Happy New Month to you from Rwazi, your AI-powered market intelligence platform providing you with actionable consumer data from global markets.

Welcome to the first issue of Market Mosaic, your essential digest for cutting-edge market insights and global economic trends. Our weekly insights newsletter will curate consumer intelligence insights for you as a business leader to inform your strategic decisions with a market competitive advantage. 📈 Thank you for joining us! 🤝

— Insights Team, Rwazi

DATA SPOTLIGHT

Tracking cross-border remitter demographics

This week’s analysis focuses on the fast-changing remittance sender demographics from the United States to African countries, covering remittance volumes and frequencies.

According to insights from Rwazi’s proprietary consumer data, there was a 32% increase in remittance flows from African immigrants over the past three years. This shows consistent remittance habits, sending money to family back home 1-2 times per month on average. Their deepening ties and financial stability in the US are driving growing remittance volumes.

Also driving this volume is the mainstream adoption of digital remittance platforms. New fintech players have lowered barriers by offering easy online access, minimal fees, and fast transfer times. Their mobile-first experiences meet the expectations of younger and underbanked demographics.

As external financing sources, remittance inflows to sub-Saharan Africa grew 14% last year, hitting US$49 billion. That's nearly on par with Foreign Direct Investment (FDI) and foreign aid flows. Advancing digital solutions catalyses an unprecedented opportunity in cross-border remittance flows.

THE PULSE

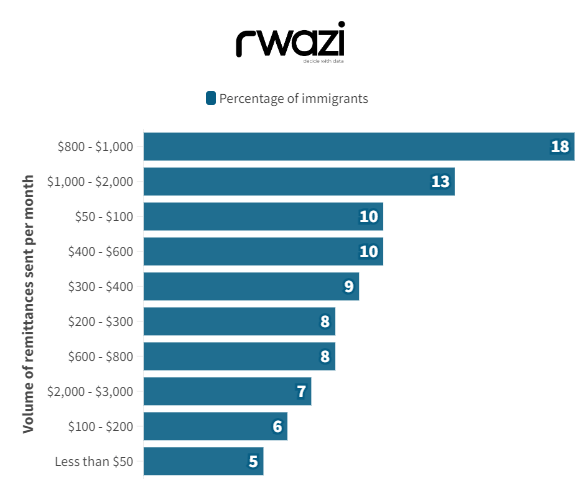

Featured Chart: Remittance growth by percentage of immigrants

Data source: Rwazi

SECTOR SCAN

Digital disruption opening access

Existing players like Western Union, MoneyGram International, and WorldRemit are now facing pricing pressure and competition for a share of remittance flows from Africa-focused fintech innovators. Compelling pricing, loyalty programs, and channel incentives will be key to defence.

As ties between the United States and Africa strengthen amidst accelerating migration, remittance markets will only expand further. Tracking cross-border senders and harnessing these flows will open up new opportunities. According to the World Bank, the average cost of sending remittances to sub-Saharan Africa was 7.8% last year, the highest globally. Reducing fees through digital channels can dramatically expand financial access.

As migration rises and digital platforms permeate, remittance markets will only grow. Leading providers are taking steps to tap into this next phase of interconnected commerce.

OUR COMPETITIVE WATCH

Innovation is key to winning share

Credit: wdstock

New digital remittance startups are disrupting traditional bank remittance channels with easy access, lower fees, and mobile-first experiences. Banks must respond with improved digital capabilities and competitive pricing to retain customers. Partnerships with fintech providers could help bridge capability gaps as well.

Western Union and MoneyGram still dominate African remittance markets with a 50% combined market share. However, the adoption rate of mobile remittance services surged to 80% last year.

Raise, a Kenyan fintech startup, now enables over 3 million monthly transactions with its app-based remittance solution at a fraction of incumbent bank fees. Social payments company Chipper Cash now counts Africa as its largest market.

To defend shares, banks like Equity Bank have launched digital subsidiaries like EazzyPay focused exclusively on international payments, including remittances. EazzyPay offers a dedicated app, loyalty rewards, and partnership programs to drive adoption.

US banks have also responded by incorporating remittance capabilities into their apps and lowering transfer fees. Wells Fargo targets the Hispanic segment in the US with its low-cost remittance offering Directo a México.

As consumer expectations shift, partnerships will enable banks to augment digital experiences rapidly. Western Union already partners with African telecoms for mobile wallet remittance services.

With increasing connectivity between Africa and its extensive diaspora, remittance channels will only grow more embedded in banking experiences. Providers that make these services frictionless and digital will capture this opportunity.

WHAT’S HAPPENING AT RWAZI?

New partnership with CGBW

Rwazi and the Circle of Global Business Women (CGBW) have entered an exciting new partnership to empower 10,000 women and youth entrepreneurs in Africa. To accelerate the growth, we will provide consumer insights, enabling CGBW members to make informed business decisions and develop competitive new offerings.

Thank you for reading and joining us on Market Mosaic this week. We hope this edition provides valuable, actionable insights to decide with data. 📊

Do you have any sector’s consumer market insights you think we should explore in future briefs? Feel free to respond to our email and share with us.