligence and decision automation will increasingly anchor supply chain modernisation efforts.

THE PULSE

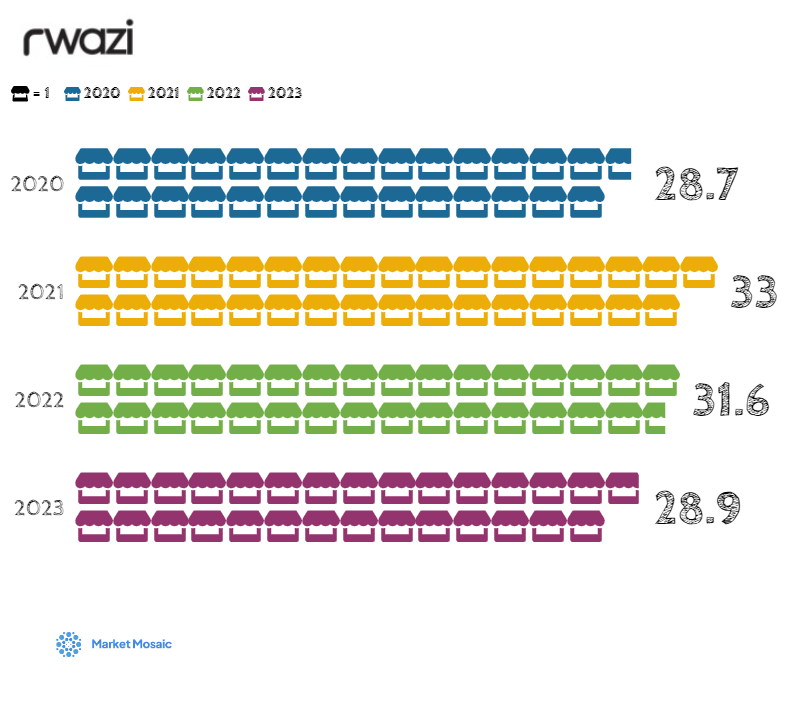

Featured Chart: U.S. Import volumes return to normal in 2023 (millions of 20-foot equivalent units)

Data analysis: Rwazi

SECTOR SCAN

Onshoring gains appeal amid geopolitical tensions

With stability and geographic clustering trumping offshoring's cost savings, we predict domestic manufacturing will rise 22% in high-tech industries like pharmaceuticals and nearshore regions, attracting up to $900 billion in relocated production through 2025. This reshoring narrative is playing out in the rhetoric and incentives of governments worldwide.

However, onshoring success requires workforce expansion, permitting reform, and locating in underutilised economic zones to prevent inflationary pressures.

Key Insight: Regional shifts will unfold, but complete global supply chain dismantling appears unrealistic.

OUR COMPETITIVE WATCH

Retailers navigate the returns balancing act

Rwazi estimates e-commerce returns produce over 5 million tons of landfill waste and 15 million tons of CO2 emissions annually in the US alone due to disposal and logistics. AI-powered virtual try-on tools, personalised recommendations, and digitally enhanced transport routing and warehouse sorting can help curb volumes.

But convenience culture and lenient return policies enabling "bracketing" pose obstacles to reducing return rates substantially without alienating customers. This represents an intricate tightrope for online retailers balancing sustainability concerns with customer experience imperatives amid thin margins.

Incremental changes combined with consumer education campaigns may aid progress on this complex issue. But sweeping shifts remain years away, absent systemic industry collaboration.

Key Insight: AI and analytics can aid sustainability, but changing consumer behaviour remains complex

WHAT’S HAPPENING AT RWAZI?

ICYMI: Feature on Alumni Ventures

We were featured on One Startup to Know, a series that examines some of Alumni Ventures’ most impactful and innovative portfolio companies. You can read the feature here.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights to decide with data. 📊

Do you have any sector’s consumer market insights you think we should explore in future briefs? Feel free to choose and share with us.